.

Will Devonshire Energy's Stock Go to $59? One Wall Street analyst thinks so!

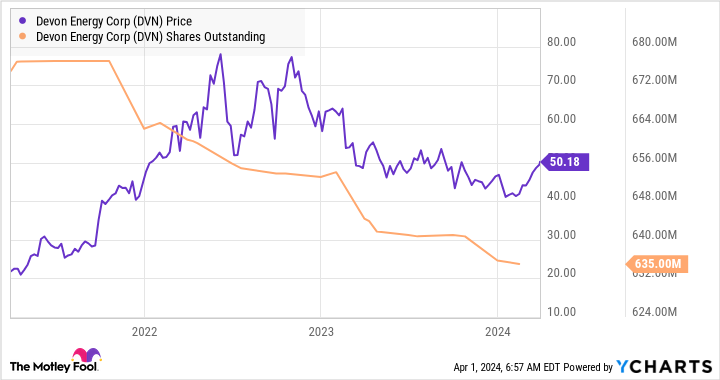

High Yield Energy StocksGerman (language)energy company(Devon) Energy (NYSE: DVN).The upside over the next 12 months or so is 15.5%.Wells Fargo) analysts just raised their price target on shares of Devon Energy Corporation to $59 from the previous $46, and upgraded the stock to a "hold" rating from an "equal weight" rating.

Devon Energy's Improving Asset Base

One of the reasons for the upgrades was enthusiasm for the company's capital allocation program, as well as a focus on its core assets in the Delaware Basin, which straddles western Texas and New Mexico. Devon Energy will allocate 60% of its $3.3 billion to $3.6 billion capital allocation for 2024 to the Delaware Basin.

The analyst believes that Devon's drilling activity on these assets in early 2024 will increase well rates. Koon's view is similar, as its 2024 plan calls for drilling investments in the Delaware Basin to increase well productivity by 10%.

As previously discussed, the company has a proven track record of expanding production, extending and discovering resources.

More than just high-yield stocks

If analysts are correct, Devon Energy Corporation will become an even more attractive stock. The current production rate and free cash flow generation imply that investors will receive a substantial return (either through share buybacks or dividends) in 2024. Based on my calculations and management's estimates (including the return of $70% of cash flow from曏 investors), Devon Energy's share purchase and dividend return this year could be as high as $6.7% of market capitalization.

It is understandable that investors are concerned about dividends, but the reality is that management is willing to prioritize share purchases based on valuation.

The reduction in the number of shares is good news for investors because it increases their claimed share of the company's future cash flow. Additionally, if Devon's resources and well production rates continue to grow and the price of oil stays around $80 per barrel, then investors can look forward to distributing more dividends in the future. As a result, Devon Energy remains an excellent choice for dividend-focused investors.

Should you invest $1,000 in Devon Energy now?

Before buying shares of Devon Energy Corporation, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Devon Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

Wells Fargo is an advertising partner of The Ascent, a Motley Fool company.Lee Samaha has no position in any of the above stocks.The Motley Fool has no position in any of the above stocks.The Motley Fool has a disclosure policy.

Will Devon Energy Stock Go to $59? A Wall Street Analyst Thinks So was originally published by The Motley Fool.