.

1 S&P 500 Dividend Stock That Can Create Generational Wealth for Your Kids

Snack GiantHershey Company (NYSE: HSY)beStandard & Poor's 500The company with the ninth lowest beta in the index defies the notion that "safe" stocks don't deliver life-changing returns. Hershey's beta (a measure of a company's stock price relative to the broader rock market) of 0.34 suggests that the company is extremely stable, and since 2000, Hershey's aggregate return has been three times that of the S&P 500.

However, over the past year, a rare confluence of challenges has caused Hershey's stock to fall 30% from its 52-week high.

Despite these difficulties, the company's kid-friendly approach and simple business model make it a worthy entry stock, which is why I've been happily purchasing Hershey shares for my daughter's portfolio for the past few months.

Here's why I still think Hershey resonates with these obstacles and promises to create lasting generational wealth for children's portfolios.

Why the resonance is unfavorably resonated in good time?

At present, Hershey's noodles are facing two short-term and two long-term problems:

Short-term pain

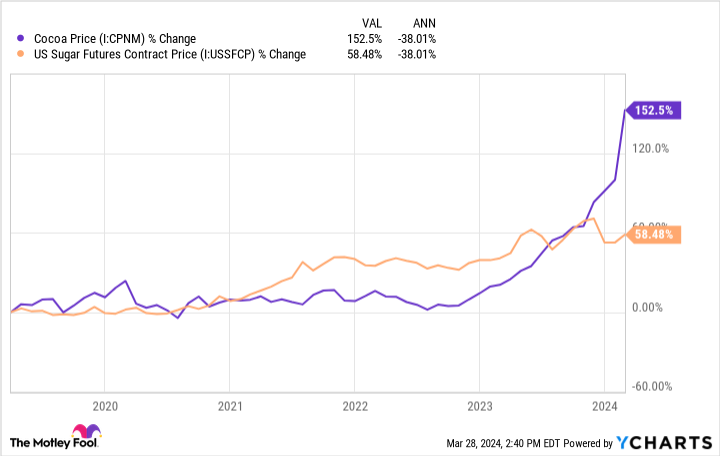

Due to heavy rains in West Africa, cocoa prices have doubled in the last year alone.

At the same time, the price of sugar exceeded the rate of inflation. On a consolidated basis, the rising prices of these two raw materials affected Hershey's confectionery business, which accounted for more than 80% of the company's sales.

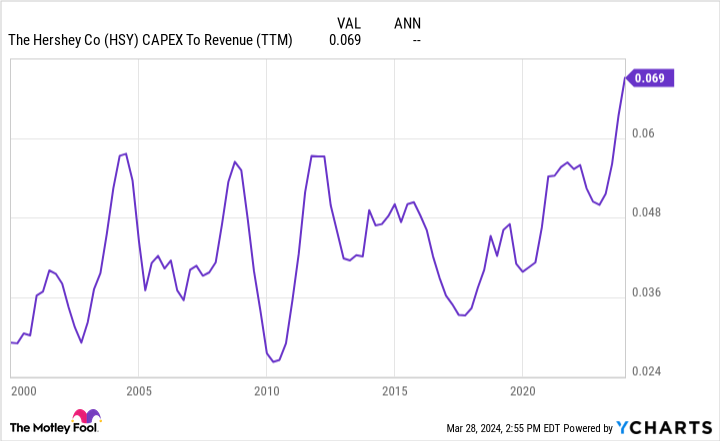

The prospects of the Company are further impacted by the significant capital expenditures required to implement the new ERP system and to increase production capacity by 25%.

With capital expenditures at their highest level this century and prices of key raw materials rising, it was reasonable to expect Hershey's profitability to plummet. However, Hershey's net profit margin and free cash flow margin have proven to be very resilient, reaching 17% last year.

While Goon expects earnings per share (EPS) to be flat in the coming year, these prices and capital expenditures should trend downward over the long term, providing an excellent catalyst for a rebound for patient investors.

