.

1 Unbelievably Cheap Dividend Growth Stock to Buy Now

NextEra Energy (New York Stock Exchange: NEE)Not your typical utility stock, as its business consists of two distinct divisions. One division provides a solid foundation, while the other provides rapid growth.

The combination of the two makes NextEra Energy a dividend grower among the usually slow-growing utility stocks. Here's what you need to know about NextEra and why this dividend growth stock is so attractive right now.

NextEra Energy is historically inexpensive.

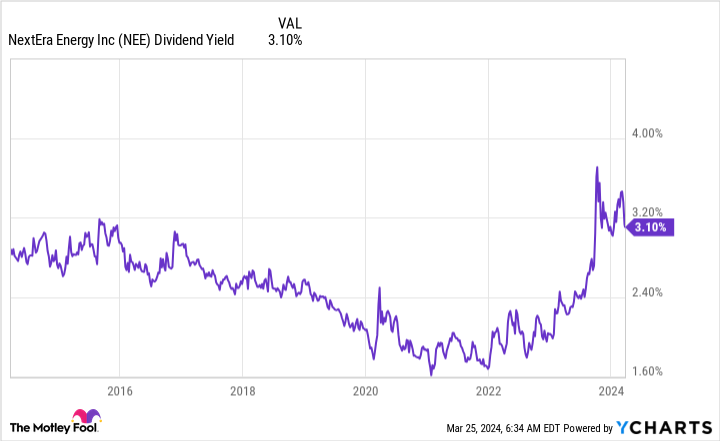

NextEra Energy currently pays a dividend yield of approximately 3.3%.Vanguard Utilities ETFThis figure is slightly below the industry average of 3.5%.

However, NextEra's dividend yield is typically a cut above when compared to its peers (see below for more details).3.31 TP3T's dividend yield happens to be near the company's highest level in the past decade, suggesting that the stock is on a hot streak.

What's even more appealing is that NextEra Energy has increased its dividend annually for 29 consecutive years. So the company's commitment to creating value for shareholders through reliable dividend growth is real.

But that brings us to the key metric of this story: over the past decade, NextEra Energy's dividend has grown at an annualized rate of 10%, which explains the premium on the company's stock, as half of that is a good dividend yield in the utility space.

In short, NextEra Energy is a dividend growth machine that looks cheap today. But why? Maybe something has changed.

NextEra expects dividend growth to remain significant going forward

In fact, the utility industry has undergone significant changes. Interest rates have risen dramatically over the past few years, which will increase the cost of doing business for utility companies.

Don't get too hung up on that, NextEra Energy is projecting dividend growth of 10% through at least 2026.Here are some important facts to know.

First and foremost, NextEra Energy is a two-winged enterprise. The core business (approximately 70% of the company's shares) is the regulated utility business. This division is comprised primarily of Florida Power & Light, one of the largest utilities in the U.S., which has long benefited from net migration from the Sunshine State. More customers mean more revenue, and customer trends aren't changing anytime soon.

As for higher costs, the regulator will likely take the rate increase into account when considering NextEra Energy's rate increase application and capex approval. It may have an impact in the short term, but in the long term, it is unlikely that an increase in interest rates will materially change the dynamics.

NextEra Energy's remaining 30% business is a fast-growing renewable energy generation business. The carpet contracts it has entered into here are market based and therefore subject to rate adjustments.

NextEra Energy hopes to double the amount of electricity generated by the business unit by 2026. In other words, more growth is expected, which will further support the strong dividend growth projected by management.

In total, despite rising interest rates, NextEra Energy does not see much change in its long-term outlook. This provides an opportunity for dividend growth investors to buy this dividend growth gem while it is still for sale.

Unique Buying Opportunities

NextEra Energy is not suitable for all investors. For example, if you are looking for high-yield stocks, you should probably keep looking.

But if you're a dividend-growth investor, or even a growth-and-yield investor, NextEra Energy looks like a very attractive option right now. It's certainly not a typical utility company, but that's what makes the company and its 10% dividend growth rate so enticing.

Should you invest $1,000 in NextEra Energy now?

Before buying shares of NextEra Energy, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10NextEra Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Reuben Gregg Brewer does not own any of the stocks mentioned above.The Motley Fool holds a recommendation for NextEra Energy.The Motley Fool has a disclosure policy.

1 Unbelievably Cheap Dividend Growth Stock to Buy Now was originally published by The Motley Fool.