.

Two Artificial Intelligence (AI) Stocks That Could Go Parabolic

The Artificial Intelligence (AI) boom has been a catalyst for many companies over the past year or so, a point thatFrom Nvidia),Palantir TechnologiesThis is evidenced by the sharp rise in the share prices of companies benefiting from this technology, such as the Hong Kong Institute of Certified Public Accountants (HKICPA).

Nvidia, for example, has seen its stock price rise 92% in 2024 on the back of huge growth in sales of AI chips, while Palantir has surged since its latest quarterly earnings report, up more than 42% so far this year. now.Broadcom ( Broadcom ) (NASDAQ: AVGO)(math.) andMicron Technology Inc. (Micron) Technology)(NASDAQ resonance stock code: MU)It seems to be joining the ranks and witnessing a parabolic jump in its share price.

A parabolic move is when a company's stock price jumps dramatically over a short period of time, like the right side of a parabola. Shares of Broadcom and Micron have both made big jumps recently, thanks to their growing artificial intelligence credentials. What's more, it wouldn't be surprising if they could sustain their recent bursts and go parabolic.

1. Broadcom

Broadcom stock recently got a shot in the arm after an investor event called "Enabling Artificial Intelligence in Infrastructure." At the event, Broadcom revealed that it now has three customers for its custom AI chips. By contrast, Broadcom's management said on an earnings call earlier this month that "demand for our custom AI gas pedals has been strong from our two mega-sized customers."

Broadcom's customized AI processor has beenMeta Platformsrespond in singingAlphabet and other companies use it, and it is speculated that the new addition may be theAmazon,AppleIt's worth noting that Broadcom's AI chip sales were already growing rapidly before this new customer came on board. Last quarter, the chipmaker's AI revenue quadrupled year-over-year to $2.3 billion.

What's more, even before the new customer came on board, Broadcom was projecting more than $10 billion in AI revenue in fiscal 2024. Now, the company expects to increase its AI chip production for the new customer this year, so it's likely to exceed expectations.

The company had originally expected AI to account for a quarter of its total gross revenue this year, up from 15% in the previous fiscal year. however, it appears that AI is poised to grow even more for Broadcom. What's more, the company's solid share of the application-specific integrated circuits (ASIC) market means it could benefit from the growing demand for custom AI gas pedals in the long run.

All of this explains why analyst sentiment towards Broadcom is improving after the company's recent activity. Investment bank TD Cowen raised its target price for Broadcom shares from $1,400 to $1,500, while also upgrading the stock's rating from "Market Perform" to "Outperform".

Broadcom's stock is trading at a forward P/E of 28x, which is in line with theNasdaq Resonance 100 With the index's forward P/E ratio flat, now is a good time to buy the stock. Broadcom appears to be on track to grow faster than Wall Street's expectations thanks to its new artificial intelligence customers, which could prompt the market to give it a higher earnings multiple and potentially send the stock on a parabolic rally.

2. Micron Technology

Shares of Micron Technology jumped 14% on March 20 following the release of its Q2 FY2024 financial results (ended Feb. 29, 2024.) Artificial intelligence (AI) played a central role in Micron's surge, as the company's revenue and earnings soared year-over-year on the back of growing demand for memory chips for AI servers, personal computers (PCs), and smartphones.

The chipmaker's revenues rose 58% year-over-year to $5.82 billion. Adjusted earnings per share were $0.42, compared with a loss of $1.91 a share a year earlier. Analysts had expected the company to report revenue of $5.35 billion and a loss of $0.25 per share. It is encouraging to see that Micron's growth will accelerate in the current quarter. Its revenue guidance of $6.6 billion indicates a year-over-year growth of 76%.

As mentioned earlier, Micron is expected to capitalize on the growing adoption of memory chips in a number of niche markets. For example, in the AI server space, Nvidia is deploying the company's high bandwidth memory (HBM). The graphics specialist recently released its next-generation Blackwell AI GPUs (graphics processing units), and Micron notes that the HBM capacity of these chips has increased by 33%.

Meanwhile, Micron said that AI-enabled PCs may have 40% to 80% more DRAM capacity compared to regular PCs. On the other hand, Micron expects AI-enabled smartphones to have "50% to 100% more DRAM capacity compared to current non-AI flagship phones." All of this suggests that the memory market has a bright future thanks to AI, and Micron will benefit from it.

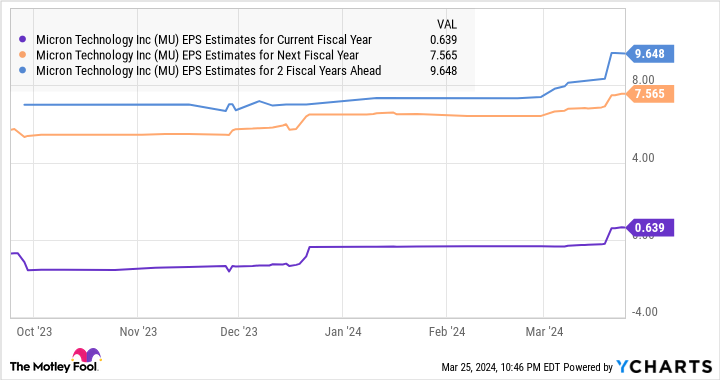

Not surprisingly, analysts expect the company's earnings growth to accelerate sharply in fiscal 2024 and beyond.

With Micron's FY2023 loss per share at $4.45, the chart above suggests that the company's bottom-line growth is set to take off dramatically in the future. Micron's dramatic earnings growth will likely translate into strong share price gains as well. Even better, given the company's rapid growth, we can't rule out the possibility of a parabolic jump in the stock price, which could prompt the market to value it at a premium.

Therefore, investors would be wise to buy the stock immediately. The stock has a price-to-sales ratio of 6.6, which is lower than the Nasdaq Resonance 100 Technology Sector Index's 7.4x, meaning it's a real bargain right now.

Should you invest $1,000 in Broadcom now?

Before buying Broadcom stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Broadcom is not one of the 10 stocks listed at ....... The 10 stocks that made the list are poised to deliver strong returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool. Randi Zuckerberg, former Facebook Marketplace Development Armsmaster and Spokeswoman and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors, and Suzanne Frey, former CEO of Alphabet, is a member of The Motley Fool's Board of Directors. (Alphabet executive Suzanne Frey is a member of The Motley Fool's board of directors, and Harsh Chauhan has no position in any of the stocks listed above. The Motley Fool owns recommended stocks in Alphabet, Amazon, Apple, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Two Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool.