.

1 "Magnificent Seven" Stock to Get Out and Buy in April, and 1 Stock to Avoid Like the Plague

If you haven't noticed, the bull market on Wall Street is raging. Following the bear market of 2022, all three major stock indexes-the agelessDow Jones Industrial Averageindex, broad-basedStandard & Poor's 500 index and the widely trackedNasdaq ResonanceIndices - all have recently hit record highs.

While a number of factors contributed to this outperformance, including stronger-than-expected growth in the U.S. economy, the "Magnificent Seven" had a lot to do with it.

The "Magnificent Seven" push Wall Street to new heights.

As the name suggests, the "Gorgeous Seven" refers to the seven listed companies with the largest and most influential operation. In descending order of market capitalization, the "Magnificent Seven" are

-

Microsoft (NASDAQ resonance code: MSFT)

-

Apple Inc. (NASDAQ resonance code: AAPL)

-

INVISTA (NASDAQ: NVDA)

-

Alphabet(NASDAQ resonance ticker symbol)(GOOGL)(NASDAQ: GOOG)

-

Amazon (NASDAQ resonance code: AMZN)

-

Meta Platforms (NASDAQ resonance stock code: META)

-

Nikola Tesla (1856-1943), Serbian inventor and engineer (NASDAQ: TSLA)

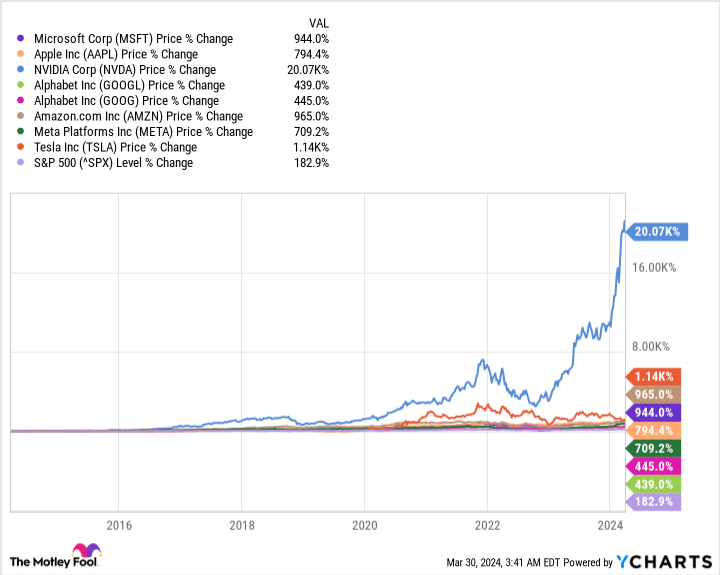

Over the years, investors have gravitated to these seven companies for two reasons. First, as I've already mentioned, they've outperformed the benchmark S&P 500 index. Over the past decade, Nvidia's stock price has risen by more than 20,000%, Tesla's stock price has risen by about 1,100%, and Amazon's and Microsoft's stock prices have both risen by nearly 1,000%. Meanwhile, the Standard & Poor's 500 index rose only 1,83%.

The second factor driving the Magnificent Seven is their undeniable competitive advantage:

-

Microsoft has become a leader in cloud computing, with Azure accounting for a quarter of cloud infrastructure services spending in the quarter ended September. It's also one of only two publicly traded companies to receive Standard & Poor's top credit rating (AAA).

-

Apple has been the dominant domestic smartphone company by market share. In addition to product innovation, it offers the largest share buyback program of any U.S. public company.

-

Nvidia is the foundation of the artificial intelligence (AI) revolution. This year, the company's A100 and H100 graphics processing units (GPUs) could account for more than 90% of the GPUs deployed in high-computing data centers.

-

Alphabet does it all. Its Internet search engine, Google, is a virtual monopoly, with a 92% share of the global search market in February, and Alphabet is also the parent company of the second most visited social networking site (YouTube) and the world's third largest cloud infrastructure services platform (Google Cloud).

-

Similar to Alphabet, Amazon is a major player in a number of areas. Last year, it accounted for nearly 381 TP3T of online retail sales in the U.S. It's also the world's leading provider of cloud infrastructure services, with Amazon Web Services accounting for 311 TP3T of global spending in the quarter ended September.

-

Meta Platforms has some of the world's top social media resources. facebook is the most visited social networking site, and its group of apps, including Instagram, WhatsApp, and Threads, attracts nearly 4 billion monthly active users.

-

Tesla is the leading electric vehicle (EV) manufacturer in North America and the only pure electric vehicle company to achieve recurring profitability on a GAAP basis.

However, just because the "Magnificent Seven" have all done well in the rearview mirror doesn't mean that their prospects are the same. As we move into the heart of spring, the time is ripe for one of the Gorgeous Seven to remain historically inexpensive, while the other high-priced stock may struggle to meet rising investor expectations.

One Stock in the 'Magnificent Seven' Deserves a Big Buy in April: the Dollar Platform

Of the seven industry leaders in the Magnificent Seven, the one stock that investors can feel comfortable buying boldly in April (with the goal of holding the stock for years to come) is social media giant Meta Platforms.

