.

If there were a "Magnificent Seven" of value stocks, these would make the cut

The "Magnificent Seven" is a group of high-cap tech companies that play an important role in the economy and have generated impressive returns for investors.

But investing is not just about growth or technology stocks. The most successful investors usually have a diversified portfolio that includes some technology stocks, some growth stocks, some value stocks, and some dividend stocks, with further diversification through other classes and categories.

Value stocks offer plenty of opportunities for savvy investors. Investment legend Warren Buffett is almost exclusively a value stock owner, and he's one of the few investors to have beaten the broader market in decades. He also advises most retail investors to buy tracking stocks.Standard & Poor's 500 Index funds, because beating the market over the long term is not an easy task.

If you want to add value stocks to your portfolio, you might considerBerkshire HathawayCompany (New York Stock Exchange Stock Symbol)(BRK.A)(New York Stock Exchange: BRK).B),Vespa.The company (NYSE stock code:V),Wal-MartThe company (NYSE stock code:WMT),JP Morgan Chase (bank)The company (NYSE stock code:JPM),MasterCardThe company (NYSE stock code:MA),Home Depot Inc (NYSE stock code: HD(math.) andCostco WholesaleCompany (Nasdaq Resonance Stock Code: COST). These seven companies have some of the largest market capitalizations in the world and have created enormous wealth for their shareholders over the years. And what's even better, there's more to come.

1. Berkshire Hathaway Inc.

Berkshire Hathaway's market capitalization is the seventh largest among U.S. companies, just behind all other companies except forTesla) other than all the "magnificent seven shares". However, with the exception ofAmazonIt has higher revenues than any of them, and a higher net income than all but theAppleMore than any other. This is Warren Buffett's conglomerate, which wholly owns dozens of companies in addition to a large portfolio of stocks. Buffett often makes the point that the best companies play a long-term role in the U.S. economy. By owning Berkshire Hathaway, investors have access to many great stocks, including Amazon and Apple, and can benefit from Buffett's wisdom and stock selection.

2. Visa

Visa is ranked 11th in terms of market capitalization. It operates the largest credit card processing network in the world, with the largest number of credit cards and the highest volume of mass payments. As the economy grows, so does Visa's business, where customers are charged a fee for each swipe of their card. It has incredible profit margins of more than 50%, and it has introduced many new features to keep up with fintech trends and strengthen its moat. Buffett's stock also pays a dividend, and while the yield is modest (0.7% based on its share price until then), management has increased its payout ratio by 4,20% over the past 10 years.

3. JPMorgan Chase

JPMorgan Chase is the largest bank in the United States, with nearly $3.4 trillion in assets. Its strong balance sheet has largely insulated it from the economic volatility that has caused some regional banks to struggle over the past year or so. These characteristics make it an excellent stock to hold for the long term. It also offers a dividend yield of 2.4% at its current share price.

4. Wal-Mart

Wal-Mart is the largest company by revenue in the U.S., and while its competitor Amazon is growing faster, the latter still has a way to go to catch up. Wal-Mart continues to generate higher sales, comparable sales and profits, and is opening new stores around the world. It's also looking for ways to make its existing assets work better, such as expanding its store presence, and it's also looking for new ways to grow, such as upgrading its advertising business, to better compete with Amazon. Walmart's dividend yield is 1.4% based on its share price.

5. MasterCard

MasterCard is second only to Visa as the most profitable credit card network powering the global economy. It's not as big as Visa, but its revenues and net income are growing faster, as is its stock price. It has the same enduring model and business, and it's a Warren Buffett stock. Its dividend yield is a paltry 0.6% at the current share price, but its management team has raised its dividend even faster than Visa's, by 5,00% over the past 10 years.

6. Home Depot

Home Depot is the world's largest home improvement chain, with more than 2,300 stores in North America. It has been feeling the pressure of inflation, but its long-term growth and ability to generate profit is trustworthy. It embraced the omni-channel model before it became popular and was well prepared for the epidemic. It is also well-prepared to resume growth in a more favorable economic environment. Home Depot's dividend yield is 2.4% based on its previous share price.

7. Costco

Costco, the button retail chain, has a membership model that increases loyalty and sales. Recently, Costco's membership revenue has been increasing and renewal rates are at record highs as shoppers are more likely to choose Costco's lower-priced merchandise when they're penny-pinching. Sales growth is starting to accelerate again, and there's plenty of room to grow as Costco continues to open new stores. Costco's regular dividend yields just 0.6%, but it does pay special dividends from time to time, most recently in January for as much as $15 a share.

