.

The Smartest Dividend Stocks to Buy Right Now for $400

Though only available weekly atStandard & Poor's 500An indexed investment of $8 may not sound like enough to set you on the road to retirement, but assuming a standardized market rate of return of 10%, an annual increase of $400 could swell to nearly $200,000 in 40 years.

In addition, looking for stocks with specific metrics, such as a recognizable brand name, a growing and sustainable dividend, and a top-notch return on invested capital, can bring these historical rates of return close to the 12% mark. This slightly higher rate of return would turn a weekly increase of $8 into $344,000 over the same period of time.

The most important thing for investors is that we see these market-fighting attributes all around us.Starbucks Resonance (NASDAQ resonance code: SBUX)respond in singingHershey Company (NYSE: HSY)Two great examples of stocks that are hiding in plain sight. Here's why these two giants are the smartest dividend stocks to buy at $400.

Starbucks Resonance's many market icons

Starbucks resonance has more than 38,000 stores globally, half of which are franchised and half are company-owned. However, with sales growing by 8% in the first quarter, and management anticipating store growth of 4% over the long term, investors should not shy away from the maturing business of Starbucks.

Starbucks resonance is ranked higher on Kantar Brandz thanDisney,Wal-Martrespond in singingTikTokIn the first quarter, the number of Starbucks Resonance's rewarded members grew by 13% to 34.3 million, driven by the company's tremendous brand impact. Notably, companies on the Kantar Brandz Top 100 Most Valuable Global Brands list have outperformed the S&P 500 by two percentage points every year since 2006.

Additionally, recent data from Statista shows that Starbucks Resonance remains the favorite coffee brand of Generation Z and Millennials, suggesting that Starbucks Resonance's popularity is likely to continue for decades to come.

Backed by 34 million loyal fans, the company's Return on Invested Capital (ROIC) is 63%. When measuring Starbucks Resonance's profitability against its debt and equity, such a high ROIC indicates that the company is adept at utilizing capital for global expansion. As mentioned in this article, a company like Starbucks resonance that ranks in the top two of the Motley Fool Investable Stock Universe for ROI has proven to be an outperformer over the long term.

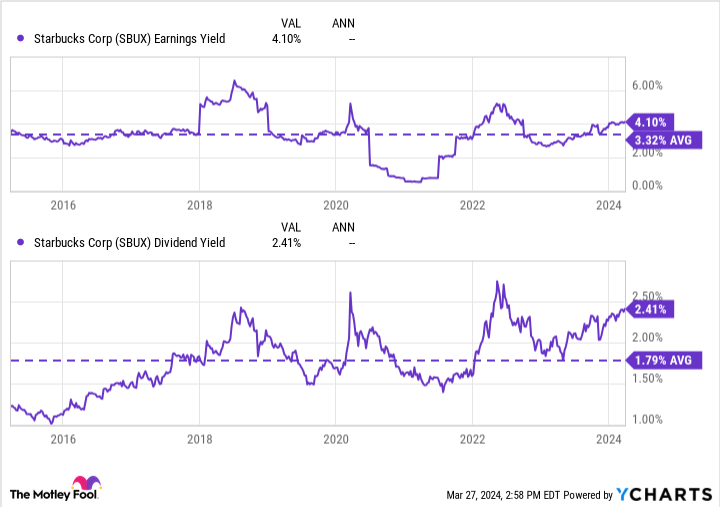

While Starbucks resonance profitability is impressive, the company's ties with China (17% of its total store count) continue to be a geopolitical risk and one of the catalysts for Starbucks' recent share price struggles. However, the resonance sentiment may be overdone as Starbucks' valuation is one of the most attractive in the last decade.

The dividend yield on Starbucks resonable shares is 2.4%, which is close to its decades high, but well below its yield of 4.1%. Investors should expect Starbucks' 13 consecutive years of dividend growth to continue in the future. Although sales growth has slowed, the well-funded and growing dividend, the company's declining share count, industry-leading brand, and top-tier ROI make Starbucks Resonance a great buy for investors at $400.

The good times continue to struggle in a cruel environment.

