.

Tractor Demand Not Necessarily a Measure of Market Health

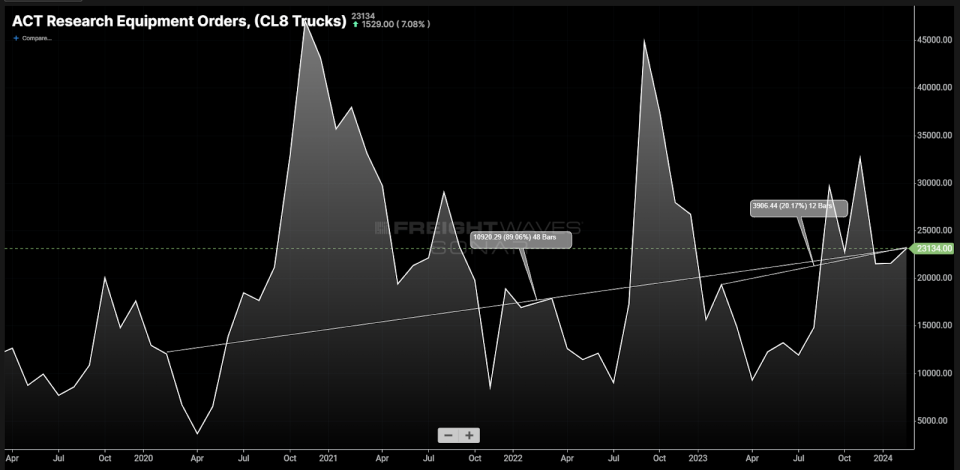

Chart of the Week:ACT Research Preparation Order - Level 8 SONAR: ORDERS.CL8

According to ACT Research, Class 8 truck orders have remained perversely strong in the first few months of 2024, exceeding last February by more than 20%. Freight semi-trucks, which typically dominate the category, have been a good indicator of the health of the industry, but like many indicators, the meaning of this number has changed.

If曏 transportation providers ask about the state of the national trucking market, they'll all say the same thing: It's terrible. National trucking companies have already begun lowering investor expectations for the first quarter.

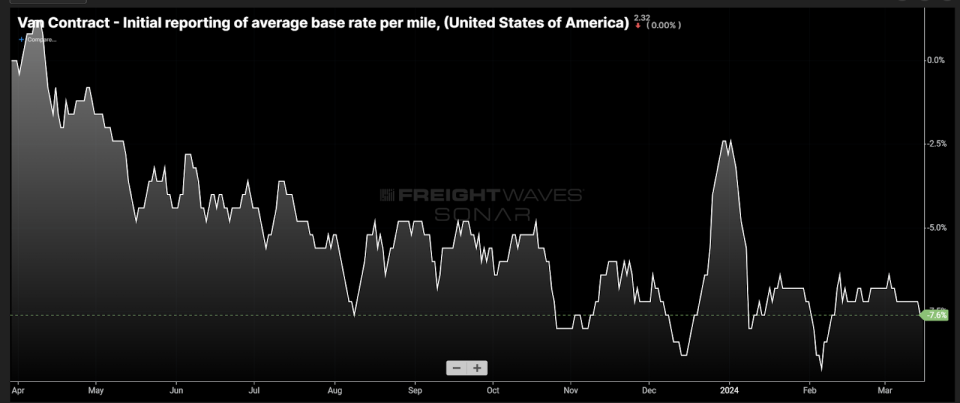

Long-term nameplate rates for dry van freight continue to be low, showing a year-over-year decline of more than 7% at the beginning of March. in other words, there is little reason to expect any sign of strengthening in this type of trucking order.

ACT provided some explanation, stating that the growth in the private fleet and a degree of occupational expenditure growth from government spending on infrastructure and offshore outsourcing noodles is supporting order levels.

Since the outbreak in 2020, the domestic freight market has been in a state of disarray.

