.

I'll buy three button retail stocks today before I buy Wal-Mart stock.

Investors have good reason to be optimisticWal-Mart (NYSE: WMT)First of all, Wal-Mart is the world's largest retailer. First of all, Wal-Mart is the world's largest retailer, with operating revenues of nearly $650 billion in the past 12 months. With more than 10,600 stores, Wal-Mart carries everything from food carriers to home furnishings to auto parts.

In short, investors of mass can expect consumers to patronize Wal-Mart - it sells almost everything, and its large stores are conveniently located to serve communities across the country. In other words, investors don't have to worry about how Wal-Mart is doing.

There's another plus: Wal-Mart's e-commerce business now generates $100 billion in annual revenue. With such a massive digital platform, the company will be able to develop its advertising business, which will be a key driver of profit growth in the coming years.

That said, it is still possible to be critical of Wal-Mart's stock from an investment standpoint. If you look at the stock's valuation from a variety of perspectives, this is one of the most inopportune times to buy a person's name in the last decade.

Walmart's price-to-sales (P/S) ratio hit a 10-year high. Its price-to-earnings (P/E) ratio is higher thanStandard & Poor's 500 The company's dividend yield is at a 10-year low. The company's dividend yield is at a 10-year low.

Therefore, I am more optimistic about the other three folding button retail chains than Wal-Mart, and consider them to be the most opportune investment opportunities:Ollie's Bargain Outlet Holdings (NASDAQ: OLLI),Five. Below (NASDAQ: FIVE) andDollar General (NYSE: DG).

1. Ollie's Cheap Shop

Earnings growth tends to drive stock prices higher, which is good news for Ollie's shareholders. The pandemic hit the company's profitability, creating supply chain issues and increasing labor expenses. But Ollie's bounced back in 2023, with a whopping 74% increase in operating income, and growth seems likely in the future.

In 2024, Ollie's plans to open 48 new stores, which is good growth momentum compared to 512 stores at the end of 2023. Considering management just raised its long-term goal to 1,300 stores, investors can expect to see new store openings at a rapid pace for some time to come.

Ollie's profit margins have remained stable throughout its growth. This gives us reason to believe that management has a good grasp of the business and can maintain strong profitability while expanding. Therefore, with hundreds of new stores opening, I expect Ollie's earnings to increase, which in turn will drive the stock higher.

2. Five Below

Five Below's investment philosophy is similar to that of Ollie's: the company has profitable stores and plans to open more, which will provide investors with profitable growth and upside. The difference between the two is that Five Below's timeline is more defined (and more aggressive).

By the end of 2023, Five Below will have more than 1,500 stores. But Koon intends to have more than 2,600 stores by the end of 2026 and more than 3,500 by the end of 2030.

Keep in mind that Five Below is completely debt-free, as it is relatively inexpensive to open new stores and has a one-year payback period. Think of it as a cash flow snowball rolling downhill. The company makes a profit and uses the cash to open new stores. These stores will soon cover their costs, and the cash flow snowball will get bigger and bigger.

The good news for investors right now is that Five Below's stock price is down about 16% year-to-date, providing investors with a better entry point for a long-term investment.

3. General dollar stores

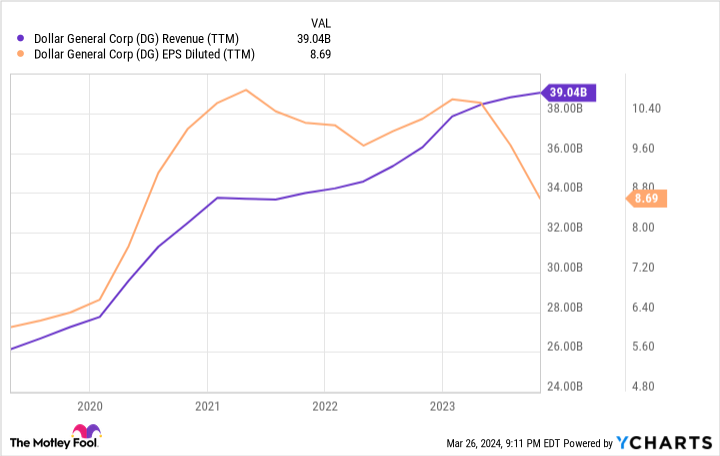

While Wal-Mart, Ollie's and Five Below are thriving, Dollar General is having some problems. On the one hand, Dollar General's revenues are at an all-time high, driven by a combination of new store openings and same-store sales growth at existing stores. However, its diluted earnings per share (EPS) declined in 2023 and is expected to decline again in 2024.

The silver lining is that Dollar General still has significant consumer demand and is still profitable. Therefore, the business could be saved. Management simply needs to identify the problems that are causing the decline in profits and fix them.

In fact, Dollar General already knows that the key to the problem lies in the unsatisfactory management of inventory, and is working hard to correct it. According to management's guidance, the turnaround will not be completed this year. But I believe it will happen sooner rather than later, and it will improve the company's earnings at an amazing rate over the next few years.

Meanwhile, investors who bought Dollar General stock today can get a return while they wait. Unlike Ollie's or Five Below, Dollar General stock pays a dividend. The dividend yield is higher than Wal-Mart's, which is another reason why people favor Dollar General. In addition, Dollar General stock will likely increase its dividend again in 2024, just as it has done for eight consecutive years.

In total, I understand why investors like Wal-Mart stock, but it's not necessarily a good value right now. Therefore, for investors who like the discount retail space, O'Reilly's, Five Below, and Dollar General offer better opportunities for profitable growth. I would buy shares of all three of these companies today before I would buy shares of Wal-Mart.

Should you invest $1,000 in Five Below right now?

Before buying shares of Five Below, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Five Below is not included in the list of stocks available at ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Jon Quast owns shares of Dollar General and Five Below. the Motley Fool recommends Wal-Mart. the Motley Fool recommends Five Below and Ollie's Bargain Outlet. the Motley Fool has a Disclosure Policy. The Motley Fool has a disclosure policy.

Before I Buy Walmart Stock, I'd Buy 3 Discount Retail Stocks Today was originally published by The Motley Fool.