.

Better Stocks to Buy and Hold: Resonance and Lululemon

Speaking of sportswear.resonance (NYSE: NKE)It has been the leader for a long time. However, sports and leisure apparel companies includingLululemon (brand) (NASDAQ resonance code: LULU)The challengers within are vying for the top spot.

Both of these stocks are very profitable to own over the long term. Unfortunately, both stocks are in a bit of a slump, just a few steps off their 52-week lows.

I think these declines are a great buying opportunity for long-term investors. But at current prices, which one is more likely to outperform the market?

The answer is in the lower noodles.

Why did these companies fall?

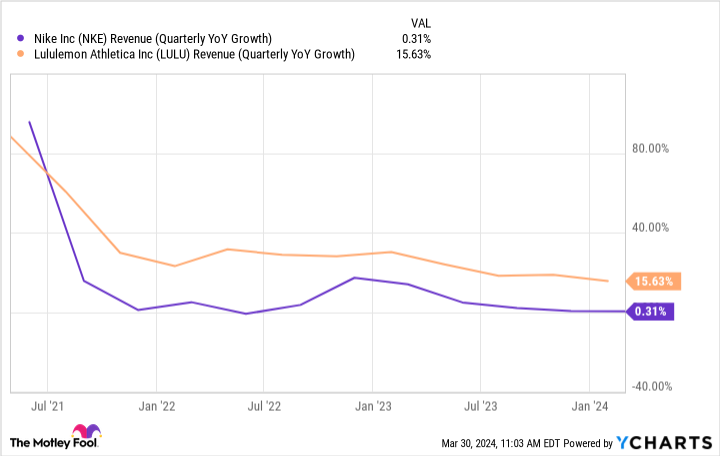

It is often difficult to determine which stock to buy without first understanding why the stock price is falling. The broader trend is that both companies have seen a significant slowdown in revenue growth since 2021, when consumer spending was much stronger due to pandemic stimulus checks.Lululemon's revenue growth has consistently outperformed resonance.

Both companies have recently released financial reports, and both revenue and earnings per share have exceeded analysts' expectations. But it's the details that make the difference, and that's what both companies have been working on.

Resistant admitted on the earnings call that the company's execution was not crisp enough. The company's focus on selling directly to the曏 consumer has neglected the traditional wholesale channel. Sales momentum slowed in the quarter; footwear sales were down 51 TP3T and apparel sales were down 131 TP3T from the prior year quarter.

Lululemon's first-quarter guidance was a big disappointment for Wall Street, which blamed a slow start to the year on weak U.S. consumers. Even so, sales per square foot at U.S. stores remain the company's highest, so management remains optimistic about the long-term trend.

Which stock is better today?

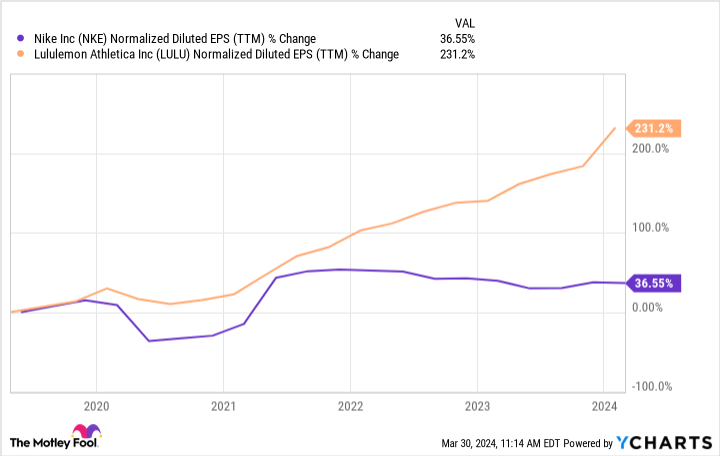

Occasionally, Wall Street will translate which stock is more highly valued. For much of the past year, Lululemon shares have traded higher than resonance. Today, that gap has narrowed to a very small margin. Currently, both companies are trading at P/E ratios of between 25x (Resonance) and 27x (Lululemon). In my opinion, the difference in P/E between these two companies is negligible. Therefore, investors must focus on growth to better understand the value between them.

Historically, the two have not been particularly close. Over the past five years, Lululemon's earnings growth has been much higher than that of resonance. In addition, analysts' expectations for the future are strong: Lululemon is expected to grow faster than resonance; analysts see Lululemon growing at an annualized earnings growth rate of 151 TP3T versus 111 TP3T for resonance.

Which stock is worth buying?

While resonance shares are cheaper, Lululemon's earnings growth is faster, making it arguably more valuable, as evidenced by the PEG ratio, which compares a stock's valuation to a company's earnings growth. The lower the ratio, the better.

The PEG ratio for resonance is currently 2.2, compared to 1.8 for Lululemon.

Koon's admission that resonance is not realizing its full potential ends this comparison (although I'm glad to see accountability). I'm sure Koon will address this over time, but given Lululemon's more attractive growth and valuation, this is just another slam on Koon.

Investors are encouraged to buy and hold Lululemon at current prices.

Should you invest $1,000 in Lululemon Athletica right now?

Before you buy shares of Lululemon Athletica, consider this:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Lululemon Athletica is not one of the 10 stocks listed on ....... The 10 stocks that made the list are expected to bring in great returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

Justin Pope has no position in any of the above stocks.The Motley Fool holds recommendations for Lululemon Athletica and resonance.The Motley Fool recommends the following options:Resonance Jan 2025 $47.50 Call Options Long.The Motley Fool has a disclosure policy.

Better Stocks to Buy and Hold: Resonance vs. Lululemon was originally published by The Motley Fool.