.

Wal-Mart and Costco Wholesale are two of the best retailers in the world. Are they still genius stocks today?

retailersWal-Mart (NYSE: WMT)respond in singingCostco Wholesale (NASDAQ: COST)They are two of the largest companies in the world. They have also been very successful in their investments. During their lifetimes, each company has turned a $10,000 investment into millions of dollars.

However, this does not mean that investors must run out and buy stocks. Instead, take a step back and look at the bigger picture. These behemoths are now worth hundreds of billions of dollars, and it takes a good entry price to reap the rewards of your investment portfolio.

Are they worth your hard-earned cash today?

Understanding the Impact of Big Numbers

Wal-Mart and Costco are large corporations today. About 90% of the population lives within 10 miles of a Wal-Mart store. Costco's business is not as extensive as Wal-Mart's, but it is no less important, with annual sales of nearly $250 billion.

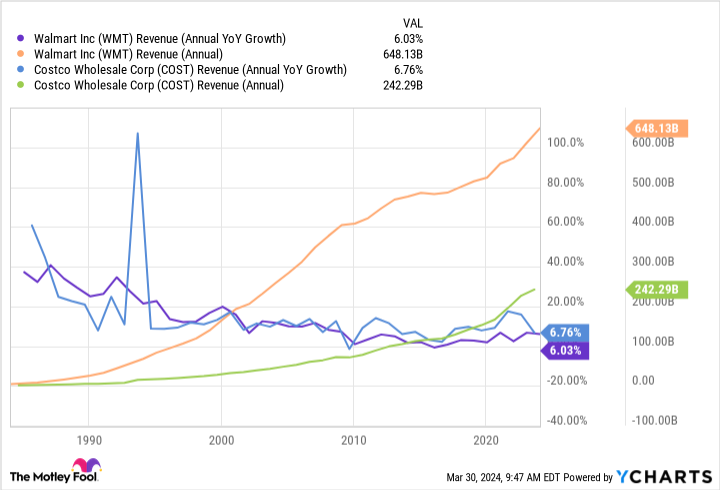

These companies have been around for decades. As time goes on, they sell more and more goods, their size grows, and their growth becomes more and more challenging. Some people call this the law of large numbers. I wouldn't say that because it's not absolute, but it is a general trend. As you can see from the noodles below, the annual revenue growth rates of both companies are steadily decreasing as annual sales increase.

What was once 40% annual revenue growth is now only mid-single digit growth. As growth slows, valuations should be more conservative, so the price you pay is critical. A significant overvaluation of the stock could result in slow-growing businesses taking years to catch up with earnings growth, causing the stock price to stagnate or fall.

Evaluate the pre-evaluation valuation

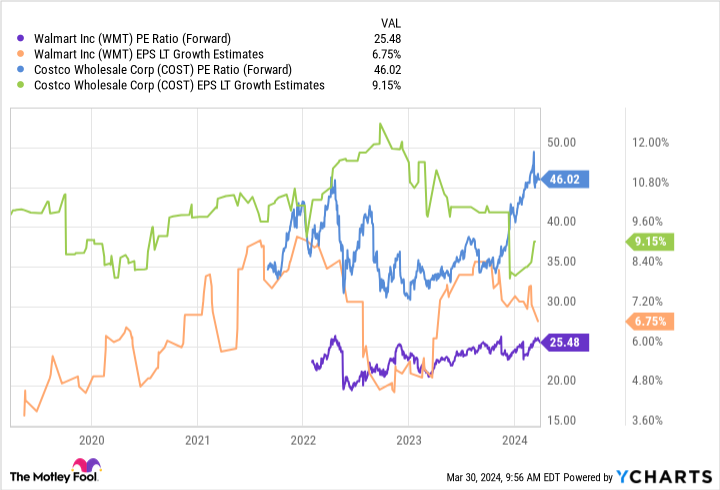

With that in mind, it's time to take a look at how these companies are trading. Wal-Mart trades at more than 25 times its estimated 2024 earnings, while Costco trades at 46 times its earnings. Meanwhile, analysts believe Wal-Mart's earnings will grow at an average annual rate of 6% to 7% over the next three to five years, and for Costco, analysts expect average annual earnings growth to be slightly higher than 9%.

Investors can use the P/E ratio (which compares a company's earnings growth to a stock's valuation) to illustrate how expensive these valuations are. Generally, I buy stocks when the P/E ratio is below 2, preferably 1.5 or lower.

Walmart's current PEG ratio is 3.7, Costco's is 5.

This means that Wall Street is paying a huge premium for these stocks. If growth does not exceed analysts' expectations, it will be difficult to justify the current prices of these two stocks.

The Danger of Overpricing

It's fine if you buy a quality business at a slightly higher price and you're willing to wait a while for earnings to cover the valuation. But where you start paying high premiums like Wal-Mart and Costco are now, you run the risk of serious losses. For example, Costco could fall 50%But stillIt is considered to be overpriced.

Wal-Mart and Costco are both quality companies with strong positions in the U.S. retail industry. However, their stock prices are way out of line with their growth rates over the next few years. Investors should avoid these companies until a better buying opportunity arises.

Should you invest $1,000 in Wal-Mart now?

Before buying Walmart stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only Wal-Mart, ......, is not one of these stocks. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

Justin Pope has no position in any of the stocks mentioned above.The Motley Fool holds recommendations for Costco Wholesale Corporation and Walmart.The Motley Fool has a disclosure policy.

Wal-Mart and Costco Wholesale are two of the best retailers in the world. Are they still smart stocks to buy today? This article originally appeared in The Motley Fool.