.

My God, this 5.71 TP3T dividend stock is a great buy.

Global Tobacco GiantPhilip Morris Internationalfirms(NYSE: PM)It's been in a deep hole for five years. The company's share price has gone up and down, but the current share price is not far from what it will be in 2019.

But that will soon change. The company has been working hard to develop and acquire the next generation of products to drive the growth necessary to push the stock to new heights.

Want to know more? Here's why Phillip Morris is a hot buy.

Next Generation Growth

Philip Morris sells Marlboro cigarettes in non-U.S. markets, but it has been developing new revenue streams for years that will eventually support the company as people smoke fewer and fewer combustible products. These are the IQOS and the Zyn, a device that heats tobacco to produce vapor but does not burn the tobacco, thereby reducing the amount of toxins inhaled by the user. Meanwhile, Zyn is an oral pouch that contains nicotine powder.

The company launched IQOS in 2014 and has built the brand over the past decade. Today, there are 28.6 million users of IQOS devices. In the markets where IQOS is offered, it has accumulated a market share of 9.7% of all tobacco use, second only to the Marlboro cigarette brand of Philip Morris, which will soon be available in the U.S., a new market that Philip Morris has not been able to enter before. It is estimated that there are 28 million smokers in the US, so this is a new market for IQOS that is similar to that of its former sister company.Altria It is a great opportunity to compete with the latter, which owns the Marlboro brand in the United States.

Philip Morris acquired the Zyn brand in 2022 with the acquisition of Swedish Match. The company is the global leader in nicotine pouch cigarettes, a fast-growing product category, and in the fourth quarter of 2023, it shipped 385 million cans in the 12-month period, a year-over-year increase of 62%. This kind of volume growth is rare in the nicotine space, and makes it an exciting long-term development for investors.

The company hopes that by 2030, these next-generation products will account for at least two-thirds of total gross revenues, up from 36.4% last year.With more than 1 billion smokers worldwide, Philip Morris has a unique portfolio of leading brands and global markets.

Generous Dividend

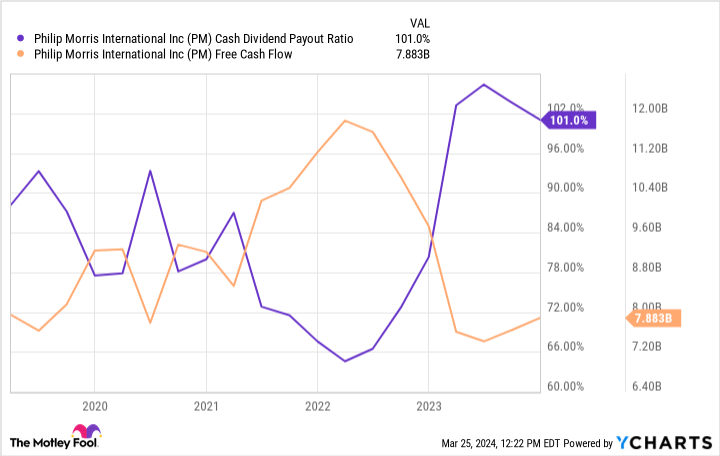

Tobacco stocks are known for their high dividend yields, and Phillip Morris meets that standard with a dividend yield of 5.7%. Granted, a dividend payout ratio of 101% of cash flow is tight, but the company has invested heavily in developing the Zyn brand's capacity and sales since acquiring it in 2022.

As cash flow improves, the dividend payout ratio should decline. Most importantly, investors are unlikely to see dividend cuts. Any company that pays a dividend is reluctant to cut it, but the Koon management team at the tobacco company is especially reluctant to do so because they know that the dividend is the main reason shareholders hold the stock. If needed, Koon management can use the balance sheet to cover any shortfall in dividend payments. At the end of 2023, there was $3.1 billion in cash on the balance sheet, and the company had an investment-grade credit rating.

Stock Pricing Provides Robust Investment Returns

The best way to profit from owning this type of stock is to buy it, hold it, and reinvest the dividends as they come in. Over time, the dividends will compound and the investor will enjoy some price appreciation.

Currently, the stock has a forward P/E of 14, and analysts believe the company could grow its earnings by 7% per year over the next three to five years. assuming the valuation remains unchanged, the annualized return to the investor would be more than 12%. this stock may be a bit expensive; it has a PEG ratio of 2, and I like to buy when the PEG ratio is 1.5 or lower. the PEG ratio tells investors how much they have to pay for earnings growth-the lower the better. The PEG ratio tells investors how much they have to pay for the company's earnings growth - the lower the better.

However, long-term investors should see the company grow in its price tag. More importantly, over a five-year or longer period, Phillip Morris could become a cash cow as Zyn's investment decreases and Phillip Morris pays down some of its debt.

Ultimately, a share purchase can bring long-term earnings and dividend growth to a company - just rinse and repeat.

Should you invest $1,000 in Philip Morris International today?

Consider the following before purchasing shares of Philip Morris International, Inc:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only one stock, ...... Philip Morris International, was not included. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Justin Pope does not own any of these shares.The Motley Fool recommends Philip Morris International.The Motley Fool has a disclosure policy.

My God, This Dividend Stock With A 5.7% Yield Is A Great Buy was originally published by The Motley Fool.