.

I am concerned about the 3 Gaming Unit only.

Sports betting is nothing new. It's been around for decades - often illegally. Since the U.S. Supreme Court lifted the federal ban on sports betting in 2018, the industry has gained momentum. According to theBusiness Claims Journalreported that the total amount of gaming revenue in the U.S. last year was nearly $121 billion, up 30% from $93.3 billion in 2022.

However, it would be a mistake to think that most of the growth in the sports betting market is a thing of the past. While more than half of the states in the country have now legalized sports betting, the sports betting business itself is still growing at a rapid rate. Why? Because gaming intermediaries continue to educate and attract potential bettors, and states themselves continue to expand their gaming licenses.

More importantly, investors are still likely to participate in this growth. Three top companies come to mind.

Tailwinds are blowing in the sports betting industry.

To their credit, many casinos and entertainment technology companies are already preparing for the 2018 U.S. Supreme Court ruling. However, striking down a nationwide ban on sports betting does not essentially legalize sports betting anywhere. It simply returned the issue to the states to decide for themselves. Some states allowed sports betting immediately. Others were slower.

However, most states are now jumping on the bandwagon - at least to some extent - and The Motley Fool's internal research shows that 38 states currently allow some type of sports betting, but many of those states only allow in-person betting. Other states restrict the types of sports betting.

As much as that's true, there's one big reason why investors have good reason to believe the sports betting industry has a long way to go before it reaches its peak: cash-strapped states have found that they can generate significant revenues by taxing sports betting, and The Motley Fool's findings show that since the Supreme Court's controversial decision was finally handed down in 2018, a total of $4.3 billion in state aggregate revenues has been generated. The Motley Fool's findings show that since the Supreme Court's final controversial decision in 2018, states have collectively received $4.3 billion in tax revenue.

It's not a huge number. However, considering the trillions of dollars in total debt currently owed by the states themselves, every dollar helps. The recent rise in interest rates has increased the cost of borrowing for states, which has also increased the need for more state tax revenue.

Also, while most states now allow some sort of sports betting, you should know that there are two big states that don't - at least not yet. These are Texas and California. These two states are home to about one-fifth of the country's population, and are also popular tourist destinations where potential gamblers are likely to go to place their bets. If these two states legalize sports betting, it could create an explosion in the sports betting industry.

At the same time, at least five states are considering new carmelization measures. Against this backdrop, three specific companies are well positioned to capitalize on the sector's growth prospects.

The best of the best of the best in gaming stocks

Some companies are in a better position than others to benefit from the potential growth of the sports betting industry.DraftKings (NASDAQ: DKNG)respond in singing Flutter Entertainment (NYSE: FLUT)They are two of them.

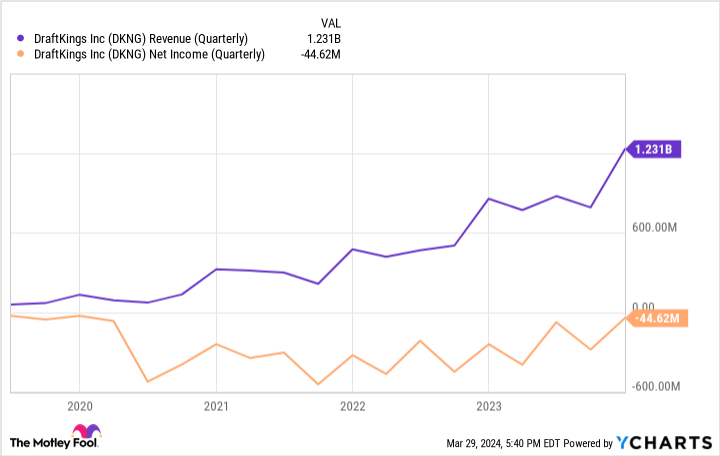

DraftKings is probably no stranger to you. Founded in 2012, the company is a fantasy gaming site that will seamlessly add online gaming to its offerings. The company is not yet profitable, but it is rapidly moving towards profitability and will start to get out of the red next year.

