.

Can Artificial Intelligence (AI) Make Nvidia the Most Valuable 'Big 7' Stock, Crushing Apple and Microsoft?

INVISTA (NASDAQ: NVDA)It has become the hottest company in the artificial intelligence (AI) field. The GPU is the most important hardware component in servers running advanced AI applications.

In the category of high-margin graphics processors customized to run AI and other accelerated computing applications, NVIDIA currently holds a market share of approximately 90%. Although this includesAdvanced Micro Devicesrespond in singingIntelCompetitors in the field are making moves to boost their capabilities in the ultra-high-performance GPU space, but many analysts expect Nvidia to maintain its impressive strength in the field.

Nvidia's stock price has risen 2,401 TP3T in the past year and 821 TP3T year-to-date in 2024 on the back of incredible industry performance and management's guidance for further explosive growth.

These increases have pushed Nvidia's market capitalization to about $2.27 trillion. It is now the third most valuable company in the world, and the third most valuable member of the "Magnificent Seven". The second most valuable company in the world is nowApple Inc.The market capitalization is US$2.65 trillion, while Microsoft, the top company, has a market capitalization of about US$3.12 trillion.

Will Nvidia soon become the world's most valuable company?

Artificial Intelligence's Most Influential Companies Are Being Reeled In.

Starting in the second half of 2022, AI technology began to take a spectacular leap forward. This progress accelerated dramatically in 2023 and shows no signs of slowing down this year.

As companies and organizations have embraced the field of artificial intelligence, demand for Nvidia's most advanced processors has skyrocketed. The company's sales and earnings have also risen.

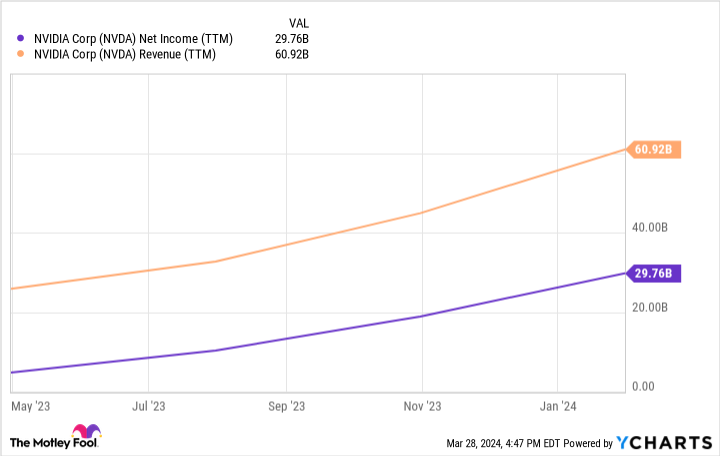

In the fourth quarter of last year, the company's sales grew 2,65% year-over-year to $22.16 billion. Nvidia's annualized sales increased 126.1 TP3T to $60.9 billion, driven by significant performance improvements in the second half of 2023.

Nvidia's net profit last year was $29.76 billion, or $49.% of its total gross sales, which is an incredible net profit margin for a hardware-driven company, which tends to have lower margins than software-driven companies because of the higher incremental cost of producing physical goods.

But the company's incredible margins reflect just how much its GPUs are in demand right now. There's reason to believe that Nvidia's incredible growth rate will slow down a bit, but the company's business will grow much faster than Apple's and Microsoft's for at least the next few years.

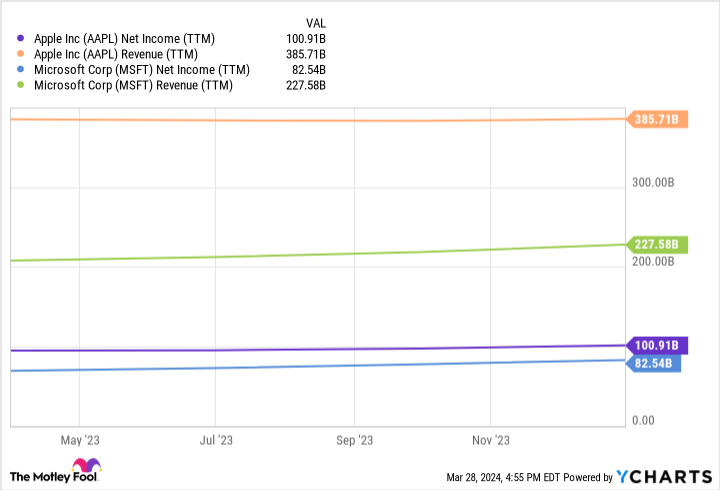

Apple and Microsoft continue to generate far more revenue and net profit than Nvidia, while the chip giant is expected to continue to be the biggest winner of the AI revolution and is growing at a much faster rate than the big tech giants.

In comparison, Microsoft's sales over the last 12 months have grown by about 10% and its net profit by 20%. Meanwhile, Apple's revenues have been flat over the period, but its net profit has grown by 7%.

If demand for AI services continues to grow significantly, Nvidia could well overtake Apple's market capitalization within the next five years and wrest the title of world's most valuable company from Microsoft. While the GPU leader's business has historically been subject to cyclical trends, it appears to be in the early stages of benefiting from the unfolding AI revolution.

Right now, Nvidia is benefiting from the emergence of an unprecedented new technology, which means that predicting its business performance over the next five years requires a great deal of speculation. But given its impressive sales and earnings momentum, as well as the market's enthusiasm for AI applications, it's not shocking that Nvidia is the world's most valuable company.

Should you invest $1,000 in Nvidia now?

Please consider this question before purchasing Nvidia stock:

Motley Fool Stock AdvisorA team of analysts just named what they think are the best values for investors right now.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Keith Noonan does not own any of the stocks listed above. The Motley Fool recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel, and recommends the following options: Long Intel $57.50 calls in January 2023, Long Intel $45 calls in January 2025, and Short Microsoft $395 calls in January 2026, and Short Microsoft $405 calls in January 2024. The Motley Fool recommends the following options: Long Intel $57.50 calls in January 2023, Long Intel $45 calls in January 2025, Long Microsoft $395 calls in January 2026, Short Microsoft $405 calls in January 2026, and Short Intel $47 calls in May 2024. The Motley Fool has a disclosure policy.

Could Artificial Intelligence (AI) Make Nvidia the Most Valuable "Magnificent Seven Samurai" Stock by Crushing Apple and Microsoft? This article was originally published in The Motley Fool.