.

Better Dividend Stocks to Buy Now: Medtronic vs. Walgreens Boots Alliance

If you're an average investor looking for stocks that can grow dividends steadily over the long term, then the healthcare industry is the place to start. People get sick just as often in a recession as they do in a boom.

Medtronic (brand) (Medtronic) (NYSE:MDT)(math.) andWalgreens Boots Alliance (Walgreens) Boots Alliance)(NASDAQ Resonance Code: WBA)are two dividend-paying giants in the healthcare industry. Both of these companies yield more than the benchmarkStandard & Poor's 500The negligible 1.4% yield on the common shares in the index is much more attractive.

Next, we will analyze their recent performance to see which stocks are most likely to pay steadily increasing dividends over the next few years.

Medtronic's Rationale

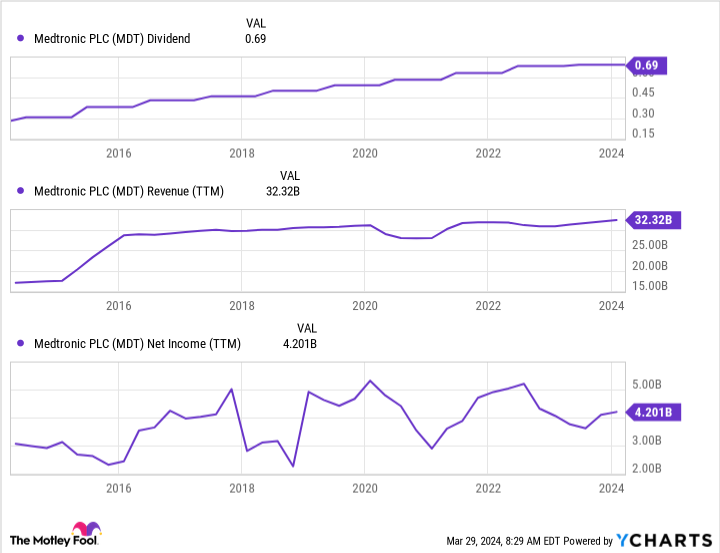

Medtronic's focus on developing new therapeutic technologies has brought good returns to its shareholders. The company has increased its quarterly dividend for 46 consecutive years. At recent prices, the stock yields 3.2%.

Medtronic's dividend payout ratio has grown by 1,461 TP3T over the past 10 years, but this rate has slowed. Over the past three years, the dividend payout ratio has grown by only 9.51 TP3T.

Many of the devices sold by Medtronic, such as pacemakers and spinal stimulators, are implanted in the patient after the patient has passed through a number of medical barriers.The COVID-19 pandemic has had an impact on the Company's industry, but investors will be pleased to learn that aggregate sales have grown by 7% over the past three years.

Medtronic's sales and earnings are likely to continue moving in the right direction. The company's product lineup has expanded significantly in recent months. In the third quarter ended January 26, the FDA approved the company's new pulsatile field ablation system and new neurostimulator. Most recently, the FDA approved the company's new aortic valve replacement system.

The Case of Walgreens Boots Alliance

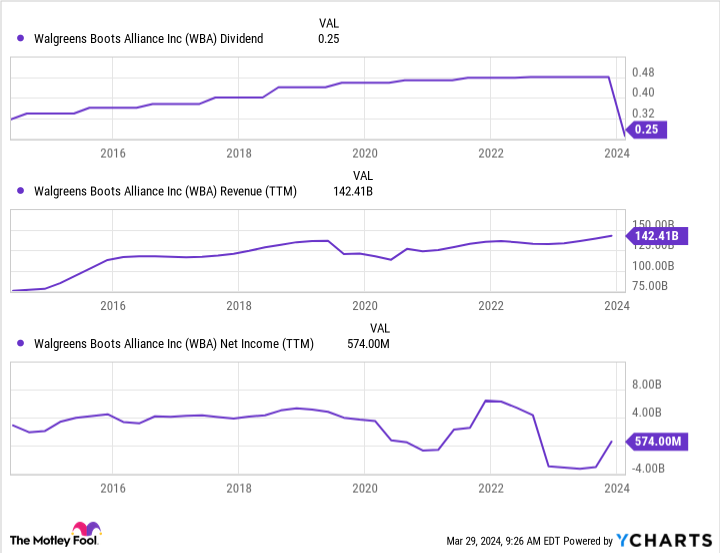

The past few years have been difficult ones for Walgreens Boots Alliance shareholders. In a nutshell, the company's attempts to outperform retail drugstore chains have been unsuccessful. As a result, the company cut its dividend this year by $481 TP3T, giving the stock a yield of 4.61 TP3T at recent prices.

Investors who follow Walgreens closely will recall that Walgreens had planned to enter into an agreement withCigna VillageMD, a partially owned carpetbagger, launched 1,000 primary care clinics. Walgreens has invested billions of dollars in VillageMD, but has realized nothing but losses. In Walgreens' second fiscal quarter, which ended February 29, the carry partners wrote down the value of VillageMD by $12.4 billion.

Walgreens' portion of VillageMD's latest impairment charge amounted to $5.8 billion, resulting in a net loss of $5.9 billion for the second quarter. Even after adjusting for non-cash impairment charges, the company's operating income for the second quarter fell 26.5% year-over-year to just $900 million.

Retail pharmacies are increasingly at the mercy of pharmacy benefit managers (PBMs), which essentially determine retail pharmacy revenues from dispensing prescription drugs. Without its own PBM, Walgreens is unlikely to achieve profitable growth in the coming years.

Buy Better Dividend Stocks Now

Walgreens has a higher yield, but shrinking margins in the retail drugstore space could make it nearly impossible to grow its bottom line and dividend payout over the long term.

Medtronic isn't growing as fast as it used to, but developing new therapeutic technologies is more profitable than the struggling retail pharmacy business. Medtronic's dividend payout is still strong, and with plenty of new product approvals on the horizon, it looks like a better dividend stock to buy.

Should you invest $1,000 in Medtronic now?

Before buying Medtronic stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... Medtronic is not one of these stocks. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Cory Renauer does not own any of the aforementioned stocks.The Motley Fool recommends Medtronic.The Motley Fool has a disclosure policy.

Buy Better Dividend Stocks Now: Medtronic vs. Walgreens Boots Alliance was originally published by The Motley Fool.