.

As the stock market breaks record highs, retail traders are jumping into riskier, more leveraged bets

-

In recent weeks, investors have flocked to the riskier, leveraged stock market, says Vanda Research.

-

These increased inflows come at a time when the stock market is hitting new records.

-

Strategists say investors may be trying to leverage their money to do more good.

In the first three months of the year, the stock market soared to record highs, and retail traders increasingly capitalized on this momentum to place high-risk bets.

Individual investors' use of leverage has steadily increased in recent weeks, according to Vanda Research.

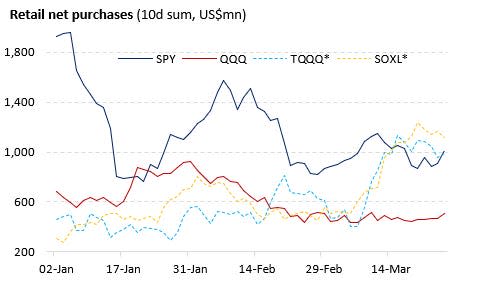

As the chart below shows, retail investors have reduced their purchases of big rock ETFs like SPY and QQQ, which track the S&P 500 and Nasdaq Resonance Indexes, while increasing their exposure to triple-leveraged funds as the stock market reaches record highs.

This trend coincided with a strong first quarter for the major averages, with the Dow Jones Industrial Average up 4.91% year-to-date, and the S&P 500 and NASDAQ Resonance Carbide Index up 10.1% and 10.59%, respectively.

Risk bets across the market, including cryptocurrencies and meme stocks, have risen again, this time running counter to the trend of higher interest rates that derailed these trades two years ago when the Fed began tightening monetary policy.

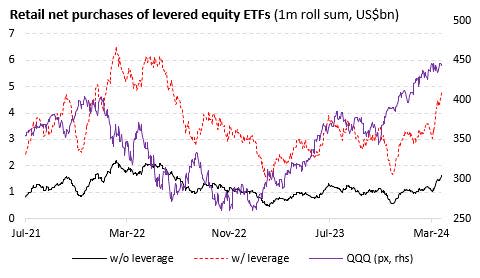

"If we then expand the pool of leveraged ETFs to some of the more heavily traded funds, we see that retail inflows (adjusted for leverage) have now easily surpassed the highs seen during the last AI-driven rally in May-July '23," Wanda strategists wrote this week.

The chart below depicts how net retail purchases of leveraged ETFs in February and March 2024 have risen. The data is based on the 22 largest U.S. leveraged ETFs as of March 26th.

Meanwhile, another potential micro-factor is that after about two years, Average Retail Portfolio has finally shrugged off the losses of the brutal 2022 bear market. Now that the focus is on driving gains rather than recouping losses, traders may feel more confident in taking higher risks, Wanda said.

Analysts continue to point out that they expect retail investors to gravitate toward betting against the曏, buying the dips or selling the rallies. They also say that retail investors are diversifying away from the top gainers like the "Magnificent Seven," which the data suggests are looking to get in early as the stock market rally expands.

Read the original article on Business Insider