.

An unstoppable stock that will turn $1,000 into $32 million. Should you buy now?

Stock market investing works best when people take a truly long-term view. Investors can take advantage of the magic of compound interest by investing over a period of decades rather than days or months.

Historically. Standard & Poor's 500indices including through dividend The average annualized rate of return is about 10%. But there are some businesses that absolutely crush that number. But there are some businesses whose earnings absolutely crush this figure.

In fact. exist September 1981 Initial Public Offering (IPO) At the same time, a 1,000% investment in a top-tier retail stock will be used to finance the investment in a top-tier retail stock. dollars.nowadays Already worth nearly 32 million dollars. Let's take a closer look at the company's rise to prominence and whether it would be wise to buy this stock today.

Boring business; exciting newspaper.

Investors may be surprised to learn that the stock that delivers such a great return is the very same stock that delivers a great return. Home Depot ( Home Depot ) (NYSE: HD)The company sells home decorating products through its network of stores. The company sells home decoration products through its store network of曏 DIYers and professional customers. It is a leader in the industry, far ahead of its smaller competitors! Lowe's)The

The key to the company's impressive stock performance is its expanding store footprint. The company says 90% Americans live within 10 miles of a Home Depot.

Thirty years ago, there were only 264 stores in the chain. Seeing the potential for rapid expansion and replicating the business model, it's no wonder the company's leadership is investing aggressively in growth. Continued revenue and earnings growth drove the stock price up.

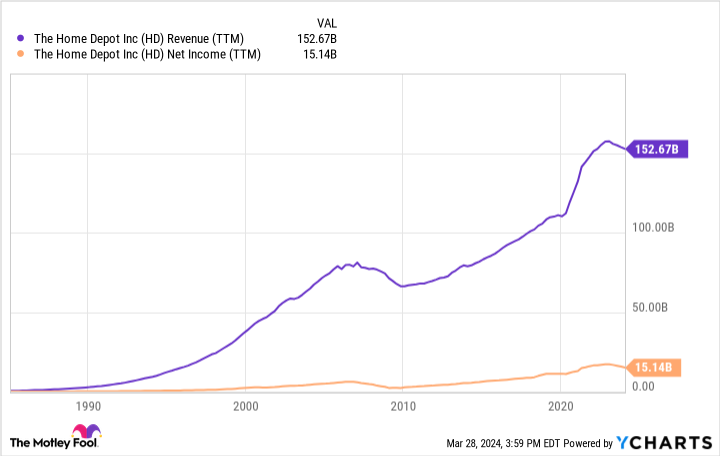

The retailer's profitability is incredible in its current mold. In fiscal 2023, which ends in January 2024, it generated $15 billion in net income and $21 billion in operating cash flow, figures that are much higher than during its initial public offering.

And the Koch team has indicated that they are prioritizing returning capital to shareholders. Over the last 24 months, Home Depot has paid out $16 billion in dividends, and its stock currently yields about 2%. It has paid 148 consecutive quarterly dividends, which has helped to boost the stockholders' revolutions, and it has boosted the $1,000 dividend to millions of dollars.

Is Home Depot stock worth buying now?

Lately, owning Home Depot stock has become less exciting. But the stock continues to reward investors. Its stock price has more than doubled in the last five years, and in the last ten years (as of March 26), it has risen nearly five-fold. These increases have outpaced the S&P 500 index.

As much as possible, it would be prudent not to expect the stock's future to resemble its past. The company market value The company's sales reached US$379 billion, compared to US$153 billion in FY2023. Growth has slowed and will continue to do so.

The company's business is slowing down as demand for tutorials surged in the early stages of the pandemic. Revenues fell 3% last fiscal year, and management expects revenues to grow 1% this fiscal year. investors may be hesitant to pay a P/E of 25 for a company that is currently not growing.

But I still think this is a smart buying opportunity for long-term investors. Home Depot is a dominant player in its industry, with strong brands and the resources to develop its supply chain and omni-channel capabilities.

As a result, the company will continue to be a leader in serving its customers. This will help it continue to capture market share in the $950 billion home improvement industry.(math.) genusOnce the economic headwinds subside, Home Depot will resume its typical growth momentum. Investors will likely be rewarded.

Should you invest $1,000 in Home Depot now?

Consider this before buying Home Depot stock:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Home Depot is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Neil Patel and his clients do not own any of the stocks listed above. the Motley Fool holds a recommendation for Home Depot. the Motley Fool recommends Lowe's Companies. the Motley Fool has a disclosure policy.

One unstoppable stock turned $1,000 into $32 million. Should you buy it now? This post was originally published by The Motley Fool.