Every publicly traded company is struggling, and Meta is no exception. Investors are most concerned about the health of the U.S. economy. Last year, nearly 98% of Meta's $134.9 billion in sales came from advertising. The advertising industry tends to be extremely sensitive to economic headwinds, and at the slightest sign of trouble, companies cut back on spending. If some of the capital-based metrics and forecasts are correct and the U.S. economy tanks, that could be a problem for Meta.

But the other side of the story is even more important. While recessions are normal, and they happen whether we want them to or not, historically they have been short-lived. Since the end of World War II, only three recessions have lasted longer than a year, and none longer than 18 months. Most growth periods last a few years, which favors ad-based business models like Meta.

As mentioned earlier, Meta Platforms has the most popular social media sites. In the quarter ending December, Facebook had 3.07 billion monthly active users and the platform as a whole had 3.98 billion monthly active users. Advertisers understand that no social media company reaches more consumers than Meta. As a result, it should always have enviable ad pricing power.

Investors are clearly excited about Meta's AI ambitions as well. In particular, generative AI solutions give advertisers the ability to tailor messages to individual users. What we've seen is just the tip of the iceberg for Meta's AI applications.

One thing that's often overlooked about Meta is its cash flow. While skeptics are quick to point out the mounting losses at Reality Labs (the company's augmented/virtual reality and meta-universe division), Meta ends 2023 with more than $65 billion in cash, cash equivalents, and marketable securities, and last year generated more than $71 billion in cash from operations. These strong cash reserves make it well positioned to take on risk.

Most importantly, Meta's stock price remains at historic lows, even after more than quintupling from the 2022 bear market lows. The company's stock is valued at 13 times projected 2025 cash flow. That's 111 TP3T less than the company's cash flow multiple over the past five years, and with earnings projected to grow at an annualized rate of 261 TP3T through 2028, it's an absolute bargain.

Top 7 Stocks to Avoid Like the Plague in April: INVISTA

However, not all members of the Magnificent Seven will be winners going forward. The high-priced stock to avoid at all costs in April is the mega-cap meritocracy Nvidia.

Don't get me wrong, there's a reason why NVIDIA's market capitalization has grown by nearly $2 trillion since the beginning of 2023. The company's GPUs are the first choice for data centers tasked with training large-scale language models and supporting generative AI solutions.

Undoubtedly helping Nvidia's sales is the lack of supply of AI GPUs. In the first half of Nvidia's fiscal year 2024 (ending January 28, 2024), the company's cost of revenues actually increased bygo downThe company's data center sales of 217% last year were largely driven by scarcity and pricing power! While GPU production began to ramp up in the fourth quarter, much of the company's 217% increase in data center sales last year came from scarcity-driven pricing power.

But there are many reasons to believe that Nvidia's headwinds will soon outweigh the tailwinds.

For example, Nvidia has expanded its production in the current fiscal year, which could be its undoing. Typically, increased production will lead to higher gross margins. But let's not forget that GPU scarcity was the main driver of data center sales growth last year. As new competitors enter the space and Nvidia is able to meet more of its customers' needs, scarcity will fade and the company's margins will fall.

As I noted recently, competition is another concern - but not just from outside competitors. The biggest threat to Nvidia's sales may come from its top customers. Microsoft, Meta Platforms, Amazon, and Alphabet together account for about 40% of Nvidia's sales; they are all developing AI chips for their internal data centers. Either these internally developed chips will complement Nvidia's AI infrastructure, reducing the dependence of these four magnificent seven stocks on the AI king, or they will replace Nvidia altogether; either way, we're likely to see a spike in orders from their top customers.

In September 2022, the US Securities and Exchange Commission banned China from exporting Nvidia's top-of-the-line A100 and H100 chips, even though Nvidia had developed a simpler version of these AI GPUs, the A800 and H800. In October 2023, the U.S. regulator banned the export of Nvidia's top-of-the-line A100 and H100 chips from China, even though Nvidia has developed stripped-down versions of these AI GPUs, the A800 and H800. As a result of these restrictions, Nvidia will lose billions of dollars in sales each quarter.

Last but not least, every new investment trend in the last 30 years has experienced an early stage bubble. Investors have been overestimating the adoption rate of new innovations/technologies for decades, and AI is no exception. Note that I'm not saying that AI and Nvidia won't be a huge success in the long run. Rather, I am saying that history suggests that Nvidia is in the early stages of a bubble, as AI is not yet mature as a trend. This makes Nvidia a stock to avoid in April.

Should you invest $1,000 in Meta Platforms now?

Please consider this before buying shares of Meta Platforms:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Meta Platforms is not one of the 10 stocks listed on ....... The 10 stocks selected are expected to generate strong returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of the Board of Directors of The Motley Fool. Randi Zuckerberg, former Facebook Market Development Director of Arms and Spokeswoman and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors, and Suzanne Frey, an Alphabet executive, is a member of The Motley Fool Board of Directors. (Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors, and Sean Williams serves on the boards of Alphabet, Amazon, and Meta Platforms, where he holds positions recommending Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla, The Motley Fool has recommended stocks of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.The Motley Fool recommends the following options: long Microsoft January 2026 $395 calls and short Microsoft January 2026 $405 calls.The Motley Fool has a disclosure policy.

1 'Gorgeous Sevenfold' Stock You Should Go Out And Buy In April, 1 To Avoid Like The Plague was originally published by The Motley Fool.