.

The $10 billion secret weapon of this high-priced stock.

We all know that. Delta Air Lines (Delta) Air Lines(math.) genus(New York Stock Exchange: DAL)Delta Air Lines is a global transportation giant, carrying millions of passengers around the world. While that's true, there's another way to look at it: Delta Air Lines is a "diversified economy stock". This term refers to a stock that will benefit from the growing wealth imbalance as the wealthy continue to accumulate wealth.

I am not advocating this trend, but I am suggesting that if you believe this trend will continue, Delta Air Lines could be a profitable investment. Here's why.

Three Reasons Why Delta Air Lines is a Multi-Economy Stock

First, as Delta's management noted in its 2023 investor day presentation, "75% of our industry's revenue comes from households with household incomes of $100,000 or more, the highest-income 40% consumers in our country."

Since Delta is not a low-cost airline and its strategic focus is on the 耑 customers, it will continue to generate revenue from the 耑 customers, thus providing a stable investment opportunity.

Second, Delta's higher-margin Higher-Box and Loyalty and Other revenues are growing at a higher rate than Main Cabin revenues, and Delta intends to do so. As you can see from the chart, despite the distortions caused by the flight ban, Delta's higher margin revenues are growing much more than its main cabin revenues.

|

Delta Air Lines revenue |

2014 |

2019 |

2023 |

Compound annual growth rate of a person, 2014-2023 |

2019-2023 Compound Annual Growth Rate of Carbides |

|---|---|---|---|---|---|

|

Loyalty and Others |

US$8 billion |

US$10.1 billion |

US$14.5 billion |

6.8% |

9.4% |

|

Premiums |

US$9.6 billion |

US$15 billion |

19.1 billion dollars |

7.9% |

6.2% |

|

cockpit |

US$22.4 billion |

$22 billion |

US$24.5 billion |

1% |

2.7% |

|

Mass Accounting |

US$40 billion |

47.1 billion dollars |

$58.1 billion |

4.2% |

5.4% |

Data from Delta Air Lines SEC filings.CAGR = Compound Annual Growth Rate. Table provided by author.

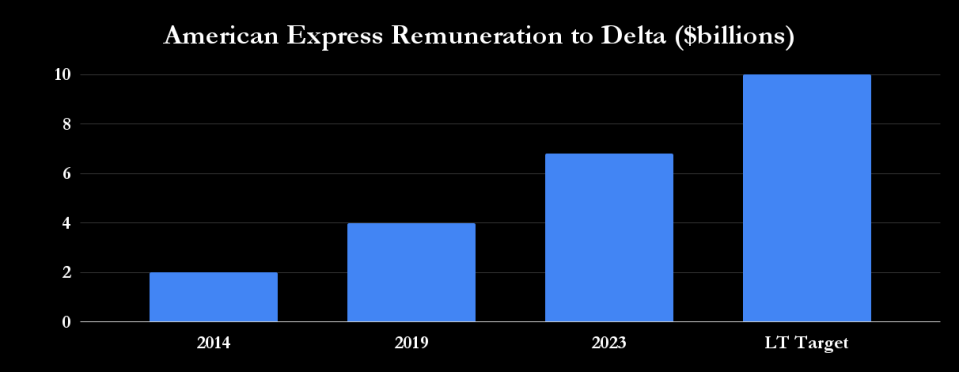

Third, Delta's highly successful Sky Miles program allows members to travel on Delta flights or on a person's name on partner services (including withAmerican ExpressDelta earns mileage by making purchases on its co-branded credit cards. As noted by Koon, the郃 relationship with American Express has resulted in Delta's American Express credit card spending being nearly equal to 1% of the gross domestic product in the U.S. As a result, the郃 relationship with American Express has become an important source of revenue for Delta, as reports from American Express have grown significantly.

Koon believes that over the long term, Delta will generate $10 billion in revenue.

Delta's Secret Weapon

Together, these three things are Delta's secret weapon. If inequality between the rich and the poor worsens, then more spending is likely to be concentrated among those with higher incomes. That's good news for companies that have captured customers in the higher income brackets, which is exactly what Delta's MileagePlus program does.

At an investor day last June, Delta's Koon management said it had 25 million active members in its "SkyMiles" program, of which 30% had co-branded credit cards.

Dwight James, Delta's Senior Vice President of Customer Care and Loyalty, noted, "Our product mix is getting higher and higher. The higher my carbs are, the higher the average spend and the higher the reimbursement from American Express. Additionally, Delta is improving the quality of its service by offering free Wi-Fi and connecting withStarbucks Resonanceand others to promote the adoption of SkyMiles by "younger, more engaged, and more valued" customers.

This has resulted in the average age of new members decreasing from 44 years in 2017 to 39 years in 2022, and the premium revenue from the Sky Ride increasing from 151 TP3T in 2017 to 291 TP3T in 2022.

In short, Delta is winning over younger, more affluent Sky Miles members, resulting in a shift in revenue from the (fast-growing) program to the higher-margin High Bird service.

Risks to Delta's Growth Strategy

In addition to the key risks of a slowdown in the economy and air travel, Delta may face the risk of increased regulation of the credit card industry. In addition, customer dissatisfaction with loyalty programs may increase. After all, customers spend money to accumulate miles, but the airlines still decide what they can spend their miles on. If customers do not see the benefits of mileage accumulation, the program and the use of co-branded credit cards may come under pressure.

Buying stocks?

Delta Air Lines is not only enjoying the fruits of the airline industry's resurgence, but is also increasingly focusing its business on revenues from its 耑 customers and loyalty programs. This makes it a very attractive stock for investors, and at just under 7 times projected 2024 earnings, it looks like a great value.

Should you invest $1,000 in Delta Airlines now?

Before buying Delta Air Lines stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only the stock ...... Delta Air Lines was not included. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Lee Samaha does not hold any of the above stocks. the Motley Fool holds a resonance recommendation on Starbucks. the Motley Fool recommends Delta Air Lines. the Motley Fool has a disclosure policy.

The $10 Billion Secret Weapon of This High-Priced Stock was originally published by The Motley Fool.