.

This sector will crush the S&P 500 by 2024 (non-tech)

Standard & Poor's 500 The index's year-to-date (YTD) gains have been driven by a handful of tech-focused companies. But that doesn't mean the tech sector is the only winner in 2024.

In fact, energy, materials, industrials, utilities and financials all beat the S&P 500 last month. Meanwhile, communications, financials, energy and industrials were the only sectors to beat the S&P 500 so far this year.

In a market where Artificial Intelligence (AI) has moved so much of the narrative, it can be refreshing to see traditional companies outperform their benchmarks. Let's take a look at what's driving the rebound in the industrial sector and how it's approaching.

Broad Rebound

The industrial sector encompasses many different industries, ranging fromUnited Hearts Parcel Service(United Parcel Service(math.) andFedEx) Such a parcel delivery company to theRTXrespond in singingLockheed Martin) such defense contractors, then toHoneywell InternationalThe company is a group of such enterprises. But it is the strength of the heavy machinery companies that has attracted the most attention in the sector.

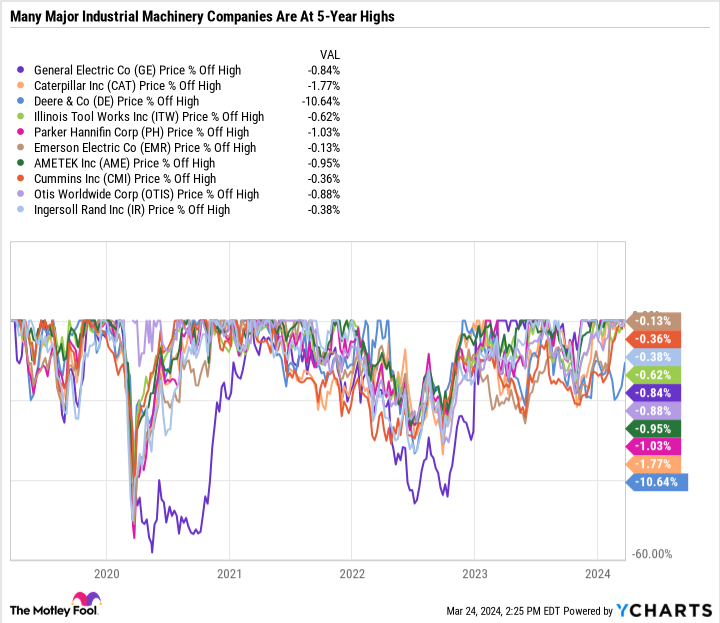

Here are the 10 largest U.S. companies in terms of market capitalization for construction, heavy construction and specialty industrial machinery. In addition toDill. With the exception of S&P 500 (which still beats the S&P 500 over the past five years), all of these stocks are within 2% of their all-time highs in terms of market capitalization.

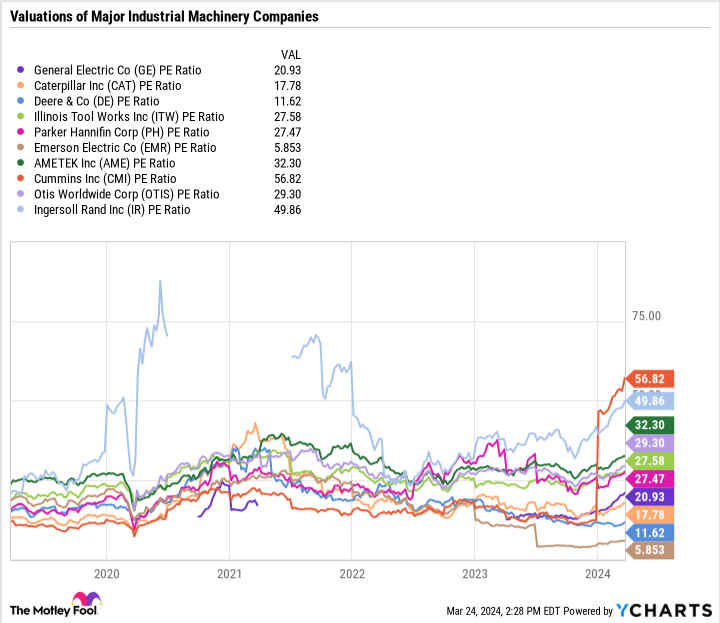

While Gwen's gains have been significant, most of these stocks do not have high price-to-earnings ratios compared to the 28.4 price-to-earnings ratio of the Standard & Poor's 500 Index. This tells us that much of the rally has been driven by earnings growth, not just valuation expansion.

Promoting Economic Prosperity

Many heavy machinery companies sell to other businesses, not to consumers. Similarly, many technology companies thatFrom Nvidia) toSalesforceand then toAmazon Network Services (Amazon (Web Services) andMicrosoft Azure and other cloud infrastructure providers are also曏 other companies to sell products.