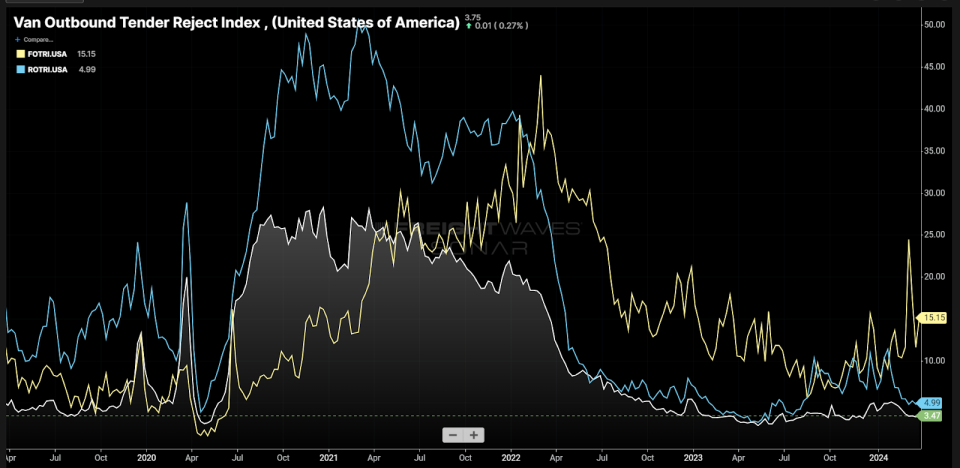

The flatbed market (FOTRI) is following a completely different trajectory than the reefer (ROTRI) and dry van (VOTRI) market in terms of reject rates by trailer type. Flatbed bid rejections peaked after reefer and van started to decline sharply, and only began to rise after a period of time.

This is mainly due to the type of cargo being consumer goods. Flatbed trucking favors industrial and construction activities, which are inhibited by supply chain and production constraints in 2020-21.

The flatbed market has been relatively healthy since the pandemic, as it has received less attention and fewer new entrants in the interim. The rising national scrap rate for flatbeds supports the notion that heavy equipment is in higher demand in the vocational transportation as well as trucking segments.

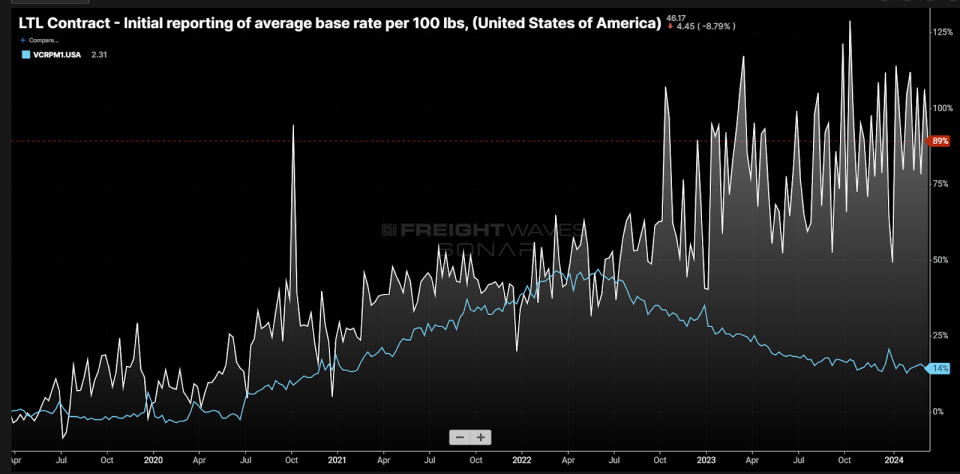

The LTL market has also experienced a different experience than the broader truckload market, in part because of the collapse of Yellow, the third-largest U.S. carrier, last year.