Long-term survival of hypochondriacs?

In addition to these short-term complications, the growing popularity of Mr. Beast fast food and the rise of GLP-1 weight loss drugs continue to worry the market about Hershey's long-term success.

YouTuber Jimmy Donaldson (Mr. Beast) predicts that his Feastables resonance will generate more than $500 million in sales by 2024, and there's no doubt that his 200 million subscribers could be a major threat to Hershey. However, even if Feastables reaches that goal, it will be less than 5% of Hershey's sales last year.

Additionally, Segmanta recently conducted a survey on the snacking habits of Generation Z (Mr. Beast's target audience), which revealed that KitKat, Hershey's and Reese's (all Hershey's brands) were their favorite resonance brands.

As for the strong demand for GLP-1 drugs, it is too early to judge the impact of these weight-loss drugs. However, there is a counter-argument that these drugs may be contributing to "shrinkflation," which could benefit Hershey's margins as customers seek smaller portions.

Despite these headwinds, Hershey's 2023 sales and earnings per share grew by 7% and 13%, respectively, while dividend payments increased by 15%, underscoring the pricing power of the business. Most importantly for potential investors, the company's current valuation is the most attractive in more than five years, despite Koon's stabilized business performance during a difficult period.

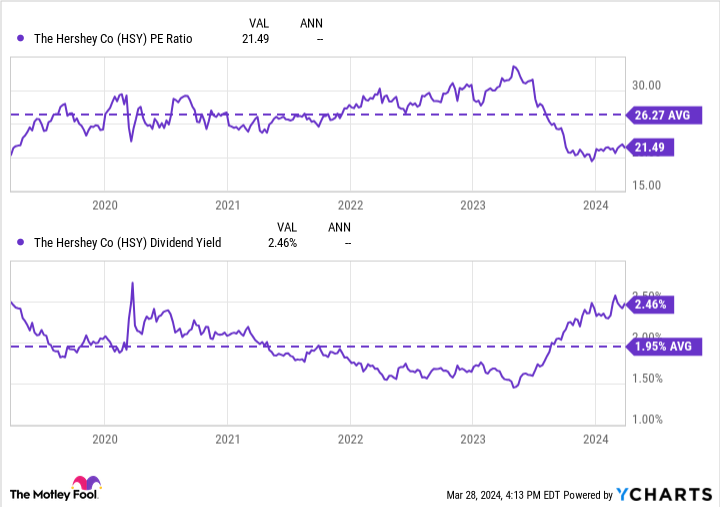

Above-market dividend yield and below-market valuation over time

Over the past year, Hershey's shares have declined 22% and now trade at a price-to-earnings (P/E) ratio of 21, which is slightly below the S&P 500 average of 23. At the same time, its dividend yield of 2.5% is well above the index average of 1.5%. Taken together, these two figures make a compelling case that the Company's share price is justified, if not undervalued, especially when compared to Hershey's five-year average share price.

While the yield is higher than normal, the company pays only 48% of its net income in dividends, so there is plenty of room to continue its 14-year streak of dividend growth into the future. I will lock in a 2.5% yield at an below-market valuation and continue to buy Hershey stock for my daughter while waiting for the company's capital expenditures to fall to normal levels with the eventual decline in cocoa and sugar prices.

While Hershey won't be the next stock in the S&P 500 to become long, I believe it will create generational wealth for my daughter in the coming decades, just as it has done so far this century.

Should you invest $1,000 in good times now?

Consider this before buying Hershey stock:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Gone are the good times at ....... The 10 stocks that made the list are poised to deliver great returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Josh Kohn-Lindquist owns shares of Hershey's. The Motley Fool recommends Hershey's. The Motley Fool has a disclosure policy.

1 Great Dividend Stock in the S&P 500 Can Create Lasting Generational Wealth for Your Kids" was originally published by The Motley Fool.