.

Will Stocks Plunge If Donald Trump Wins Re-Election? Here's what the stock market loop has looked like historically when Republicans have won.

Spring has officially arrived and so has the election season.

Seven months from now, Americans will go to the polls to decide who will lead the United States for the next four years. While there are many political paths that do not intersect with investing, changes in the U.S. Arbitron's fiscal policy have been a major source of concern for the U.S. government.willIt affects everything from corporate profits to the U.S. economy.

As of this writing, former Aggregate President Donald Trump has nearly 1,700 delegates and is the Republican candidate for Aggregate President. During Trump's tenure as president of Massachusetts, from the time he was sworn in on January 20, 2017 until he left the White House on January 20, 2021, the agelessDow Jones Industrial Average (DJINDICES: ^DJI)The following are some of the most popular and broadly basedStandard & Poor's 500Index (SNPINDEX:^ GSPC) and the strong growth of theNasdaq Resonance Index (NASDAQINDEX: ^IXIC)57%, 70% and 142% respectively!

But will Donald Trump's re-election send the stock market over the cliff? Let's take a closer look at the challenges Trump's presidency will face and let history be the final word.

Will the Stock Market Crash if Donald Trump Wins in November?

The potential downside catalyst for Trump's victory comes in two forms:

-

Regardless of who wins in November, the macroeconomic catalysts will remain in place.

-

Specific policy changes proposed by Trump that could adversely affect the U.S. economy and/or corporate earnings.

Last week, I took a closer look at some of the proposals made by Joe Biden, the Democratic candidate for President of the Arms and now President of Massachusetts, that could knock the Dow Jones, S&P 500, and Nasdaq Resonance Indexes off their all-time highs. These include a proposal to double the tax on stock purchases to 4% and to increase the alternative minimum corporate tax rate and the maximum corporate tax rate. These measures have the potential to make reinvestment, hiring, and acquisitions less attractive to companies, while slowing earnings growth in an already expensive market.

For Donald Trump, there's one obvious policy proposal that could panic U.S. businesses and investors.

In early February, Trump noted in an interview on FOX News' "Sunday Morning Futures" program that he planned to impose tariffs of up to 60% on imported Chinese goods if he won a second term. During Trump's first term, tariffs on Chinese goods led to higher prices for consumers and strained relations with an economy that ranks second in the world in terms of gross domestic product. The increased cost to consumers could push the U.S. economy into recession.

But as noted, whether Donald Trump or Joe Biden is at the helm in January 2025, there are headwinds that could send the Dow, S&P 500, and Nasdaq resonance composite down.

WARNING: Money supply is officially shrinking. 📉

In the past 150 years, this has happened only four times.

The Great Depression accompanied by double-digit unemployment every time. 😬pic.twitter.com/j3FE532oac

- Nick Gerli (@nickgerli1) March 8, 2023

For example, since its record high in July 2022, M2 money supply has declined by more than 41TP3 T. M2 money supply takes into account everything in M1-cash and coins in circulation and demand deposits in checking accounts-with the addition of money market accounts, savings accounts, and certificates of deposit (CDs) of less than $100,000 or more. The addition of money market accounts, savings accounts, and certificates of deposit (CDs) of less than $100,000

Although the reversal of M2 money supply beyond 4% may only be a mean reversion after the historic expansion of the U.S. money supply during the COVID-19 pandemic, historical experience suggests that a significant decline in M2 spells trouble.

Last year, Reventure Consulting's chief executive resonance Nick Gerli conducted a backtracking test of year-on-year changes in M2 money supply since 1870, and found that there have been only five occasions, including the present, when M2 has declined by at least 2%. The first four (1878, 1893, 1921, and 1931-1933) coincided with a combination of The first four (1878, 1893, 1921, and 1931-1933) coincided with deflation and high unemployment.

To be fair, there was no national central bank in 1878 or 1893, and the knowledge now available to the Fed and the federal government makes a depression very unlikely. However, the decline in M2 suggests that consumers may be cutting back on spending, which is not good news for the U.S. economy.

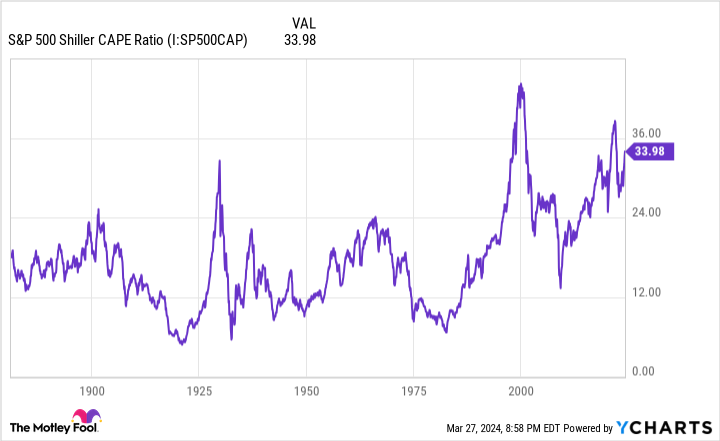

In addition, stocks are expensive. The S&P 500's Simpler P/E ratio (also known as the cyclically adjusted price-to-earnings ratio, or CAPE ratio) has surpassed 35, which is not only more than twice the 150-year average, but also a historic warning to investors.

