.

How many Real Estate Income Shares would you need to buy to earn $100 per month in passive income?

The great thing about holding dividend stocks is that you can consider your expenses based on the number of stocks needed to pay for them. For example, let's say you pay $100 a month for car insurance. You might ask: How many shares do I need to pay for my insurance?Realty Income (NYSE: O)Such a monthly dividend stock to be able to pay for this with passive income?

In this case it was 390 shares.

If you do it right, you can build your own portfolio and generate the money you need to pay your bills. In the end, you can spend less time working, more time doing what you like, or just lounging on the beach.

Whatever your goals are, consider buying some Realty Income stock to help you achieve them. Here's how it works.

Real Estate Income Corporation helps provide a reliable source of income

Realty Income is a real estate investment trust (REIT). It specializes in the real estate business, allowing investors to invest in real estate without actuallyOwnershipReal Estate(used form a nominal expression)It is a good way to enjoy the benefits of owning real estate. It combines the owner with the shares. A REIT must pay its shareholders at least 90% of taxable profits, so a REIT like Realty Income is a good dividend paying stock.

As a real estate company, Realty Income relies on quality tenants who will pay rent. Otherwise, investors don't get paid. That's where Realty Income excels. It focuses on retail tenants in depressed businesses. Like car-carrier, convenience, and dollar stores.regardless ofIt's a place where people go whether the economy is good or bad.

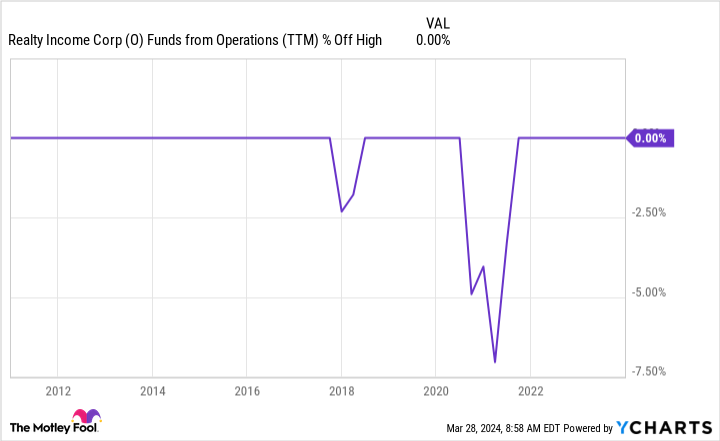

This has always been Realty Income's winning formula, as its profits have remained resilient regardless of economic conditions. The pandemic was a real estate crisis, but Realty Income's operating cash never dropped more than 7% - in other words, there was a constant flow of money to pay dividends.

Realty Income's Dividend is as Solid as It Gets

Reliable cash flow makes Realty Income a reliable dividend stock. The company has paid and raised its dividend for 31 consecutive years. It's also a high dividend stock; at the current share price, investors receive a dividend of 5.7%.

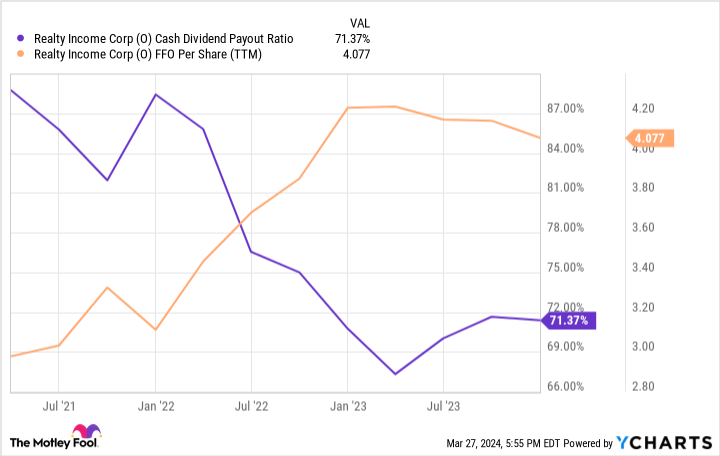

The dividend payout ratio is only 71%. Remember how I said that during a pandemic cash flow never drops more than 7%? That's right, that's a 22-point dividend payout safety factor.

The company's dividend has not grown very fast, with an annualized growth rate of only 3.6% over the past five years, but with a high starting yield of 6.1%, Realty Income is a very good stock to hold for a long period of time to allow the dividend to accumulate. Reinvesting the dividends can also bring great returns to your portfolio.

Is it worth buying stocks today?

The price you pay is especially important since the real estate income company's business is not growing very fast. If a business needs to chase a high valuation, a price that is too high may result in poor performance. So, is Realty Income attractive today?

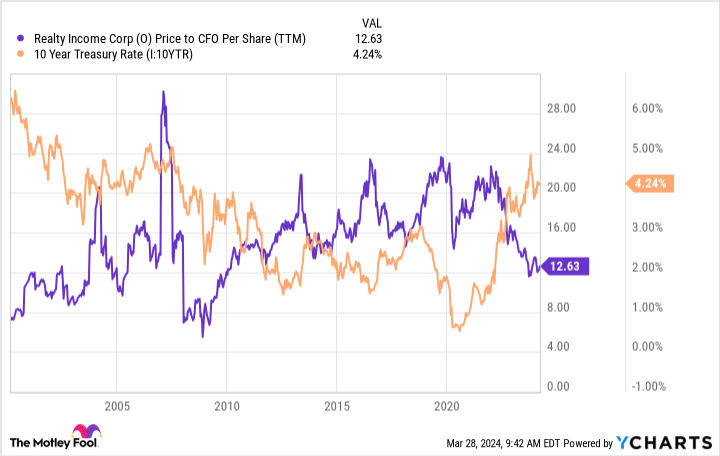

The company's stock trades at 13 times its working capital (FFO), which is comparable to the earnings of a real estate investment trust. Meanwhile, analysts expect the company's FFO to grow at an annualized rate of 3% to 4% over the next few years.

This is not a cheap valuation for such modest growth, but Realty Income's quality fundamentals have earned it some premium. In total, I think the current valuation of the shares is reasonable. Investors can look forward to a high single-digit annualized gross return and a growing dividend.

Keep in mind that Realty Income is sensitive to U.S. Treasury yields. A rise in Treasury yields can be detrimental to Realty Income by making borrowing, a key part of the REIT business model, more expensive. If yields are attractive enough, investors will also flock to Treasuries rather than stocks. You can see the relationship between the antipodes in the lower noodles:

In total, Realty Income remains a conservative but high quality dividend stock that provides investors with monthly cash flow. Investors who want to pay their bills passively should not hesitate to consider this stock.

Should you invest $1,000 in Realty Income now?

Before buying Realty Income stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Realty Income were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Justin Pope has no position in any of the stocks mentioned above.The Motley Fool holds a recommended position in Realty Income.The Motley Fool has a disclosure policy.

How many RealtyIncome shares would you need to buy to earn $100 per month in passive income?