.

Is Uranium Energy Corp stock worth buying?

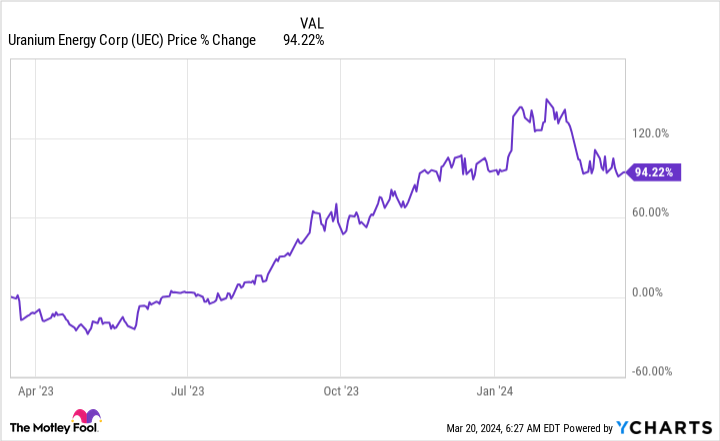

look as ifUranium Energy Company ( Uranium Energy Corp(math.) genusNYSEMKT: UEC)Such a commodity-focused business can be very volatile. That's not surprising when you consider that uranium, the product the company sells, is also somewhat volatile. Uranium Energy's share price has risen by around 90% over the past year, which is largely related to the rise in uranium prices. But there's a lot more to know before you consider buying this stock.

It's going up and it's going down.

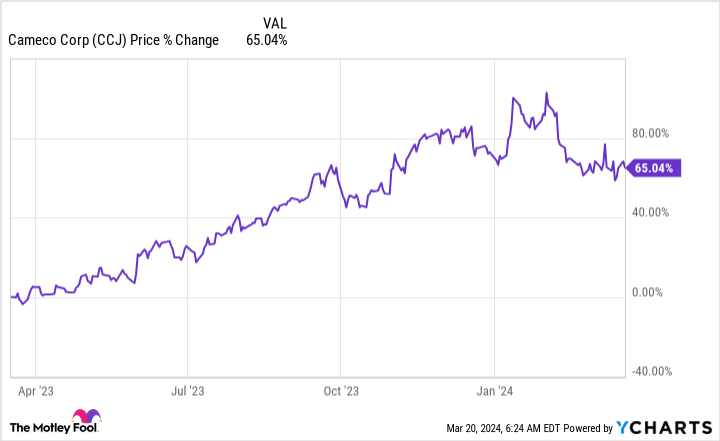

The spot price of uranium has risen to $95 by the end of February 2024, up from around $49 a year ago. That's a pretty big jump, so it's no surprise that the stocks of companies that mine nuclear fuel have risen along with the commodity they produce. As the chart below shows, industry giantsKamekko (name) (Cameco) (NYSE: CCJ)This is a very good example.

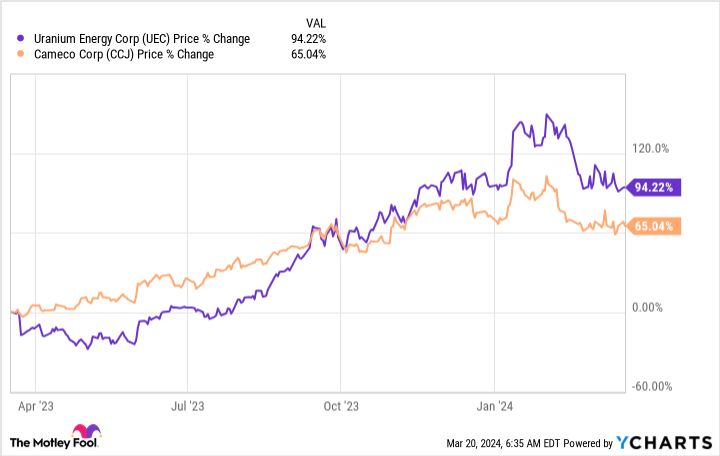

Note, however, that uranium producer Cameco's prices have dropped towards the end of the chart. This is due to the fact that the uranium price has fallen from just over $100 at the end of January. As is the case with commodities, there are ups and downs, which can have a significant impact on the prices of companies in the sector, and the performance of Uranium Energy Corp's share price follows much the same basic trend as Cameco's chart.

But why not put these two companies on the same chart, Cameco is a uranium company. Cameco is a uranium company. In any case, Uranium Energy Corp does not currently operate any uranium. It has a lot of uranium it wants to build, but its main goal for the near future is to have a uranium plant back in operation by August 2024. Building uranium is difficult, time-consuming and expensive. If you want to own a uranium company, Cameco is probably a better choice than Uranium Energy Corp, which is not yet a real uranium company.

Uranium Energy's story doesn't end there.

Here's another tidbit. When the uranium price was at a very low level, Uranium Energy Corp entered into a number of favorable agreements to purchase fuel. This allowed the company to build up uranium reserves, and more will be built up in the future as the uranium purchases are still active. It appears that investors value Uranium Energy Corp. primarily on the basis of the uranium stocks owned by the company.

This is not unreasonable, but it suggests that uranium energy companies may be more volatile than other companies in the sector, such as Cameco, which has significant operating assets. The graph above compares the stock movements of the two companies over the past year and demonstrates this point. On the investor side, the difference is not insignificant. Uranium energy companies' share prices seem to be highly dependent on the prices of the commodities they are involved in. Unless you have a very strong feeling about the price of uranium, you should proceed with caution.

You must also consider the execution risk involved in Uranium Energy Corp's plan to reopen a mountain in August. This does not include the company's six other projects in North and South America. Each project has its own execution risk. This is not a simple mining story.

Just a name of the adventurer.

In all fairness, Uranium Mining Corp seems to have made a great decision by signing a deal to buy uranium at a historically low price, thereby creating a low-cost nuclear fuel reserve (which is probably already well reflected in the stock price). (Meanwhile, the profits from the sale of the reserves could help the company fund its long-term uranium construction program, which is a very interesting story.

But more conservative investors need to keep their eyes open. Commodity prices will have a significant impact on the share price, as their main value lies in the uranium reserves created by the company. In addition, the construction of uranium itself carries significant risks. This may not be a good option for most investors.

Should you invest $1,000 in Bria now?

Consider this before buying shares of Uranium Energy Corporation:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Uranium Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Reuben Gregg Brewer does not own any of the aforementioned stocks.The Motley Fool recommends Cameco.The Motley Fool has a disclosure policy.

Is Uranium Energy Stock Worth Buying? This post was originally published by The Motley Fool.