Since 1871, there have been only six occasions when Simler's P/E ratio exceeded the 30 level during a bull market. The first five timesfinal(keyword) have been accompanied by declines in the S&P 500 and/or Dow Jones Industrial Average of at least 20%. While this is not a timing tool, it does serve as a warning that long-term valuations will not last forever.

Given these macro factors and the unknown nature of Trump's policy proposals, a stock market crash is not out of the question if he wins re-election. Thankfully, history is a double-denominated coin that undeniably favors the optimistic and patient.

Here's what stocks have done historically when Republicans have won the presidency of totalitarianism

If there's a silver lining for investors as we head into election season, it's that both parties are making relatively modest gains in the Oval Office.

According to an analysis by CFRA Research, an independent financial intelligence firm, in 2020 (i.e., while Trump is still in office), the S&P 500 has risen by an average of 6.91 TP3T since 1945 when a Republican president of the Republican Party was in the White House. conversely, the S&P 500 has risen by an average of 11.21 TP3T when a Democrat president of the Republican Party is in office.

While the stock market has performed poorly during the tenures of several Republican presidents of agriculture, including George W. Bush, Jr. and Richard Nicholson, with the S&P 500 falling by an average of 5.6% and 3.9% per year during their respective presidencies, there have been a number of Republican presidents of agriculture who have made substantial gains during their tenure in the White House. Donald Trump's rise in office happens to be at the top of the list, while Republican Calvin Coolidge has the largest annualized gain of any president of the last century (26.1% over 5-1/2 years in the Roaring Twenties).

Regardless of which President of Massachusetts is in the White House, there is plenty of data to suggest that investors with a long-term vision will be successful.

One of the main reasons patient investors make money regardless of which party is in power is the economic cycle.

Although recessions are a normal part of the economic cycle, they tend to come and go quickly. Since the end of World War II in 1945, the United States has experienced 12 recessions. Nine of these 12 recessions were resolved within one year, and the remaining three did not last longer than 18 months.

By contrast, since 1945, there have been two periods of economic growth that have exceeded the 10-year mark. The U.S. economy has spent too much time expanding, which is good news for any sitting president of mass and for U.S. businesses.

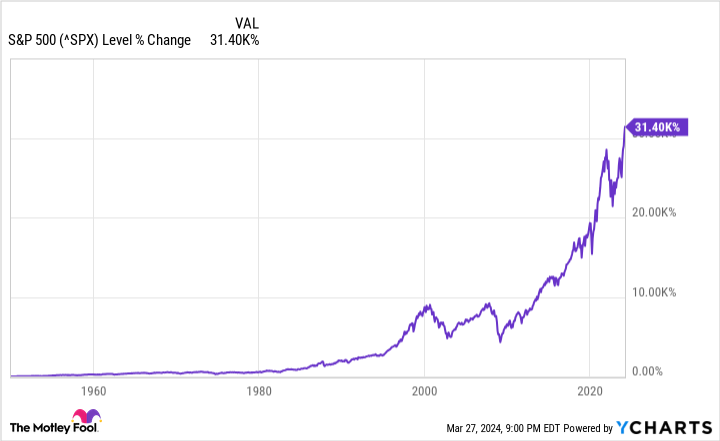

The most important thing to realize is that the stock market has been rising for a good portion of the time. Although the U.S. economy and stocks are not closely linked, over time economic growth drives up corporate earnings. These higher earnings allow valuations to expand.

It's official. A new bull market has been confirmed.

The S&P 500 has now risen 20% from its closing low on December 10, 2002, after falling 25.4% in 282 days during the previous bear market.

For more information visit https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

- Bespoke (@bespokeinvest) June 8, 2023

Last June, analysts at Bespoke Investment Group, an investment insight firm, looked at the average duration of S&P 500 bear and bull markets since September 1929, when the Great Depression began. The average duration of an S&P 500 bull market is 1011 days, while the average duration of an S&P 500 bear market is 286 days.

While it's nearly impossible to predict when Wall Street will experience short-term corrections and crashes, long-term investors won't have much of a problem if Donald Trump wins a second term as President of the United States.

Invest $1,000 now

irregularityOur team of analystsIf you have stock investment advice, it would be good to listen to them. After all, they have been running a newsletter called "The Newspaper" for more than a decade.Motley Fool Stock AdvisorIt has nearly tripled the market*.

They have just revealed what they believe to be the current-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only stocks...

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Sean Williams does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Will The Stock Market Crash If Donald Trump Wins Re-Election? Here's What Stock Market Returns Have Looked Like in Historical Republican Victories was originally published by The Motley Fool.