.

Should you buy this "Gorgeous Jigsaw" stock as long as Gwen is unfavorable?

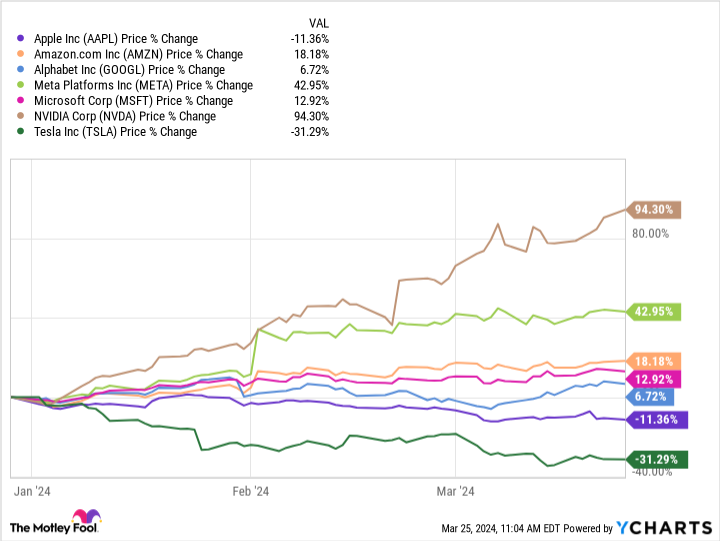

This year, the fortunes of the "Magnificent Seven," the lauded tech companies, have been very different.Apple Inc. (NASDAQ resonance code: AAPL)It was the worst performer among these seven companies, second only to the peer group ofNikola Tesla (1856-1943), Serbian inventor and engineerThe

Investors aren't happy with Apple's financial performance, but the company just ran into major resistance from Supervisor Koon Noodle, which won't make it any more popular in the market. Let's take a look at whether investors should give up on Apple stock.

Anti-trust issues re-emerge

For years, Apple and other members of the "Big Seven" have been under investigation for alleged antitrust practices. It has been argued that the success of these technology giants is partly due to the fact that they have illegally stifled competition to the detriment of consumers. on March 21st , the U.S. Department of Justice, in conjunction with no fewer than 16 states, filed an antitrust lawsuit against Apple, alleging that the company has illegally monopolized the smartphone market. the case is now under investigation by the U.S. Department of Justice, which is now investigating the company's antitrust practices.

The lawsuit alleges that Apple does this in a variety of ways. For example, communications between iPhones and other brands of smartphones, including texting and sending pictures, are far less smooth than communications between iPhone users. The lawsuit also alleges that Apple's App Store charges application developers unreasonable fees, not to mention that the tech giant suppresses innovation on its platform. These are just some of the allegations that the Justice Department has leveled against Apple's most important moneymaker, the iPhone.

Don't jump ship for a while.

It is too early to know the outcome of this lawsuit. It could drag on for years. Thankfully, Apple has the capital to handle such a lawsuit. The company has tens of billions of dollars in free cash flow. It's also not the first time the tech giant has been in the middle of a heated lawsuit, and it's probably one of the most important ones it's faced in its long history.

So what should investors do? According to Wall Street, I am giving Apple stock a "Hold" rating for the time being. That is, while I don't recommend that investors sell their shares, I do cautiously add to my position after a decline. The reasons for this approach go beyond Apple's recent legal troubles. In addition, the tech giant seems to be lagging behind several of its peers in the next big growth sector - artificial intelligence (AI).

It was rumored that Apple was planning a number of initiatives. Considering the company's reputation for utilizing existing technology and adapting it into a better version, and the great success it has had in doing so, Apple is still in the race. Apple's stellar record of innovation cannot be ignored. But for now, the company's approach to the AI market remains a bit unclear.

Meanwhile, the iPhone, while still its largest source of sales, is no longer the growth engine it once was, not even close. Despite the growing importance of its services division and its incredible profit margins, it remains a relatively small percentage of Apple's total revenue. Apple has more than 2 billion devices installed, but depending on the outcome of the DOJ lawsuit, the profitability of its ecosystem could change dramatically.

The combination of these unfavorable factors is why Apple isn't worth buying low right now.

Should you invest $1,000 in Apple now?

Before buying Apple stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Apple is not one of them. The 10 stocks that made the list will generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Prosper Junior Bakiny does not hold any of the stocks mentioned above.The Motley Fool holds recommended Apple and Tesla.The Motley Fool has a disclosure policy.

Should You Buy This "Magnificent Seven" Stock Despite Gwen's Resistance? This post was originally published by The Motley Fool.