.

TTWO, LYV, DIS: Which Entertainment Stock Is the Best Buy?

While the macro environment remains challenging, entertainment stocks such as TTWO, LYV and DIS have shown signs of life over the past year. As the economy shows signs of recovery and consumers have the opportunity to save more disposable income to enjoy life and enjoy themselves, I think the entertainment sector will continue its recent growth momentum.

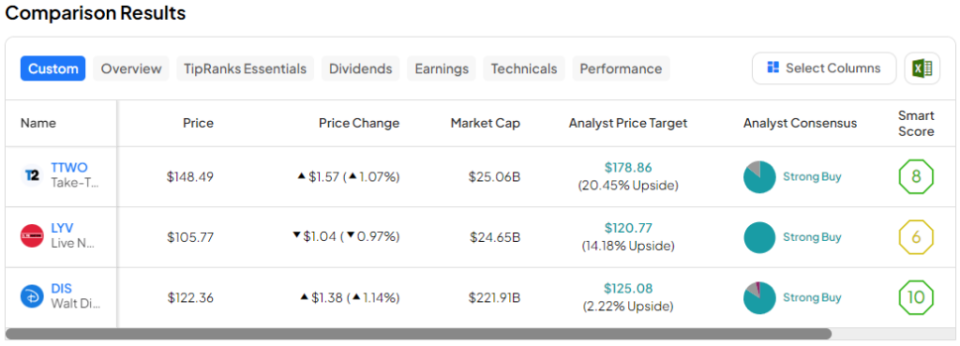

In fact, only time will tell if they will be the next companies to make new all-time highs. Regardless, Wall Street is confident in each of the following companies, and most analysts recommend buying them. So let's use TipRanks' comparison tool to compare each entertainment company to see which one Wall Street is most bullish on.

Take-Two Interactive (NASDAQ:TTWO)

First, let's take a look at home entertainment game Take-Two Interactive, which has been looking to grow over the past year after dropping much of its pandemic-era earnings in 2021 and 2022. There's no doubt that the reopening of the economy means that e-gaming companies will have to compete once again with theme parks, concerts, and other "real-world" forms of entertainment.

However, as inflation and layoffs continue to put potential pressure on consumers' balance sheets, I think home entertainment stocks may once again prevail.

Speaking of Take-Two, it's about to release the long-awaitedRogue Hunter 6(GTA VI), this will be the perfect opportunity as it looks to entertain gamers with a new generation of immersive open-world blockbusters.

In the first trailer for the game, we saw stunning water physics and gorgeous scenes, and everyone was excited and ready to put their money where Take-Two's mouth is. regardless of when GTA VI is finally released, I'm as enthusiastic as everyone else, and will continue to be optimistic about the game.

Regardless, Take-Two's stock has hit a snag lately with news that GTA VI may be delayed. According toKotaku Reportedly, this delay could push the game from 2025 to late 2025 or 2026, and Take-Two issued a backorder in hopes of minimizing the potential delay.

Even if GTA VI has to wait another two years before it is released, I don't think the recent 4.2% one-day plunge in the name is justified. It speaks to the short-term nature of some profit-seeking investors. Now that a large portion of them have left the market, investors with a long-term perspective may have a chance to snag a great entertainment product at a slight discount.

If you have a five-year investment horizon, does it really matter that TTWO's blockbuster will be released a few months later than expected? Maybe not.

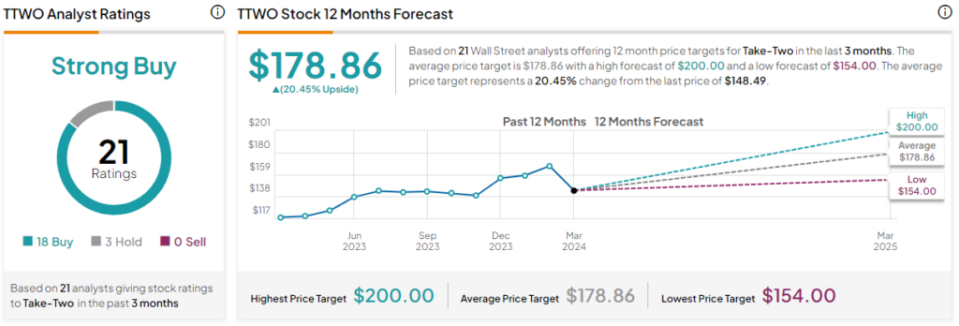

What is the target price for TTWO stock?

