.

Now, for $1,000, buy a stock that will turn a loss into a profit without breaking a sweat.

Sometimes the best time to buy a company is when it's hardest to like it.Stanley Head Resonance Co. (New York Stock Exchange: SWK)That's exactly what's happening right now. However, you can take comfort in the fact that management is predicting a turnaround in the company's performance by 2024. Here's what you need to know and why this iconic industrial company is a great place to invest $1,000 today.

OPPORTUNITY: The bottom line for Stanley Blake Resonance Daikers is a disaster

In 2021, in the wake of the COVID-19 pandemic, Stanley Black & Decker announced full-year adjusted EPS of $10.48. This was $30% higher than 2020 earnings, a record high for the company. To be fair, there are some extenuating circumstances. People are working from home and are socially detached, which may lead to more do-it-yourself home improvement projects being completed. You need the tools sold by Stanley Black & Decker to do this kind of work. On balance, however, 2021 is clearly a very good year for this industrial company.

And then the wheels fell off. In early 2022, Stanley Bruckner-Dyer expected full-year adjusted EPS to be in the range of $12.00 to $12.50. But that was not the case. But that was not the case, with full-year adjusted EPS coming in at just $4.62. Management's forecast was very different, but they immediately began to develop a turnaround plan. Cost cutting, mold adjustments, debt reduction and efficiency improvements were all part of the strategy.

All of this is good, and exactly what you'd expect from a leadership team, but there's one big problem. The company expects to be struggling again in 2023, with full-year adjusted earnings guidance between breakeven and $2 per share. In other words, it's the second consecutive year of declining performance. The end result, 2023 adjusted earnings of $1.45 per share. Granted, management met the top half of the target range, but it's still not a great number, and the trend is toward two consecutive years of sharply declining earnings.

Stanley Resonance-Daikon sees a bright future in 2024

There's an old saying: "If you don't forget what you've done before, you'll learn from what you've done later. In reviewing the progress of the turnaround plan, Koon believes that the adjusted earnings per share in 2024 will be between US$3.50 and US$4.50. On the low side, this would be a 140% improvement, and on the high side, a 210% leap. If the company's forecasts are close to target, 2024 could be the year earnings rebound significantly.

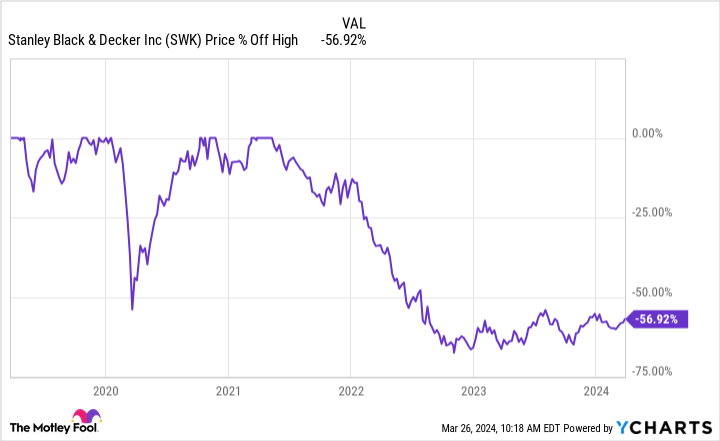

However, given the multi-year downward trend, Wall Street's "show me" sentiment on Stanley Black & Decker is perfectly justified. The stock is still trading 50% below its 2021 highs. that's where the opportunity lies, especially if you're a dividend investor who likes companies with a history of reliable dividend payouts.

Stanley Black & Decker is the king of dividends, having increased its dividend every year for 56 consecutive years. It is noteworthy that the Board of Directors has continued to raise the dividend every year, despite the recent troubles that Koon has encountered. This speaks to both the company's long-term concerns and its belief that the current problems are only temporary. Yes, the last two dividend increases were only $0.01 per share per quarter. This is no more than a token increase. But given the company's unfavorable circumstances, it's exactly what you'd expect. The key is that the board hasn't wavered in its commitment to maintaining its dividend king status.

Can Stanley Blake Resonance-Daikon really turn around its profitability?

If Stanley Black & Decker's earnings can move higher again, Wall Street will likely start to become more bullish on the company's stock. Meanwhile, adjusted gross margins have been on a steady upward trend, suggesting that expectations for earnings improvement are well supported. It's hard to like an industrial stock that's been on a roll, but it seems to have reached the clutches of a potential earnings rebound. If you don't already own Stanley Black & Decker and its historically high dividend yield of 3.3%, you might want to take a deep dive before the first-quarter earnings announcement.

Should you invest $1,000 in Stanley Drinker now?

Before buying Stanley Black & Decker stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Stanley Black & Decker were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Reuben Brewer has a position in Stanley Black & Decker. the Motley Fool does not own any of the stocks mentioned above. the Motley Fool has a disclosure policy.

1 Stock You Can Buy for $1,000 Now That Will Turn Your Losses Into Profits Without Really Trying was originally published by The Motley Fool.