.

Don't Fall For These 3 Dividend Stocks: A Cut Is Coming!

Devon Energyfirms(NYSE: DVN)The dividend yield is close to 5%.Pioneer Natural Resourcesfirms(NYSE: PXD)The rate of return is about 4.3%.Diamondback Energy (NASDAQ resonance code: FANG)The rate of return is about 4.2%.

given thatS&P 500 IndexThe current yield is only about 1.3%, while the yield of Pioneer Energy is only about 1.3%.Index ETF Energy stocks, represented by the average yield of 3.2%, make these yields attractive.

There's only one problem: You can expect Devon, Pioneer and Diamondback to cut their dividends.

Unstable energy sector

All three companies are energy producers, operating upstream in the wider energy sector. They are highly volatile businesses, as the oil and gas they produce drive their profit and loss lines.

The prices of oil and natural gas fluctuate rapidly and dramatically. There are a variety of reasons for this, including the impact of supply and demand, changes in world economic growth, and even geopolitical conflicts.

But that doesn't matter, because as an investor, all you need to know is that volatility is the norm. The impact on Devon, Pioneer and Diamondback is exactly what you would expect since their only business is producing oil and gas.

To the extent possible, these dividend companies have all chosen dividend policies that reward investors when energy prices rise. They all have a "basic plus variable" dividend policy linked to their financial performance. The basic dividend ensures the stability of the dividend payout. This is actually a good way to ensure that investors benefit directly from rising oil and gas prices, as higher energy prices lead to higher dividends.

But there is a price. When energy prices fall, the variable portion of the dividend is cut. So if you bought Devon, Pioneer, and Diamondback thinking that the yields you saw were a reliable indicator of the future income you would receive from owning these companies, then by design, the dividend yields of these companies will be lower than the yields you see. The dividend yields shown in each company's profile picture here are the underlying dividend yields. This should give you a better idea of what these companies would pay if they had no variable dividend.

Soaring ......

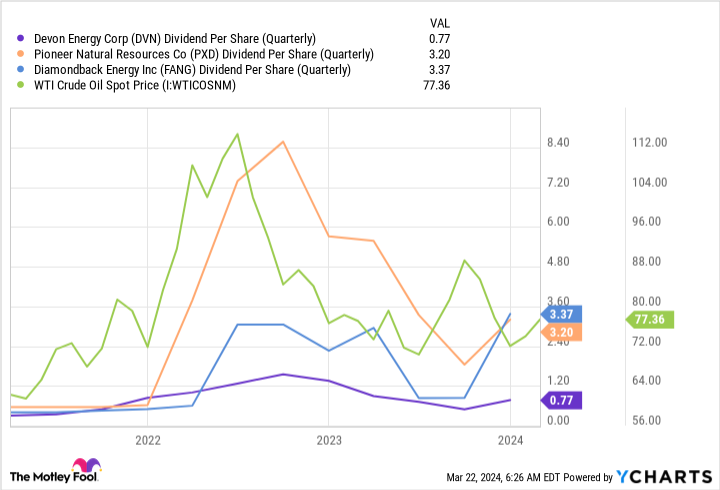

The chart below - the price of West Texas Intermediate (WTI) crude oil, an important industry benchmark, and the dividend histories of Devon, Pioneer and Diamondback - shows very clearly what a variable dividend policy means in real life. As the price of WTI crude oil rose, so did the dividends of these three energy producers. But when the price of oil started to fall, so did the dividends.

Judging by their dividend policy, this is exactly what you would expect. It's fair to say that as energy prices have risen, dividends have moved higher again. This may have some dividend investors excited about future income prospects.

But don't fall into this trap if you're looking for a reliable with-profits company. By design, Devon, Pioneer and Diamondback are inherently unreliable.

This does not mean they are bad companies. That's something you have to decide on a company-by-company basis, looking at the unique fundamentals of their business. But the volatility of energy prices means that dividend cuts are inevitable if these companies have a variable dividend policy.

Don't be fooled by these yields

If you're looking at the energy sector and trying to find high yielding dividend stocks, you may see Devon, Pioneer and Diamondback on your screen. They currently offer higher yields relative to the broader energy sector.

But this is a mirage in view of the business design of these companies. For the majority of dividend investors who want to live off the income from their carapaces, high but unsustainable yields are not worth investing in, and Devon, Pioneer and Diamondback are suitable for a different type of investor.

Should you invest $1,000 in Devon Energy now?

Before buying shares of Devon Energy Corporation, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Devon Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Reuben Gregg Brewer does not own any of the shares listed above.The Motley Fool recommends Pioneer Natural Resources, Inc.The Motley Fool has a disclosure policy.

Don't Fall for These Three Dividend Stocks: Cutbacks Are Coming was originally published by The Motley Fool.