Markets can be divided into seemingly infinite categories. But one of the simplest classifications is between business-centered companies and consumer-centered companies.

There is a divide developing in the marketplace, with many business-to-business companies doing well and some (but not all) consumer-focused companies struggling. Recent examples areresonancerespond in singingLululemon (brand)Both companies sold off sharply after releasing disappointing earnings reports on March 22nd.Apple respond in singingNikola Tesla (1856-1943), Serbian inventor and engineerPrimarily consumer-centric, they have been under pressure while many other large tech stocks have been popular.

In short, industrial stocks are now on the right side of the market, which is undoubtedly one of the reasons for the sector's rebound.

A balanced company with room for growth

Many heavy machinery companies are cyclical and are currently enjoying record earnings, but eventually earnings will fall and valuations will become more expensive. One of the benefits of investing in a leading industrial company is the potential upside from growth, as well as the stability of dividends and share buybacks.

Illinois Tool Works (NYSE: ITW)Illinois Tool Works is an example of how to create value for shareholders through dividends, buybacks, and capital gains. Over the past 10 years, the company's stock price has outperformed the S&P 500, and its dividend has more than tripled, while its share count has declined by 27.61 TP3T. Illinois Tool Works is also a dividend king, having raised its dividend for more than 50 consecutive years. Illinois Tool Works is also a dividend king, having raised its dividend for more than 50 consecutive years. The company has increased its profit margins and focused on bottom-line growth rather than sales growth, a strategy that has paid off handsomely for shareholders.

In a challenging period of high interest rates, Illinois Tool Works has demonstrated the effectiveness of business-to-business strategies. The prospect of lower interest rates could keep the cycle on track. Wall Street likes future growth, and that's exactly what's happening in the industrial sector.

Investment in the industrial sector

There are many ways to invest in the industrial sector other than buying stocks of leading companies in the sector.

Industrial Select Sector SPDR Fund (NYSEMKT: XLI)It's one of the easiest ways to gain access to essential investment opportunities in the sector without breaking the bank. The fund's expense ratio is just 0.09%, which means investors pay an annual fee of just $9 per $10,000 invested. With 78 holdings, none of which account for more than 5% of the fund, and a market capitalization of $17.7 billion, it's a large, diversified fund. One drawback is that the yield is only 1.5%, mainly due to stock prices outpacing dividend growth.

For investors focused on passive income, theiShares Global Infrastructure ETF (NASDAQ resonance code: IGF)An alternative choice is the fund, which has a yield of 3.5% and a P/E ratio of 21, but a higher expense ratio of 0.41%.

The fund includes a variety of industrial, energy and utility companies that contribute to global infrastructure development. Many of the fund's international constituents are undervalued, making the ETF a good choice for investors looking for higher yield and value.

Carrying a person's name

The industrial sector accounts for 8.8% of the S&P 500, so it doesn't have the same ups and downs as the technology sector. However, the strong performance of the industrial sector is encouraging for the broader market rebound.

This suggests that non-technology companies that have little to do with hot trends such as artificial intelligence are gaining cash flow and generating revenue for shareholders. Cycles can change, and the sector may be weak in the short term. But there is every reason to believe that the sector will perform well over the long term.

There is room for sustained earnings growth in this industry, and even in times of economic downturn, shareholders can be rewarded through buybacks and dividends.

While sectors such as industrials are at all-time highs, the stock market remains an excellent vehicle for long-term wealth accumulation.

Should you invest $1,000 in Illinois Tool Works now?

Before buying shares of Illinois Tool Works, consider the following:

Motley Fool Stock AdvisorThe team of analysts at the University of California at Berkeley have just selected what they believe to be the most suitable carriers for investors to buy now.10Only ...... and Illinois Tool Works were not included. The 10 stocks that made the list could generate huge returns in the coming years.

stock (market)ConsultancyIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. Daniel Foelber has no position in any of the stocks mentioned above. The Motley Fool recommends shares of Amazon, Apple, Emerson Electric, FedEx, Lululemon Athletica, Microsoft, Nvidia, Salesforce, and Tesla, among others. The Motley Fool recommends shares of Amazon.com, Apple, Emerson Electric, FedEx, Lululemon Athletica, Microsoft, Resonance, Nvidia, Salesforce, and Tesla, among others. The Motley Fool recommends Cummins, Deere & Company, and Lockheed Martin, RTX, and United Parcel Service, and recommends the following options: the Resistant January 2025 $47.50 Call Option Long, the Microsoft January 2026 $395 Call Option Long, and the Microsoft January 2026 $405 Call Option Short.The Motley Fool has a disclosure policy.

This Sector Will Crush the S&P 500 (Non-Tech) by 2024 was originally published by The Motley Fool.