.

Is it too late to buy shares of Chevron?

If I had to pick one energy stock to buy right now.Snowdragon (Chevron) (NYSE: CVX)There are a lot of favorable factors. But at the end of the day, the real microdynamics of a company's financials and stock performance are the prices of oil and natural gas. This is a complex factor that investors need to understand before buying this (or any) energy stock. Still, there are reasons to be bullish on Chevron compared to its peers, and reasons not to buy it. Here's what you need to know to make your final decision.

Snowdragon's yields are extremely attractive

If the two integrated energy giants were to face each other squarely, the most obvious would probably be between Chevron and fellow U.S. energy companies.Everson Mobil (New York Stock Exchange: XOM)Both companies are integrated energy companies. Both are integrated energy companies, both are based in the United States, and both are largely focused on oil and gas (their European counterparts are more aggressive in adding clean energy).

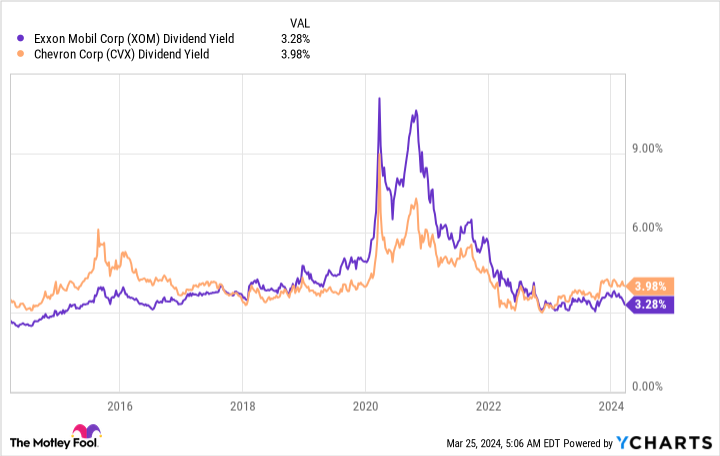

So, how do these two companies stack up? Using the dividend yield as a rough proxy for valuation, Chevron's dividend yield of 4.2% is much more attractive than Eversheds' dividend yield of 3.3%. In percentage terms, this is a rather large difference. Historically, both stocks had higher yields during the oil downturn, but reson's yield is particularly low today, as shown in the chart below. Of course, this makes Chevron's yield higher, but it also shows that Chevron is the more attractive of the two stocks in terms of valuation.

Note that both companies have increased their dividends annually for decades, making them reliable dividend payers. Everson's 41-year streak is longer, but Chevron's 36-year annual growth is hardly something to complain about. This cuts nicely into another interesting point of comparison.

Stronger and stronger.

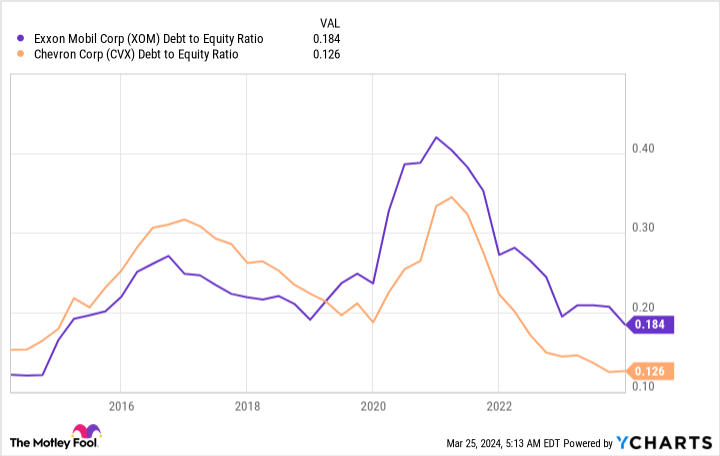

One of the key reasons for the impressive dividend histories of Chevron and resonance is their strong balance sheets. In short, they raised debt during the oil price downturn to support their businesses and continue to pay dividends. Where oil prices have rallied, these companies have reduced their leverage, as they always do, to prepare for the next downturn in the industry. In terms of leverage, however, Chevron is currently more leveraged than resonance, with a debt-to-equity ratio of 0.12 compared to resonance's 0.18.

While this isn't a huge difference, it does mean that Chevron has more financial room for maneuver than resonance in the face of adversity. For conservative investors, the higher yield and stronger financial foundation may make Chevron a better choice for now (assuming you want to buy an energy stock).

However, from a longer term perspective, waiting for the industry to decline may be the best option. At that point, investors will question whether Freddie Mac will be able to maintain its dividend, given its long history of dividend maintenance (and the whole balance sheet issue). So while Koon's current share price is relatively attractive, if you like to buy shares at a low price, you may have missed out. However, given the cyclical nature of the oil industry, you will eventually have a chance. But - and this is important - you have to be willing to buy when most other investors are panicking. That can be a difficult thing to do.

Relatively attractive, but not cheap.

It's hard to argue that Chevron is cheap in absolute terms at the moment, so value-conscious investors may have missed their chance this time around. In recent memory, the best time to buy the stock would have been during COVID's worst downturn. That said, Chevron does look relatively attractive compared to its closest competitor, Eversheds. If you are looking to add an energy stock to your portfolio, Chevron is a well-positioned company with a strong financial base and a track record of reporting back to investors. Just be aware that while it may be relatively cheap, it is not historically cheap.

Should you invest $1,000 in Chevron now?

Please consider the following points before buying shares in Snowdrift:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... is excluded. The 10 stocks that made the list have the potential to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Reuben Gregg Brewer does not hold any of the shares mentioned above. the Motley Fool holds shares of the recommended Freddie Mac company. the Motley Fool has a disclosure policy.

Is It Too Late to Buy Chevron Stock? This post was originally published by The Motley Fool.