.

Down More Than 50%, This 'Magnificent Seven' Stock Is Worth Buying

From pioneering technological advances to disruptive business models, each member of the "Big Seven" has carved out a niche in the global economy. ByApple,Amazon,Alphabet,Microsoft,Meta Platforms,INVISTA (NVIDIA)respond in singingNikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA)This giant group of companies represents the epitome of success, with dominant market positions, visionary leadership and unrivaled growth prospects.

However, one stock in this respectable lineup offers a particularly compelling opportunity for growth investors - Tesla.

Explaining Tesla's Recent Troubles

After exploding in the 2020s, Tesla's stock price has been on a downward spiral since 2021 when it hit an all-time high of $407. That downward trend has intensified further in 2024, with the stock down more than 25% this year alone.

Several factors explain Tesla's poor performance, but one in particular stands out: the weak outlook for electric vehicle (EV) sales growth in 2024. While the EV market is still expected to grow in 2024, it is forecast to grow at a slower rate than in the past, as rising interest rates raise the cost of purchasing a vehicle and discourage many potential buyers.

In addition, the customer base for electric vehicles is shrinking, at least temporarily. Many consumers who can afford to buy a new electric vehicle and who may consider themselves trend-setters have already purchased an electric vehicle. The smaller customer base is made up of people who don't necessarily care about switching to electric vehicles or who can't afford to buy one.

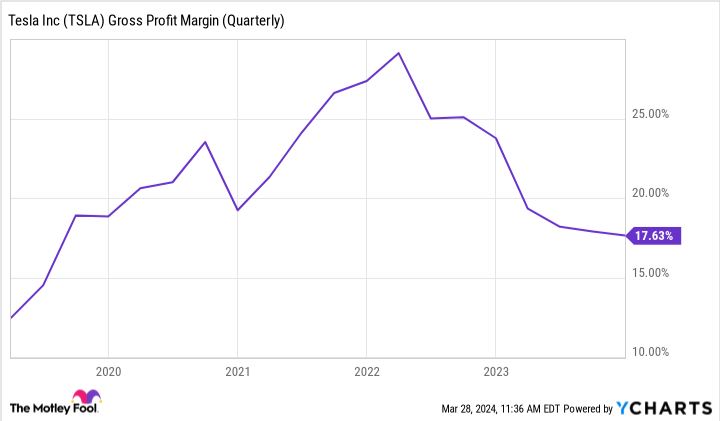

To address this issue, Tesla implemented a series of significant price cuts on all of its models in 2023. While this helped maintain demand, it had a negative impact on its profit margins. 2022 saw Tesla's gross margins reach nearly 30%, an impressive achievement for a capital-intensive company and one of the top in the auto industry by this measure. However, Tesla's margins have slipped since the price cuts were implemented. Today, Tesla's margins hover around 17%, which is close to other companies in the automotive industry.

A little more background

With all of this in mind, it's not hard to understand why Tesla's stock price has fallen by more than half. However, in order to see the opportunity today, we need to zoom out a little further, realize how prolific a company Tesla is, and realize that these struggles are only minor obstacles in its growth story.

Even in the face of these challenges, Tesla continues to prove why it is unique, setting new records for mass production and unit sales in 2023. In addition, even with the price cuts, Tesla's annual revenue hit a new record of over $95 billion, net income hit a new record of $15 billion, and cash reserves increased to $29 billion.

It's that cash that makes Tesla more attractive. Its large capital reserves give Tesla the ability to do things that other electric-car makers can't afford to do until now, such as expanding production capacity.

The company is in the early stages of building a new factory in Mexico, and is in preliminary discussions to build its first factories in India and Thailand. Tesla is expanding its customer base and production capacity at a time when other manufacturers have been forced to scale back operations due to rising costs and interest rates.

In addition, the weakening of interest rates and sales expectations may be a short-term phenomenon, giving Tesla the ability to weather market turbulence. If interest rates start to fall, which is likely to happen this year, Tesla should see demand pick up.

One step further.

Strictly from an electric car perspective, Tesla's current prospects are tantalizingly close. However, Tesla's true potential comes to the fore when analyzing its other ongoing efforts. Fueled by huge cash reserves, Tesla is actively developing several promising technologies. Learning robots, autonomous driving, and artificial intelligence are the main areas of concern for Tesla right now. This year alone, Tesla will invest more than $1 billion in its supercomputer R&D budget.

As Tesla's CEO described on a recent earnings call, the company is currently in between two growth cycles. The first cycle saw Tesla leapfrog the world's most valuable automaker and make its Model Y the world's best-selling car. But the next growth cycle will be driven by its next-generation cars priced below $25,000, robots, artificial intelligence, and other technologies. Once these technologies are fully developed, Tesla will one day become the world's most valuable company, resonates Ma.

In many circles, investing in Tesla today is similar to investing in Tesla 2020. So while many skeptics and critics fan the flames of panic, let's add some context and zoom out a bit to see where Tesla is headed relative to its current position.

While Mas resonance is notorious for his grandiose visions and overly optimistic timetables, it's hard to dismiss the potential for him to ultimately realize his goals. For investors with time on their hands who are looking for the most promising stock among the Magnificent Seven, Tesla's plummeting stock price makes it extremely tempting.

Invest $1,000 now

It's good to listen to our analyst team when they have stock tips. After all, they've been running a newsletter for 20 years called "The New York Times".Motley Fool Stock AdvisorIt has more than tripled the market.

They have just announced what they consider to be the current-est (superlative suffix)The name of the person is suitable for the investor to purchase10Gone are the stocks ...... Tesla is on the list, but there are 9 other stocks you may have overlooked.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool. Randi Zuckerberg, former Facebook Marketplace Development Armsmaster and Spokeswoman and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors, and Suzanne Frey, former CEO of Alphabet, is a member of The Motley Fool's Board of Directors. (Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors. rj Fulton owns shares of Tesla. the Motley Fool owns and recommends shares of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. the Motley Fool recommends the following options. The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short.The Motley Fool has a disclosure policy.

Down More Than 50%, This 'Seven Giants' Stock Is Worth Buying was originally published by The Motley Fool.