Carbon-carrying rates (LCWT1) tend to lag dry trucking rates by six to nine months. Last spring, as LTL carpet was showing signs of weakness, news broke of a dispute between Yellow and the Teamsters. This seemed to help keep rates high as shippers scrambled to diversify their supplier base away from struggling carriers.

While the LTL space has not been completely insulated from the overall state of the truckload market, it has certainly been given a strong cushion and has been able to maintain more pricing discipline than truckload providers. Todd Maiden's recent coverage of ArcBest is a shining example of this effect.

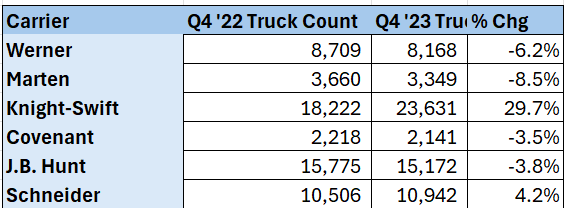

A survey of a sample of publicly traded truckload carriers found that most had experienced annual declines in average truck volumes.

The two exceptions in the sample relate to acquisitions: Knight-Swift acquired U.S. Xpress and Schneider acquired M&M Transportation Services. Neither of these companies added fleets outside of the carpet.

There is strong support for the notion that the growth in Class 8 freight orders is the result of continued fleet replenishment and investment outside of the for-hire trucking environment.

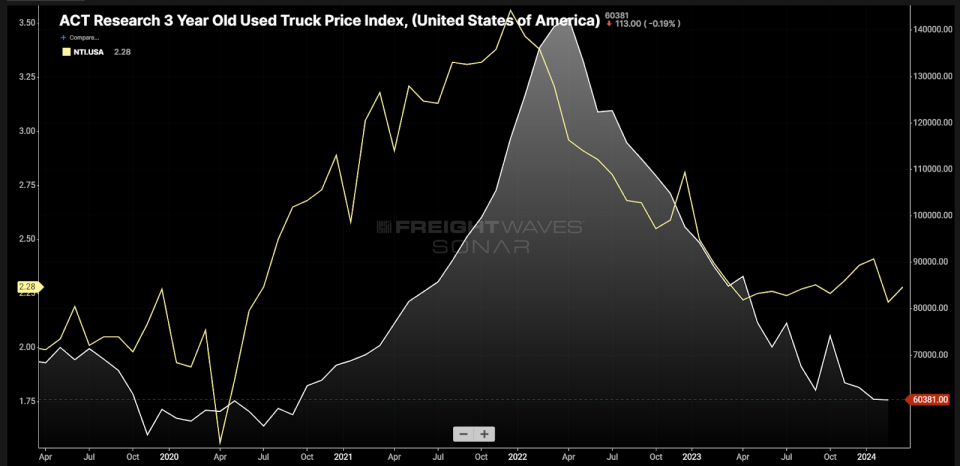

A better indicator of the health of the industry is the average price of used trucks, which is shown above for 3-year-old models (UT3) as reported by ACT Research. After the collapse of the cash market in 2022, prices went through the roof and have been falling ever since. This data point has its biases, but it seems to be a better explanation of the previous market than new carbs.

As is the case with many high-level traditional macroeconomic indicators, the relationship between Type 8 order quantities and the environment and the ability to explain the environment has changed. It has become increasingly important to understand value beyond conventional thinking.

About this week's chart

The FreightWaves Weekly Chart is a selection of charts from SONAR that provide an interesting data point on the state of the freight market. The charts are selected from thousands of potential charts on SONAR and help participants gain a real-time, intuitive understanding of the freight market. Each week, market experts publish a chart on the front page with commentary. The "Chart of the Week" is then archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presents the data in graphs and maps, and provides real-time industry commentary that freight market experts want to know.

The FreightWaves data science and product teams release new datasets every week to improve customer satisfaction.

For SONAR logo, please click here.

TheTractor demand no longer necessarily a gauge for market health was first published on FreightWaves.