.

Like Chipotle Mexican Grill and Cava, a small-cap restaurant stock that may have higher long-term upside.

Chipotle Mexican Grill (NYSE: CMG)A pre-restaurant chain specializing in burritos with more than 3,400 locations. Mediterranean ChainCava Group (NYSE: CAVA)They are much smaller, with just over 300 outlets. The two chains are very different in terms of style and cuisine. But they have important similarities for investors.

For starters, both companies' Koon management teams see plenty of room for expansion. Despite Koon's impressive growth over the past decade, Chipotle's chief executive Brian Niccol still wants to more than double the number of stores. Kawa's management wants to more than double the number of stores. These are huge growth targets that investors are salivating over.

Second, both Chipotle and Cava are exceptionally popular with diners. For example, Cava averages $2.6 million in annual sales and Chipotle averages $3.0 million in annual sales, and these figures are already industry-leading and rising. These figures are already industry-leading, and they continue to rise, with both studios experiencing same-store sales growth in 2023.

Third, Chipotle and Cava have high profit margins because of the high sales at each store. Pre-primary margins only take into account the economic benefits of the restaurant, not corporate factors, and Chipotle has one of the highest margins I know of. its pre-primary operating margin is 26% in 2023, and Cava is right behind it at nearly 25%.

These three factors briefly summarize why investors love these restaurant stocks.

But there's another similarity between Chipotle and Cava - both stocks are very expensive. That's why I'm trying to lure investors to the low-profile restaurant chain.Kula Sushi (Kura) Sushi USA ) (NASDAQ: KRUS)This stock is valued at a low P/S. The stock is valued at a low price-to-sales (P/S) ratio, but the company is similar to Chipotle and Cava on the aggressive side.

Kura Sushi has a lot to offer!

Kura Sushi is under the radar because it is so small - at least in the United States. By contrast, its parent company in Japan operates more than 500 stores. And it owns 70% of voting rights in American Real, which means it controls American Real's future.

Warehouse Shushi's Koon team, like those at Chipotle and Cava, has ambitious plans. At the time of its IPO, it said that, according to a study it commissioned, it had room to grow to 290 U.S. locations in the long term. By the end of 2023, it will have just 54 U.S. locations.

This expansion will have a significant impact on Kura Sushi's business, which averaged $4.3 million in pre-prandial sales in 2023. If it operates 290 locations at this level of sales, it will generate more than $1 billion in annual revenue, and Kura Sushi's sales continue to grow. 2023 saw same-store sales increase by nearly $10%, so it's safe to say that diners are loving this new sushi chain.

Like Chipotle and Cava, Kura Sushi's high sales volume supports its strong profitability. At the pre-primary level, the company's operating margin is a whopping 22%, which is even enough to give it a net profit of $1.5 million in 2023 (even including all corporate expenses).

In total, Kura Sushi is profitable, and as sales continue to grow, profitability will become even stronger and Kura Sushi plans to expand significantly. This could make it a long-term growth opportunity on par with, if not better than, Chipotle or Cava. Kura Sushi's more attractive valuation makes it a better buy.

There are a few more things to keep in mind

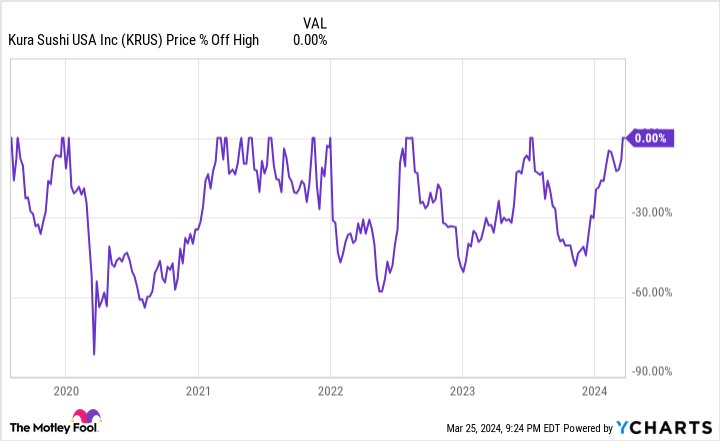

In summary, for those interested in Kurashushi stock, it may be wise to build a position using the average dollar cost method, rather than buying all of the shares at once. As a small rock stock, Warehouse's share price is prone to volatility. In 2024 alone, it has risen nearly 50%, which is a pretty steep rise.

However, in its years as a publicly traded company, it has a track record of frequently falling from its highs by 30% or more. This suggests that a reversal is likely to occur at some point in time, so taking a fractional position can help investors get a better average price.

However, investors may not want to wait too long to buy at least some shares of Kura Sushi, as the company is growing rapidly. The company plans to open 11 to 13 new locations by 2024 alone, a growth rate of more than 20%. As such, the stock could test new highs as the business expands.

Should you invest $1,000 in Kura Sushi Usa now?

Before buying shares of Kura Sushi Usa, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Kura Sushi Usa is not one of the 10 stocks listed on ....... The 10 stocks selected are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Jon Quast does not own any of the stocks mentioned above.The Motley Fool holds a recommendation for Chipotle Mexican Grill.The Motley Fool recommends Cava Group.The Motley Fool has a disclosure policy.

Like Chipotle Mexican Grill and Cava, This Small-Cap Restaurant Stock May Have Higher Long-Term Upside was originally published by The Motley Fool.