.

This dividend stock is valued at nearly a one-in-a-decade valuation. Is it worth buying?

Artificial Intelligence, Genetic Editing Biotechnology, Humanoid Robots and many more, there are many mind-blowing things to invest in these days. But boring businesses can also be profitable for investors. Flavor and spice giantsMcCormick Resonance Corp. (McCormick & Company ) (NYSE: MKC)It is one of the most boring and profitable businesses.

McCormick Resonance announced its Q1 FY2024 results on March 26th, and the market reacted enthusiastically. As a result, this stock is not as good a deal as it was a few days ago.(modal particle intensifying preceding clause)The stock's valuation is still close to a decade high. Nevertheless, the stock is still valued at close to a one-in-a-decade valuation by one important metric.

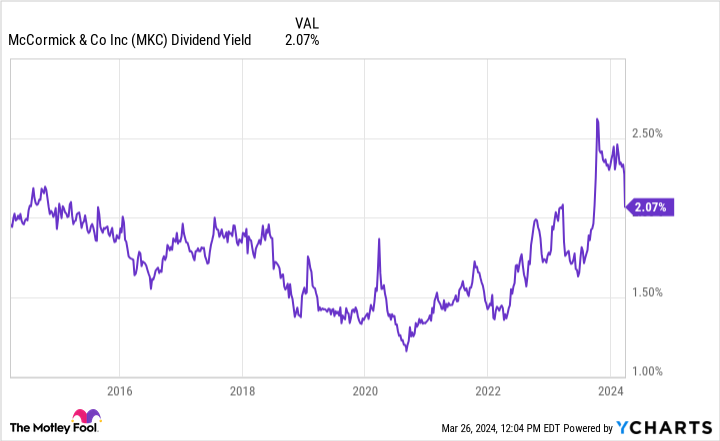

It's one of the best dividend-paying stocks in the world (more on that later). As of this writing, its dividend yield is about 2%, which means that for every $1,000 invested, shareholders receive $20 per year. As you can see in the chart below, the dividend yield has exceeded 2% for several months in a row, the first time it's been this high in nearly a decade.

It's appropriate to talk about its yield because McCormick Resonance is an excellent dividend stock, and in November 2023, the company increased its quarterly dividend, marking the 38th consecutive year that Koon has increased its dividend. Few companies can match that.

Where a dividend-paying stock such as McCormick Resonance trades at a rare valuation, it is worth examining whether it is a good investment. As I will explain, McCormick Resonance may now be a solid addition to the dividend portfolio.

Understanding the Business of McCormick Resonance

McCormick Resonance's assortment of condiments and spices seemed to take up shelf space in the car-carrying store. The company owns the eponymous brand as well as other brands such as Old Bay, French's, Frank's Red Hot, etc. It also owns other food brands such as Zatarain's and Thai Kitchen. It also owns other food brands such as Zatarain's and Thai Kitchen.

Given the diversity of its products and brands, the company is constantly experimenting. It uses existing brands to launch new products, acquires other brands, and sometimes even divests itself of brands. This constant mending doesn't always lead to excess revenue growth, but it often improves margins when they're struggling.

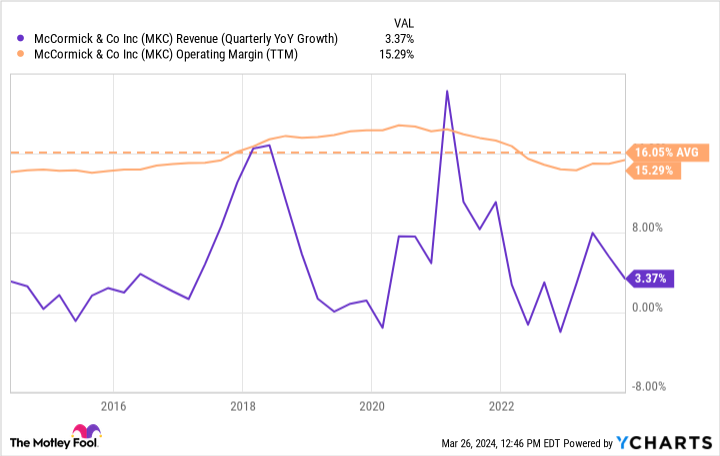

For example, net sales for the first quarter were up only 3% year over year. sales were down, in part due to the divestiture of a small canning operation. However, the company's operating margins improved over the same period last year. This resulted in an increase in diluted earnings per share (EPS) of 191 TP3T.

As shown in the chart below, McCormick Resonance rarely has high revenue growth. However, sales rarely regress. Moreover, its operating margins are relatively stable, usually above 15%.

The outlook for the second half of the year is largely the same. Koon expects sales to grow modestly, full year operating income to grow by 8% to 10%, and earnings per share to grow by double digits.

This last point is important for dividend investors. As of this writing, McCormick Resonance is using about 60% of its earnings for dividends. That leaves room to increase dividends over the next few years. But continued double-digit EPS growth also supports further dividend increases.

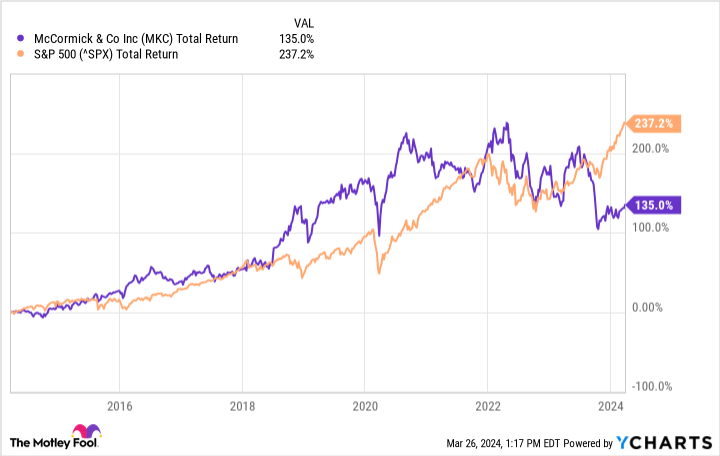

I wouldn't necessarily say that McCormick resonance stock has the most upside. Over the past 10 years, it's underperformed theStandard & Poor's 500 This is worth noting.

As much as possible, it is comforting to know that McCormick Resonance sells products that are in short supply. In addition, it has been able to generate profits no matter what the struggles.

Management's priority for shareholders is the dividend, so I have every confidence that the dividend will continue to grow over the next few years. And the company's ability to continue to grow profits will provide it with the ability to continue to do so.

As such, McCormick Resonance is a solid business that deserves a place in the portfolio. And with a dividend yield of over 2%, it's one of the best times to be a buyer in the last decade.

Should you invest $1,000 in McCormick Resonance now?

Before buying shares of McCormick Resonance, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and McCormick Resonance were not among them. These 10 stocks could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Jon Quast does not own any of these shares. the Motley Fool recommends McCormick resonance. the Motley Fool has a disclosure policy.

This gorgeous dividend stock is trading near a once-in-a-decade valuation. Is it a buy? This post was originally published by The Motley Fool.