.

1 Small Cloud Computing Companies Prepare for a New Round of Innovation - Is it Time to Buy?

Small Cloud Computing Infrastructure ProviderDigitalOcean (NYSE: DOCN)Performance in 2023 is not ideal. While generative AI infrastructure is starting to equate to a boom in cloud spending among fellow tech giants, that's not the case for DigitalOcean-at least not yet.

Last summer, the company acquired one of its own AI startups, with a new chief executive at the helm. Is it too late to buy shares?

Accelerated Growth Program

DigitalOcean has made a name for itself by offering affordable, easy-to-use "Droplets." Droplets" are a bit of computing power running in the data center that a developer or startup can use to run a website or application, store business data, run analytics, or perform a number of other digital tasks. The combination of simplicity and affordability is impressive, and DigitalOcean has hundreds of thousands of loyal users and a rich database to help them understand all aspects of cloud computing.

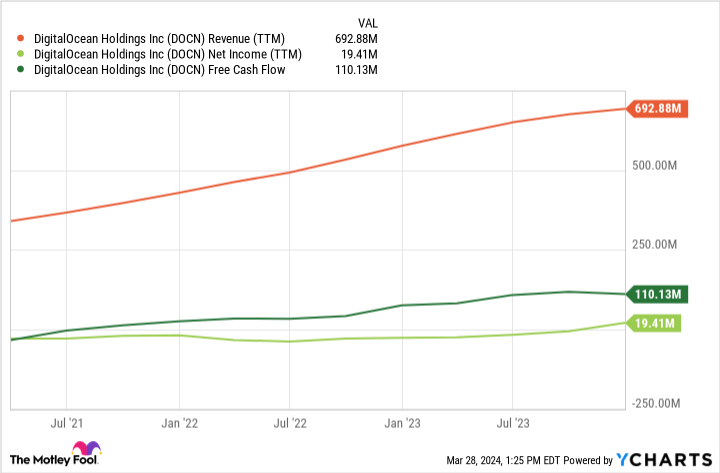

However, the bear market in 2022 and 2023 left many cloud computing companies devastated, and DigitalOcean was ultimately not immune. While 2023 revenue grew 20% year-over-year to $693 million, sales in the fourth quarter in particular slowed to just 11%.

In addition, Management has indicated that it expects revenue growth in 2024 to be only at the midpoint of guidance of 10%.Gartner (name)In the view of the global 耑 users of the whole cloud spending this year will beexpedite Growth 20%. it is clear that small businesses and developers are feeling the effects of the slowdown in global economic growth, which is also hitting DigitalOcean's financials.

The good news, though, is that new mat executive Paddy Srinivasan (who takes over in February 2024) is at the helm of a profitable company-both from a Generally Accepted Accounting Principles (GAAP) and free cash flow perspective.

Srinivasan has a background as a software developer, having worked for several large technology companies and several smaller ones. In a recent conversation, he explained to me that the company's goal will be to revitalize growth through innovation, and that DigitalOcean has the tools to do so.

Last summer, DigitalOcean acquired AI training and development startup Paperspace, which essentially provides DigitalOcean with a strongNvidiaThe GPU fleet is in high demand today. With a lot of interest from DigitalOcean developers flowing through Paperspace, the new Koon team is looking to capitalize on these GPUs with some new innovations that will help customers easily implement AI - just as the DigitalOcean core platform does for basic cloud use.

Is it time to bet on DigitalOcean to make a comeback?

DigitalOcean has been a crazy investment since the start of the bear market a few years ago, and since the start of 2023, it bounced back only about a year and a quarter ago to about 50%. some of its cloud software peers have bounced back even more than that. From this perspective, if DigitalOcean can execute its AI software product strategy well, it could gain even more.

Again, all the conditions are in place for the company's business to pick up again. It has a global data center infrastructure and, to emphasize the important point mentioned earlier, DigitalOcean is profitable. This could set the stage for further growth.

However, one worrying aspect is the balance sheet. At the end of 2023, the company has US$412 million in cash and short-term investments, but US$1.48 billion in debt. Debt repayment may become a limiting factor for DigitalOcean in the coming years. Time will tell.

At the moment, I am satisfied with the way DigitalOcean is managing itself in a bear market. It's a small company, so it's not a big position in my portfolio. But if Srinivasan and the new Koon team execute well later this year and starting next year, maybe I'll pay more attention to this top cloud computing stock that's looking to innovate in the artificial intelligence industry. As a passive investor in this promising company, I prefer to wait and see what happens.

Should you invest $1,000 in DigitalOcean right now?

Before buying shares of DigitalOcean, consider the following:

Motley Fool Stock AdvisorThe team of analysts at the University of California, Berkeley, just named what they believe to be the best values for investors to buy.10DigitalOcean is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

stock (market)ConsultancyIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Nicholas Rossolillo and his clients own shares of DigitalOcean and Nvidia.The Motley Fool holds a recommendation for DigitalOcean and Nvidia.The Motley Fool recommends Gartner.The Motley Fool has a The Motley Fool has a disclosure policy.

1 Small Cloud Computing Company Poised for a New Round of Innovation - Is It Time to Buy? This post was originally published by The Motley Fool.