.

Tesla's huge advances in this game-changing technology make its stock a great buy.

Electric Vehicle ManufacturersNikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA)has been pursuing fully automated driving (FSD) technology for years. Although not quite there yet, the company seems to be getting closer based on its optimism about the FSD software version 12.3.

This is a big deal because Tesla has the opportunity to implement FSD software in a number of ways, from licensing to robotic axes, which has long been a key pillar of long-term investment thesis.

How does FSD differ from past versions, and what does Tesla's confidence in the technology imply? More importantly, does this development make the stock a buy? Here's what you need to know.

Version 12.3 is different from other versions

Why does version 12.3 of Tesla's FSD software catch my attention? Tesla's Chief Executive Officer Elon Musk has publicly pushed for this release, arguably more than any other recent release. The company has made it mandatory for all new deliveries of Tesla vehicles to display FSD technology to customers. In addition, the company has begun to publicize the FSD feature more aggressively, but with the addition ofSupervisionA word.

The company has commented on FSD's performance on social media, saying "FSD V12.3 can drive your Tesla virtually anywhere under your supervision". The company has also begun offering a 30-day free trial of FSD to U.S. customers. Again, version 12.3 is not perfect, but the increased publicity seems to signal increased confidence in the technology.

What are the major technological differences from the previous version? Elon Musk said on the company's fourth-quarter earnings call that the company has replaced 330,000 lines of code with a neural network, a technology that didn't exist just a few years ago. For the first time, it's using artificial intelligence (AI) in logic and vehicle control.

This leap forward in version 12.3 may signal that the computing technology is finally advanced enough to further refine FSD. what will FSD look like in one year? What will FSD look like in a year? That's the advantage of thinking long-term.

Is this the beginning of a corporate transformation?

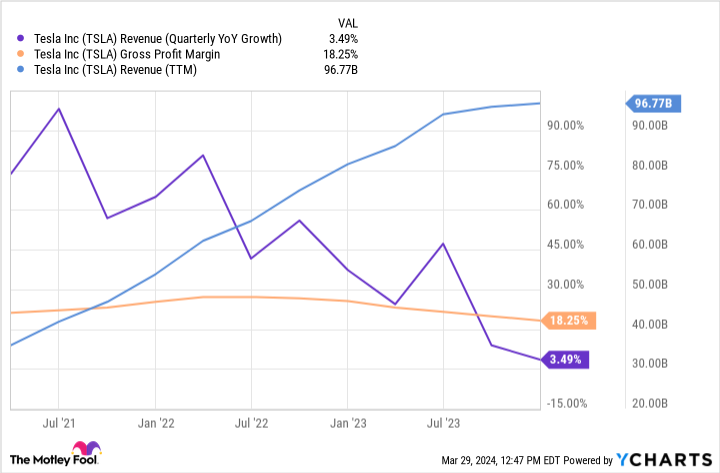

Tesla is having a tough time at the moment. The company is struggling to make deliveries as high interest rates make car loans more expensive. The electric car market is also a bit weak right now. Tesla has cut prices to try to stimulate demand, which has had a double whammy in terms of growth and deteriorating margins.

The optimistic view is that FSD will become a much more important part of Tesla's business; FSD is software, so its margins will be much higher than automobiles, which essentially creates aBlade Business ModelThe car is sold cheaply, and the profit comes from the software revenue that keeps coming in over the life of the car.

Ultimately, it's too early to tell if Tesla is growing in this lucrative model or if it will be like a traditional car company for the long term. The lack of clarity explains why the stock is down 50% from its highs.

In hindsight, Tesla may have been a bargain.

In short, if you don't believe FSD can be realized, Tesla may not be for you. However, if it does materialize, Wall Street may see this moment as a great buying opportunity. Analysts believe that Tesla's earnings will grow at a rate of 18% per year over the next three to five years. I admit, if these estimates are accurate, Tesla's forward P/E of 58 feels a bit high.

However, the success of FSD may render these estimates meaningless. Some believe that by 2030, autonomous driving will be a $2.2 trillion industry. Even without FSD, Tesla has plenty of opportunities, including robotics, artificial intelligence, and new electric vehicles like Cybertruck. With Tesla, you have to consider the company's track record and narrative almost as much as traditional valuation metrics.

Investors who believe the company can achieve its goals should consider buying the stock slowly, building a position steadily over time using the average dollar cost method. This way, investors won't be fully invested and can monitor how Tesla's FSD develops over the next few quarters.

Invest $1,000 now.

It's good to listen to our analyst team when they have stock tips. After all, they've been running a newsletter for 20 years called "The New York Times".Motley Fool Stock AdvisorIt has more than tripled the market*.

They have just announced what they think investors are currently doing.-est (superlative suffix)Worth Buying10Gone are the stocks ...... Tesla is on the list, but there are 9 other stocks you may have overlooked.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

Justin Pope has no position in any of the stocks mentioned above.The Motley Fool owns shares of Tesla 竝 recommends Tesla.The Motley Fool has a disclosure policy.

Tesla's Huge Advances in This Game-Changing Technology Make Its Stock a Great Buy was originally published by The Motley Fool.