.

Is McDonald's Stock Worth Buying After Collaboration With Krispy Kreme?

The two iconic food chains have recently joined forces.McDonald's (NYSE: MCD)respond in singingKrispy KremeThe name of the person will be launched nationwide in the coming years.

Krispy Kreme's stock soared on news that McDonald's will start selling Krispy Kreme doughnuts at pre-prudential restaurants in hopes of boosting breakfast traffic. Will McEllo's stock follow suit?

While this is a fantastic carry, the financial impact on McDonald's may not be what you would expect. Instead, investors should look at the underlying business and valuation of the company to make an investment decision.

Here's what you need to know.

Donuts will be at a McDonald's near you.

McDonald's made the announcement after a trial run at about 160 stores in the Louisville, Kentucky area. By 2026, McDonald's will introduce the doughnut in all U.S. stores in three flavors: glazed, frosted and resonance. This will boost traffic during breakfast hours. McDonald's has been emphasizing its coffee products and trying to introduce 24-hour breakfast. This is a clear indication that McDonald's management is trying to grow here.

The increase in donut sales is funneled back to McDonald's as a royalty on sales, but the aggregate financial impact of this carragee relationship may be overstated. First, Massachusetts receives revenue from 38% from the rent paid by the franchisee. Secondly, this will be a gradual rollout process that will take several years to complete. Over a period of time, the financial impact may be minimal.

However, investors can still appreciate McLean's name as it shows that McLean is willing to try to attract consumers. McLean has collaborated with celebrities in the past to create limited edition menus, and this time they have taken it a step further.

The stock price is still hot

McDonald's shares have fallen from a 52-week high and have been essentially flat for the past 12 months. Does this mean you can buy the stock today? It's not that simple. Wall Street is looking at the company's dynamic business model and 49-year track record of dividend growth.

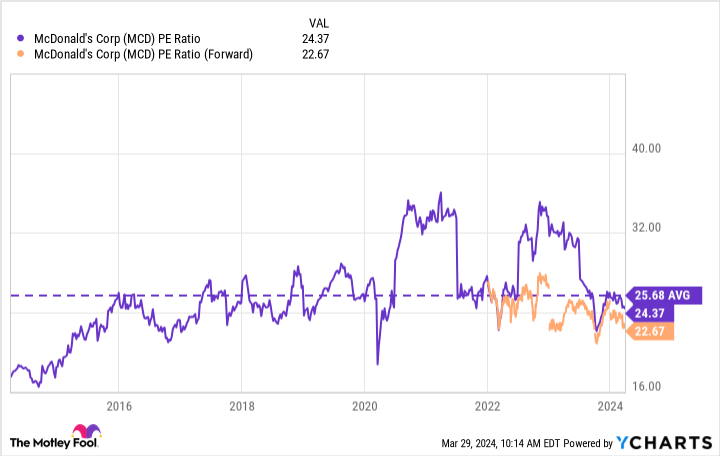

Over the past decade, the stock has averaged a P/E of nearly 26, with a current forward P/E of 23. I'm not sure McDonald's is an obvious buy, despite the button, but I'm not sure it is.

Growth must be factored into a stock's valuation so that investors can understand the whole picture. For this reason, I like to use a PEG ratio. McDonald's P/E ratio of 3 is still high compared to its projected earnings growth, which analysts believe will average 7% to 8% over the next three to five years.

The stock market may be slowing down.

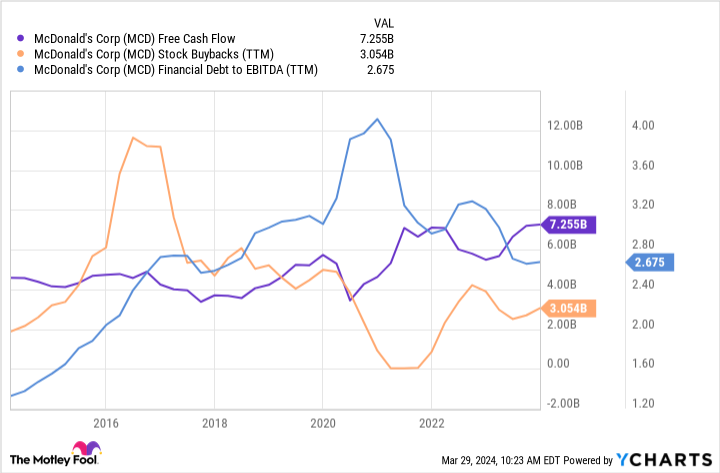

The company's balance sheet is the reason why I think McGuinn's valuation is not attractive enough, even though it is lower than historical norms. The company has bought back a lot of stock, and in the last 10 years the stock has been reduced by more than 26%. In order to do this, McDonald's sometimes has to borrow money, which has steadily increased its leverage to 2.6 times EBITDA.

I don't think McDonald's current level of debt is fundamentally weakening the company - that's manageable. But I don't expect McEllo to return to the glory of the last decade. McDonald's doesn't have enough room to borrow as much as it did in the past. McDonald's future earnings growth will probably be slower than the repurchase, which will require a lower valuation.

As much as that is true, McGoon is a fantastic stock that investors can buy and hold forever and sleep well at night. If you buy and hold it for years, you can. The valuation is reasonable enough that you will still make money in the long run. However, investors who want to buy a good stock are better off waiting for a lower entry point.

Should you invest $1,000 in McDonald's now?

Before buying McDonald's stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and McDonald's is not one of them. The 10 stocks selected could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

Justin Pope does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Is McDonald's Stock Worth Buying After Collaboration With Krispy Kreme? This post was originally published by The Motley Fool.