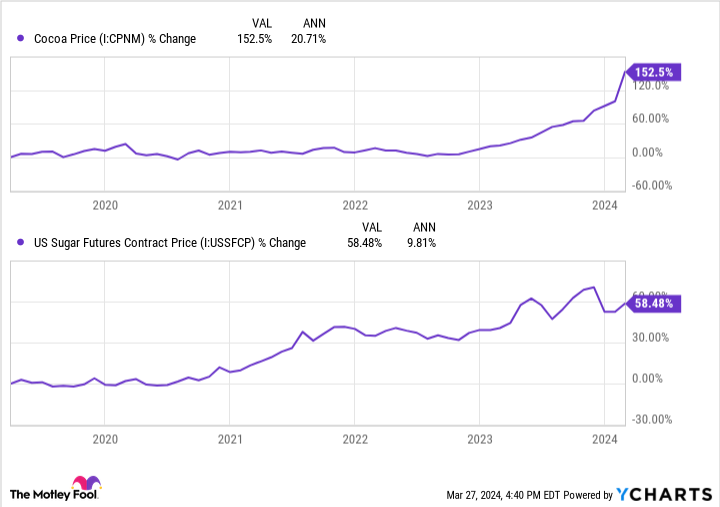

Hershey is targeting sales growth of 2% to 3% and flat EPS growth in 2024. With the stock down 30% from its all-time high, the company's operations are facing a number of headwinds. The first and most immediate issue is the soaring prices of cocoa and sugar, which have risen by 1,53% and 58%, respectively, since 2019.

Due to heavy rains in West Africa, cocoa prices have soared by more than 1,20% in the last 15 months alone. Considering the sharp rise in the cost of its core raw materials, Hershey's flat EPS forecast for 2024 looks promising - especially after last year's profit growth of 14%.

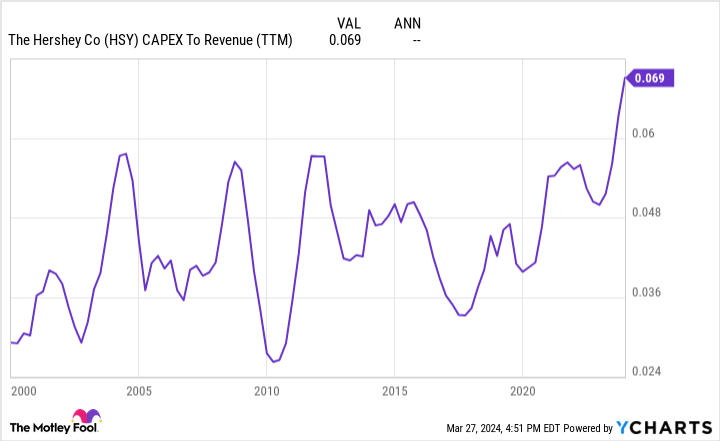

In addition to the difficult pricing situation, Hershey has recently launched a new capacity expansion program, implemented a new enterprise resource planning system, and increased CapEx to levels not seen in this century.

Despite these challenges, Hershey has maintained a net profit margin of 17% and an ROI of 22%. This incredible feat may indicate that the company operates under a wide moat, as it has so far been able to pass on most of these higher expenses to its customers without losing their trust. According to a Statista brand awareness study, the company's Reese's, Hershey's and Kit Kat brands will all be among the top five most recognized candy brands in the U.S. in 2023.

Driven by the strength of the Hershey's brand and its ability to maintain profitability in the face of significant headwinds, investors can reasonably imagine that the company will continue its 14-year streak of dividend growth. Hershey's dividend yield of 2.51 TP3T represents only 481 TP3T of the company's net income, and the dividend yield for 2023 has increased by 151 TP3T.

Hershey's P/E ratio is a reasonable 21 times, and like its consumer goods counterpart Starbucks, Hershey boasts a long list of market-beating metrics. These metrics, combined with the eventual decline in raw material prices and capital expenditures, make Hershey one of my favorite dividend stocks, and I'm adding it to my daughter's portfolio today.

Should you invest $1,000 in Starbucks Resonance now?

Before buying shares of Starbucks Resonance, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only the stock ...... and Starbucks Resonance were not among them. These 10 stocks could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Josh Kohn-Lindquist owns shares of Hershey's and Starbucks Resonance. the Motley Fool has positions in Starbucks Resonance, Wal-Mart, and Walt Disney. the Motley Fool recommends Hershey's. The Motley Fool has a disclosure policy.

The Smartest Dividend Stocks to Buy Now for $400 was originally published by The Motley Fool.