.

High-Yielding Toronto Dominion Bank Stock: Buy, Sell or Hold?

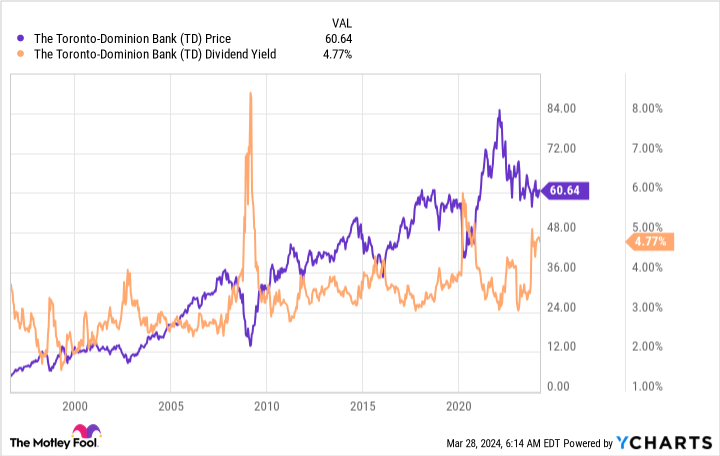

Toronto Dominion Bank (NYSE: TD)The only time yields have been higher than current levels was during a time of severe global hardship, namely the Great Recession and the COVID-19 pandemic. For income investors, is this an opportunity to lock in an attractive yield of 4.9%, or is something going on to discourage potential shareholders?

Here are reasons to buy, sell and hold Toronto TD Bank.

Sell Toronto Dominion Bank

The Toronto Dominion Bank (TD Bank), as the Canadian banking giant is commonly known, is facing two main problems. The first is an industry-wide problem. The rise in interest rates has put pressure on the bank. Rising interest rates can help in some ways because banks can charge more for loans. But they can also have a negative impact, because they can increase the number of customers who default on their loans (or worse, on their mortgages) and decrease the number of customers looking for new loans. This is particularly worrisome in Canada, where the real estate market has been in good shape for many years. Investors are concerned that the housing crash could result in significant losses for Canadian banks.

The second problem facing TD Bank is unique to the bank. Last year, TD attempted to acquire a regional U.S. bank, but the acquisition was effectively blocked by the U.S. Securities and Exchange Commission (SEC). The U.S. Securities and Exchange Commission has expressed concern about the way TD Bank handles money laundering. The bank has negotiated a stronger money laundering agreement with the GSEs, but it seems likely that it will be fined. In the longer term, however, TD's plans to grow in the United States through acquisitions will have to be put on hold.

In short, therefore, there are questions about the prospects for TD's core business in Canada and its U.S. operations. These are legitimate concerns, and for very conservative investors, this may be enough to keep them away from TD Bank or cause them to sell their holdings.

Holding of Toronto Dominion Bank

But if you take a step back, neither of TD's current challenges seems to be a long-term problem. Interest rates go up and down, and the bank, which dates back to 1855, has proven itself to stand the test of time. Moreover, the bank has been paying dividends since 1857, which shows that dividends are a top priority. In this regard, it is noteworthy that TD did not cut its dividend during the Great Recession, unlike many of the largest U.S. banks. In addition, TD has one of the highest Tier 1 capital ratios (a measure of a bank's strength) in North America (the higher the better), which means that TD is one of the best prepared for adversity.

As for the U.S. Supervisory issue, it will probably result in a fine and TD Bank will not be able to make any acquisitions. However, TD can still open new branches, and it is doing so. Therefore, TD's growth in the U.S. market will not be halted; it will just be slower than it could be. That being said, purchases are unpredictable, so there's no way to know what would have happened (except for the canceled deal). Over time, however, it is highly likely that TD Bank will regain the trust of the regulator and will again be allowed to make bank acquisitions at some point in the future.

If you own a TD bank and can tolerate a period of uncertainty, then panic selling may not be appropriate.

Buy Toronto Dominion Bank

These unfavorable factors have caused TD Bank shares to move lower. As mentioned earlier, this has pushed the dividend yield to the high end of its historical yield range. The yield is slightly above 4.9%, which is very impressive. If you're a dividend-conscious investor, you should at least consider buying TD Bank when it's out of favor.

The reasons for buying the stock are the same as the reasons for continuing to hold the stock. There are problems, but they seem to be temporary. The bank is financially strong, so it will likely be able to weather any challenges that arise. While U.S. economic growth may slow temporarily, it will not stop. If you look at decades rather than days, TD Bank is more of a fallen angel that will eventually rise again than the next bank that might fail.

In this regard, it is worth noting that Canadian banks are very tightly regulated. This has not only created a few entrenched giants (TD Bank being one of them), but has also created a very conservative culture within Canadian banks in general. If you have a safety-first mentality, then TD Bank is an ideal choice for your investment portfolio. This could be a rare opportunity to join it while it appears to be on sale.

TD Bank's bad news isn't bad.

While it's unfair to say that TD Bank stock has been unloved on Wall Street for no apparent reason, it seems unlikely that this unfavorable factor is long-term. While you can sell or not buy due to interest rates (and related economic issues) or US regulatory issues, this seems like a very conservative choice. Most investors would be better off holding the stock if they own it, or taking a position while yields are still near all-time highs.

Should you invest $1,000 in Toronto Dominion Resonance Bank now?

Before buying shares of Toronto Dominion Bank, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... and Toronto Dominion Resonance Bank were not among them. These 10 stocks could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Reuben Gregg Brewer holds shares of Toronto-Dominion Bank.The Motley Fool does not hold any of these shares.The Motley Fool has a disclosure policy.

High-Yielding Toronto Dominion Bank Stock: Buy, Sell or Hold? Originally posted by The Motley Fool