.

Top 1 Semiconductor Stocks to Buy After Micron Technology's Star-Studded Report

Micron Technology Inc.firms(NASDAQ resonance code: MU)Last week, it announced a series of outstanding industry results for the second quarter of fiscal year 2024 that wowed investors.

The chipmaker benefited from a surge in demand for memory chips. As a result, its revenue jumped 58% year-on-year to $5.8 billion. Driven by increased demand for memory chips for artificial intelligence (AI) servers, smartphones and personal computers (PCs), Micron expects its revenue to grow by 76% year-on-year in the current quarter.

The memory industry has recently seen a major turnaround as demand for consumer electronics gets back on track while artificial intelligence creates demand for advanced memory chips known as high bandwidth memory (HBM). In its latest earnings call, Micron's management said that it has sold out of HBM capacity for 2024, and that "the vast majority of our 2025 supply has already been allocated".

For semiconductor device manufacturersLamm researchfirms(Lam) Research ) (NASDAQ: LRCX)That's good news. Let's take a look at why Micron's latest industry performance suggests that investors would be wise to buy shares of Lam Research right now.

Lam Research is on the verge of a solid turnaround.

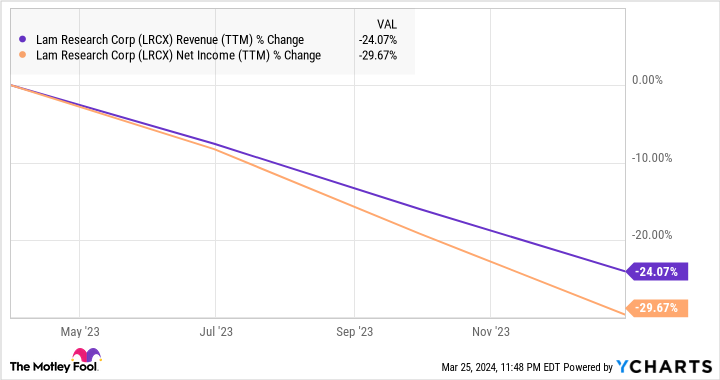

In the most recent quarter, Lam Research 48%'s revenues came from sales of semiconductor manufacturing equipment to曏 storage manufacturers. This also explains why the company's performance has been poor in recent quarters. The memory market is oversupplied, forcing companies such as Micron to suspend capacity expansion, and as a result, Lam's revenues and profits are declining.

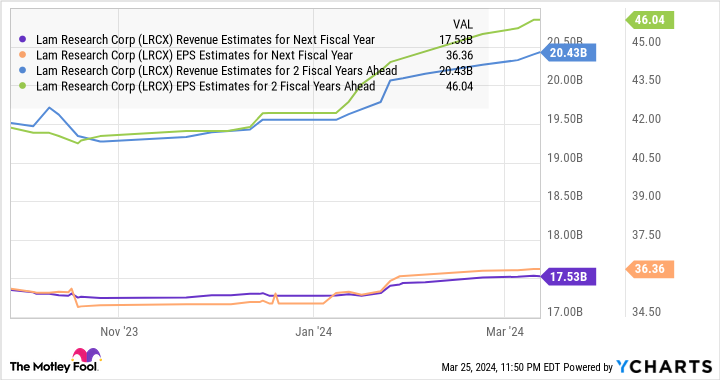

Analysts expect the company's revenue to fall 22% to $13.6B for the current fiscal year. In addition, earnings per share are expected to fall from $34.16 to $26.76. However, Lam Research's revenue and earnings could jump significantly in the next fiscal year, which starts in late June 2024, as shown in the chart below.

Micron's latest business and management comments tell us why Ram's fortunes are turning around. Memory makers need to increase the supply of HBMs to meet the growing demand for AI servers. Happily, Lam's HBM equipment is already receiving a steady stream of orders. Chief Executive Officer Tim Archer noted on the company's January analyst call, "In 2024, we expect HBM-related DRAM and package shipments to more than triple year-over-year..."

It is worth noting that the entire memory market will also jump significantly in 2024. According toGartner (name) This year, revenues in the memory industry are set to jump by 66%, following a decline of 39% in 2023.What's more, the growing popularity of artificial intelligence will drive strong growth in long-term memory demand.

According to Micron, the DRAM (Dynamic Random Access Memory) capacity of AI-enabled PCs could increase by 40% to 80% compared to traditional PCs.On the other hand, the company expects that, compared to current non-AI flagship phones, "the DRAM capacity of AI-enabled smartphones will increase by 50% to 100%".

Meanwhile, demand for HBM is expected to more than double by 2024, generating $14 billion in revenue, compared to $5.5 billion last year. Even better, the HBM market could generate nearly $20 billion in revenue next year. All of this suggests that memory manufacturers will have to increase capacity, and a closer look at the industry shows that this is exactly what is happening.

For example, Samsung expects to increase HBM production by 2.5 times in 2024 and another 2 times next year. Similarly, SK Hynix expects to increase capital expenditure this year to support the growing demand for HBM. Therefore, the end-to-end market conditions will be favorable to Lam Research.

There is no doubt about buying the stock now.

Lam Research is currently trading at a P/E ratio of 27x. This is in line withNasdaq Resonance100 It trades at a slight discount to the index's average multiple of 28 times (using the index as a proxy for tech stocks). If Lam Research's earnings come in at the expected $46, and it trades at 28 times earnings, then its shares will trade at $1,288, a jump of 33% from where they were before.

But don't be surprised if the stock rises even more, as the market may be mirroring it with a higher price-to-earnings ratio due to its AI-driven growth, which is why investors should consider buying this semiconductor stock before it jumps off the charts.

Should you invest $1,000 in Lam Research now?

Before buying shares of Lam Research, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and Lam Research were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Harsh Chauhan does not hold any of the above stocks.The Motley Fool holds a recommendation for Lam Research.The Motley Fool recommends Gartner.The Motley Fool has a disclosure policy.

1 Semiconductor Stock to Buy After Micron Technology's Star Report was originally published by The Motley Fool.