Value stocks provide low risk, stable growth

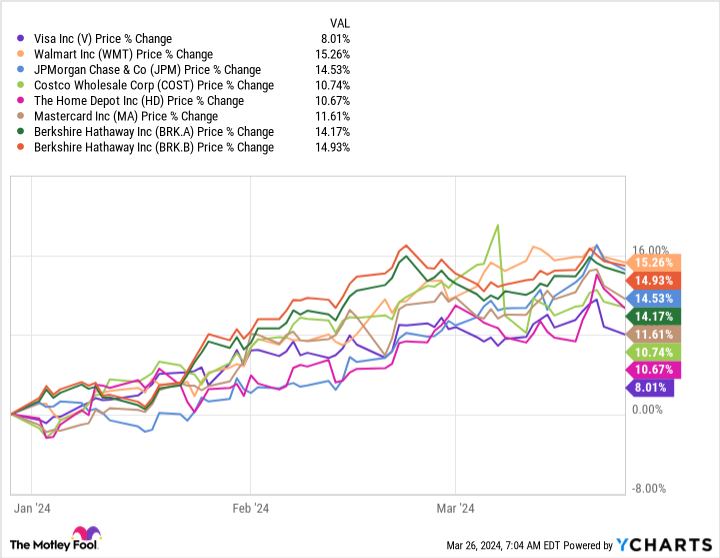

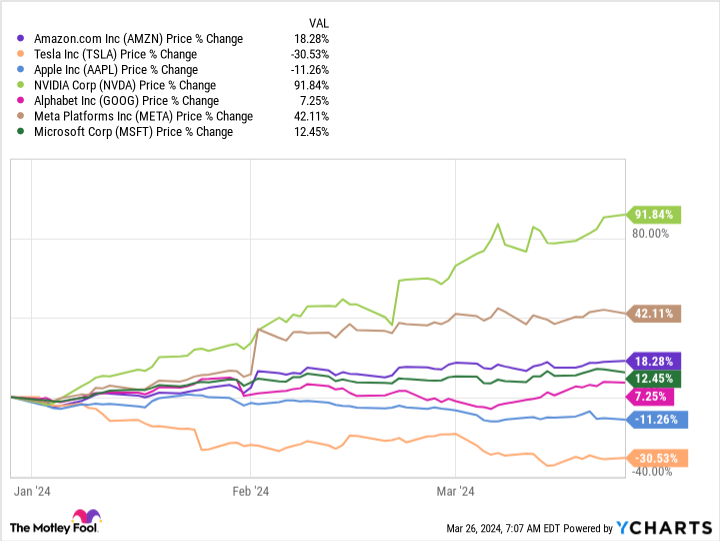

Let's take a look at how these stocks have performed year-to-date compared to tech stocks.

As the chart below shows, as a whole, the Magnificent Seven have outperformed value stocks year to date. But the former are also more volatile.

So far this year, all value stocks have been positive, while technology stocks have not, and they have almost all outperformed the S&P 500, which is up 10.1% year-to-date.

Value stocks create value for shareholders with less risk. Even if you don't choose to invest in all of these stocks, any one of them will make a good addition to your diversified portfolio, and most of them will provide additional dividend income.

Should you invest $1,000 in Berkshire Hathaway now?

Before buying shares of Berkshire Hathaway, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Berkshire Hathaway are not included. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool Board of Directors. JPMorgan Chase is an advertising persona partner of The Ascent, a Motley Fool company. Randi Zuckerberg, former Facebook Market Development Armsmaster and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. (Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's Board of Directors, and Jennifer Saibil has no position in any of the stocks mentioned above. The Motley Fool owns recommended stocks in Alphabet, Amazon, Apple, Berkshire Hathaway, Costco Wholesale, Home Depot, JPMorgan Chase, MasterCard, MetaPlatforms, Microsoft, Microsoft, MetaPlatforms, and other stocks. The Motley Fool recommends the following options: Long the January 2025 $370 MasterCard Calls, Long the January 2026 $395 Microsoft Calls, Short the January 2025 $380 MasterCard Calls, and Short the January 2026 $380 MasterCard Calls. Short Jan 2026 $405 Microsoft Calls. The Motley Fool has a disclosure policy.

If There Was a Value Stock 'Magnificent Seven', These Stocks Would Make the Cut was originally published by The Motley Fool.