Analysts consider TTWO stock to be a "Strong Buy" stock, with 18 "Buys" and 3 "Holds" over the past three months.The average price target for TTWO stock is 178.86 USD, implying an upside potential of 20.45%.

Live Nation Entertainment (NYSE: LYV)

Live Nation Entertainment is perhaps the best way to bet on live music and real-world entertainment. Granted, the Metaverse and all the categories are trying to replicate the feeling of going to a concert. But don't expect the next generation of spatial computing to fulfill the demand for Taylor Swift concert tickets anytime soon, or ever.

Live Nation is the undisputed king of live entertainment, and as such, it deserves its high price tag (80.7x P/E) and analyst bullishness. As the stock's rebound reaches a crescendo, I'm as bullish as they come.

Earlier this year, Roth MKM's Eric Handler upgraded LYV's stock rating to "Buy" from "Hold" while raising the target share price by approximately 231 TP3 T. Mr. Handler was very bullish on LYV's demand trajectory, noting that the company appears to be on track for "above-trend" growth going forward.

As much as the price of tickets to the most sought-after concerts is prohibitively high, it seems that people are more than willing to pay the high price of a ticket for such an unforgettable experience. Indeed, there's nothing like a great performance by a favorite artist.

In short, Live Nation is a low-tech entertainment giant whose moat is impenetrable to even the next generation of technology. With plenty of big events coming up (like Creed's reunion tour) in addition to Taylor Swift's "Eras" tour, Live Nation is poised to continue its strong growth momentum.

What is the target share price for LYV stock?

Analysts consider LYV stock a "Strong Buy", with 14 analysts unanimously rating LYV stock a "Buy" over the last three months.The average price target for LYV stock is $120.38, implying a 13.8% upside potential.

Disney (NYSE: DIS)

Disney's stock is finally on the upswing, having risen about 25% in the past year, and while new highs are still out of reach, I think the possible candidacy of Nelson Peltz for the Board of Directors could give the media and entertainment giant the spark it's been looking for. There's no doubt that chief executive Bob Iger has had plenty of time to work his magic. Until now, the only magic investors have been waiting for is a change in management.

In addition to the change in management, there are some fascinating and possibly overlooked catalysts that could help DIS stock continue to rise. From investing in incremental theme park expansion to utilizing Epic Games' Fortnite to get a boost, I believe there is enough momentum to get Disney excited again.

Oh, and let's not forget that Disney has the potential to monetize its ESPN assets even more effectively as live sports and streaming go gold. Like many analysts, I'm bullish on Disney.

There's no denying that theme parks have been Disney's strength of late. By betting big on expanding its capacity, the company stands to gain a great deal by being able to accommodate more visitors at the same time, many of whom are willing to pay a lot of money to get into the parks. While Koon's investment in Epic Games is still a bit up in the air, I can't help but imagine what Disney's doubling down on its meta-universe efforts could yield in the distant future.

When it comes to meta-universe type games that resonate with young people, Fortnite is hard to ignore. As Disney continues to put its money in the right areas (gone are the days of splurging on Disney+), I find that a comeback is likely only a matter of time. With Peltz on board, Disney's recovery will pick up the pace a bit. He's a smart activist who could bring a lot of value to the legendary media and entertainment giant.

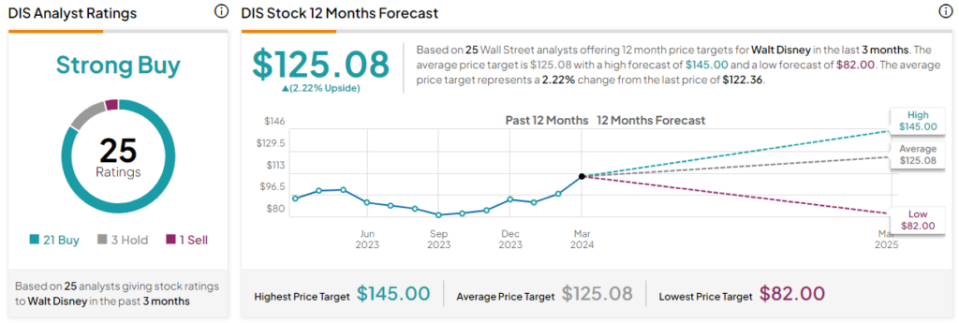

What is the target share price of a DIS stock?

The stock has a Strong Buy rating by analysts.DIS stock has an average target price of $123.21, implying an upside potential of 2.2%.

enlightenment

As consumer sentiment improves, value investors may want to consider buying these strong buy-rated stocks as they continue to compound. Of the three stocks, analysts see TTWO gaining the most ground over the next year.

Disclosure of information