.

Supermicrocomputer Stocks Down 191 TP3T From 52-Week High: That's Good News for Investors

Super Micro Computer Inc. (NASDAQ resonance code: SMCI)The company's stock has seen a reversal in recent trading sessions as it revealed the pricing of its common stock offering, which will dilute the shares of existing shareholders. As a matter of fact, shares of the soaring server maker are down 19% from their 52-week high on March 8th.

Savvy investors who want to invest in a top artificial intelligence (AI) stock right now should consider buying SuperMicro's shares while they're down. Here's why.

Micro investors should focus on the big picture.

Supercomputer is offering 2 million shares of its common stock at a price of $875 per share. In addition, underwriter Goldman Sachs has a 30-day option to purchase an additional 300,000 shares in the offering.

At the time of the news, Supermicro was trading at just over $1,000 per share, which seemed to dampen investor confidence. The company sold its shares at a discounted price, and the market quickly pushed the panic button.

However, in the larger scheme of things, Supercomputer Koon's move is sensible, as the company aims to raise $1.75 billion in gross proceeds from the event. Koon added that the proceeds will be used to support "the company's operations, including purchasing inventory and meeting other working capital needs, expanding production capacity and increasing investments in research and development.

Given the strong demand for server solutions for deploying AI chips, the company is rightly focused on expanding capacity. On its second-quarter fiscal 2024 earnings call, Supermicro noted that its manufacturing facilities in the U.S., Taiwan, and the Netherlands are utilized at 65%. management added that its spare capacity is filling up quickly.

Therefore, Supermicro needs to commission new production facilities to meet the demand of the fast-growing AI server market. This is not surprising," said Francis Leung, Chief Executive Officer, at the teleconference:

To meet this tight capacity challenge, we are building two new production facilities and warehouses near our Silicon Valley headquarters, which will be operational within a few months. The new facility in Malaysia will focus on expanding our building blocks at lower cost and higher volume, while the other new facilities will support our annual revenue capacity of more than $25 billion.

Supermicro is on track to reach the midpoint of its guidance range with revenues of $14.5 billion for the current fiscal year. This would be more than double the $7.1 billion in revenue in fiscal 2023. Now that the company has built up $25 billion in revenue capacity, it needs to bring more capacity online given the rapid growth of the AI server market.

According to Global Market Insights, the AI server market is estimated to be worth $38 billion in 2023, and by 2032, this market is expected to reach $177 billion in revenue, with a CAGR of 18% over the forecast period. By 2032, this market is expected to generate revenues of US$177 billion, representing a compound annual growth rate of 18% over the forecast period. supermicro's share of the AI server segment is increasing as it grows at a much faster rate than the market.

In the long term, given the lucrative end-to-end market opportunities, it makes sense for the company to grab a bigger share in this field for the carpet. This may also explain why management has decided to take advantage of this year's surge in share price to raise more capital by issuing shares. In addition, Supermicro's reversal means that investors can now buy at a relatively cheap valuation.

Another reason to buy the stock after the correction.

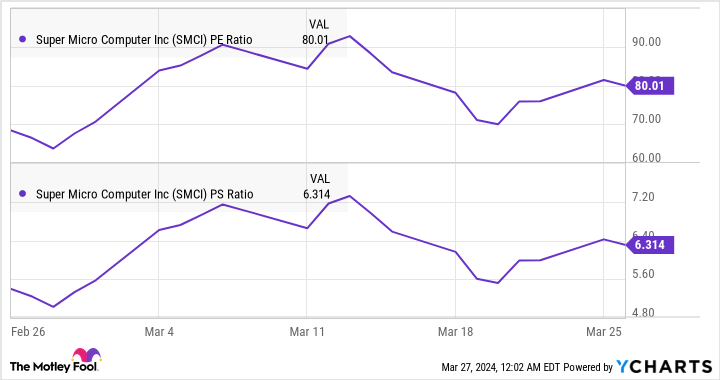

Supermicro's earnings and sales multiples have recently declined.

At one point this month, the stock was trading at a price-to-earnings ratio of more than 90 times, while its sales margin was nearly 7.5 times. Some might argue that Super Micro is still expensive in terms of earnings multiples. However, there is no problem buying the stock now.

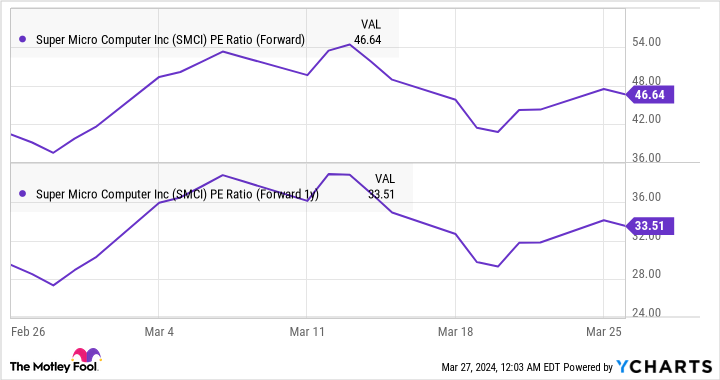

Supermicro's forward earnings multiple is significantly lower than the trailing P/E, as the company is expected to realize large bottom-line growth. Analysts expect Supermicro's earnings to grow a solid 86% in FY2024 and jump 40% to $30.83 per share in FY2025.

Now that Supermicro is looking to increase its capacity by issuing common stock, it's likely to increase its manufacturing levels and realize even stronger growth given the market it's in. That's why savvy investors should consider buying this tech stock, as it could quickly regain its momentum.

Should you invest $1,000 in Supermicro now?

Consider the following before buying shares of Supercomputer, Inc:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Only ...... and SuperMicroComputer are not among them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Harsh Chauhan does not hold any of the above shares.The Motley Fool does not hold any of the above shares.The Motley Fool has a disclosure policy.

Supermicrocomputer Stocks Down From 52-Week High 19%: Why is this good news for investors?