.

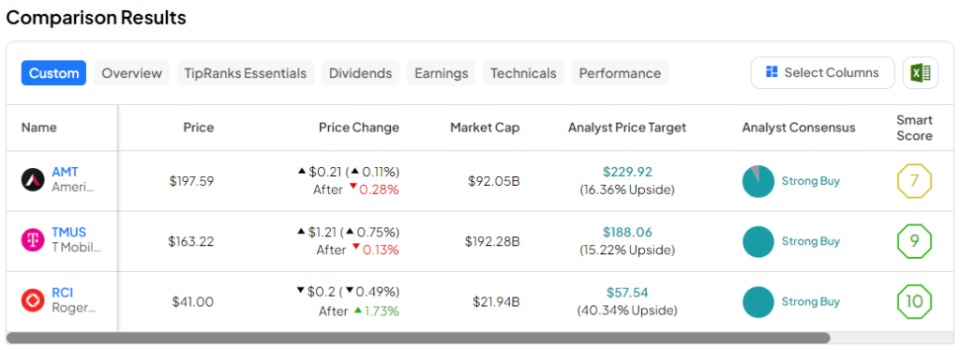

TMUS, RCI, AMT: Which Telecom Stocks Have the Most Potential to Rise?

There are some very cheap with-profits companies in the telecoms sector that can help you increase your quarterly passive income stream. There is no doubt that the days of high interest rates may be numbered. If that is the case, investors may need to return to the stock market to get a yield higher than 4.5%. The good news (for potential investors) is that U.S. telecom stocks are under tremendous pressure today for a variety of reasons, including macro headwinds.

With interest rates falling, consumer pressures easing, and the next generation of connected devices coming online, the companies fueling the 5G (and beyond) wireless communications boom are expected to move higher again. As such, this article will use TipRanks' comparison tool to examine three strongly Buy-rated telecom stocks that could be great buys this quarter.

T-Mobile (NASDAQ:TMUS)

When it comes to telecommunications companies, it's hard to think of one that's doing half as well as T-Mobile. Over the past five years, the company's stock price has risen by more than 1,35%, while some of its biggest traditional competitors have fallen deeper and deeper into the red. Better networks, lower prices, and maybe even belligerent promotions are all key to gaining market share.

While T-Mobile's peers have been taking steps to catch up with the fast-growing wireless king, it's likely that T-Mobile will continue to lead the pack as it looks to further expand its leading 5G wireless coverage. There's no doubt that T-Mobile is still the king of 5G, and I don't see anyone dethroning it, at least in the near future.

Getting a state-of-the-art 5G network doesn't happen overnight. It takes years, if not decades, of focus and significant investment. Smart investments over the years have helped T-Mobile build a deep moat around itself. All that said, I have to say that I'm as enthusiastic and bullish on this stock as Wall Street is.

Looking ahead, T-Mobile seems to be positioned to provide better connectivity for the next generation of (wireless) wearables. With the recent establishment of T-Mobile with the best names in 5G and spatial computing (or hybrid reality helmets), it's hard not to see T-Mobile as an enabler of spatial computing and one of the biggest beneficiaries of the rise of the Metaverse.

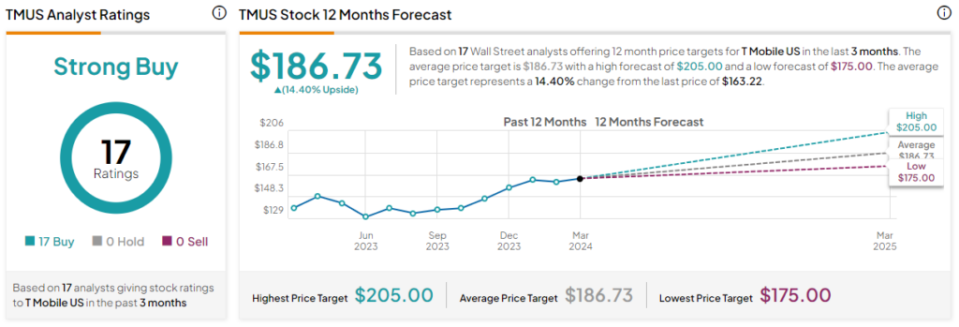

What is the target share price for TMUS stock?

Analysts consider TMUS stock a "Strong Buy", with 17 analysts unanimously rating TMUS stock a "Buy" over the last three months.TMUS stock has an average price target of $186.73, implying a 14.4% upside.

Rogers Communications Corporation (NYSE:RCI)

Rogers Communications, a Canadian telecommunications company, has also received an impressive "Strong Buy" rating from analysts. However, unless you live in Canada, you probably haven't heard of this company.

Unlike T-Mobile, which has been a successful investment for many years, Rogers Communications' stock price has been underperforming in recent years. Not only has the stock price declined over the past five years, but also over the past decade. Over the past 5 and 10 years, the stock has fallen 23.6% and 1%, respectively.

While investors are getting a nice dividend (current forward yield of 3.62%), I think it's safe to classify RCI stock as a "dumb stock". Even after adjusting for the dividend, the stock is still down nearly 101 TP3T over the past 5 years, and up just 401 TP3T over 10 years.

However, while some may consider the dividend to be worthless, others may see great value in the stock. Otherwise, why would most analysts be optimistic about this Canadian telecom company?

Perhaps the biggest argument in favor of Rogers Communications is the progress made last year with the merger of another Canadian telecommunications company, Shaw Communications. The deal, which encountered significant regulatory hurdles to completion, concentrated market power (particularly in the Western Canadian market) into the hands of one company, which was a source of great concern for the regulatory agencies, but an opportunity for investors.

Looking ahead, analysts cite synergies and strategic alignment as key advantages of the deal, as Edward Jones analyst David Heger said in a recent meeting withBNN BloombergIn an interview with the Canadian Securities and Exchange Commission (CSEC), the company noted that Rogers seems to be saving money faster than expected. With that in mind, it's hard not to be bullish on this Canadian long-term laggard.

Perhaps the cost savings could be passed on to customers? If not, perhaps shareholders will benefit the most, and the company could raise its dividend significantly in the future. Regardless, Rogers stock looks relatively cheap at a forward price-to-earnings (P/E) ratio of just 11.5 times, well below TMUS, which trades at a forward P/E of about 18 times.

However, perhaps the stock's greatest attraction is its implied upside potential, which at the time of writing exceeds 40%.

What is the target price for RCI stock?

Analysts consider RCI stock to be a "Strong Buy" stock, with a consensus rating of "Buy" from nine analysts over the past three months.The average price target for RCI stock is $57.71, implying an upside of 40.8% Potential.

American Tower (NYSE: AMT)

American Tower Corporation is a real estate investment trust (REIT) that leases signal towers to its customers. The REIT has been hit hard in recent years, with its stock falling from its peak to the bottom of the barrel by nearly 47%. Recently, AMT's stock has regained traction thanks to an expected interest rate cut, a slight beat in quarterly sales ($2.79 billion versus $2.74 billion in the fourth quarter of 2023), and optimistic guidance for the year ahead.

Undoubtedly, with such a low threshold and an even more optimistic tone for 2024, it's hard for the REIT not to be bullish as it looks to add to its newfound momentum, which has sent its shares up more than 20% from last year's lows.

In the coming year, U.S. building companies seem poised to cash in on the growth of data centers. With the rapid rise of generative artificial intelligence in the cloud (and its potential in edge computing), data centers seem to be the place to be. With the success of the company's previous acquisition of data center company CoreSite, the unheralded base station REIT could well be poised for an epic comeback.

At the time of writing, the company's stock trades at a forward P/E of 26.7x, which is slightly higher than the other two telecom companies in this article. Regardless, I see this 3.32% yielding stock as a long-term winner, as it can use data centers to spur growth and further diversify its business.

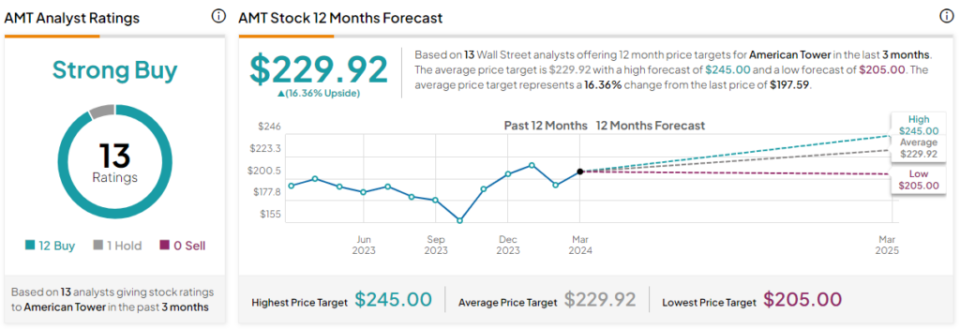

What is AMT's target share price?

Analysts consider AMT stock a "Strong Buy" stock, with 12 "Buys" and 1 "Hold" in the last three months.The average price target for AMT stock is 229.92 USD, suggesting an upside potential of 16.41 TP3T.

bottom line

The telecom sector seems to hold a wealth of opportunity for value investors who like dividends or payouts. While I'm a big fan of all three companies, RCI stock appeals to me the most, as Wall Street sees it as having the biggest upside over the next year (~40%). It's also the cheapest of the three in terms of price-to-earnings ratio.

Disclosure of information