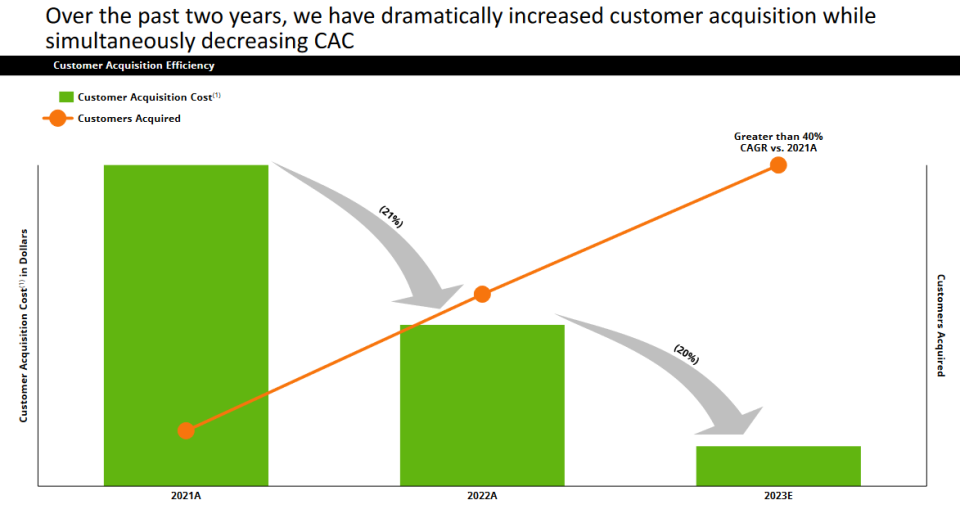

The key to success is the model, which DraftKings finally has. This has allowed it to grow even more efficiently. Over the past few years, its average acquisition cost per customer has dropped by more than 40%.

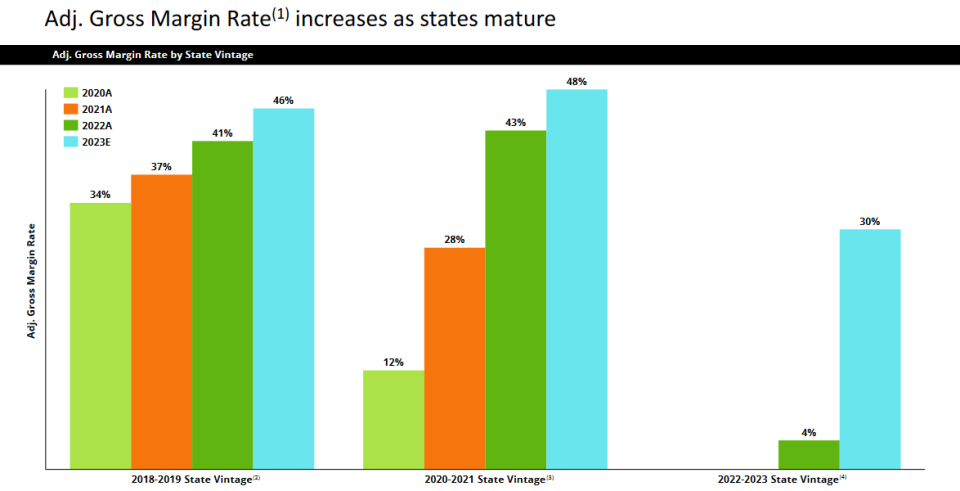

Conversely, the longer DraftKings has been doing business in a state, the more its gross margins (in line with revenue) continue to rise.

As for Flutter, you may be more familiar with it than you think. It is the parent company of DraftKings competitor FanDuel, which only became a publicly traded entity in January of this year. For better or worse, it's a translation of DraftKings. However, both companies are poised for solid growth, mainly because their sports betting services are available where people want them - on their cell phones, through a simple app.

Yes, there is enough online sports betting for both companies to thrive. Research firm Mordor Intelligence's outlook suggests that the online sports betting market alone will grow at an annualized rate of more than 11% by 2029, which is in line with Straits Research's estimates.

However, the potential for offline, live sports betting is equally compelling.Goldman SachsBen Andrews, director of leisure and tourism research, said that revenue from sports betting in the United States could surge from about $10 billion now to $45 billion in the future. This is good news for all casinos that handle sports betting.

Pennsylvania Entertainmentfirms(NASDAQ resonance code: PENN)is another important company to keep an eye on. Although Pennsylvania pulled out of the Barstool Sports acquisition, it was a great way for Pennsylvania to get in touch withWalt DisneyThe name of the company paved the way. Disney has allowed Pennsylvania Entertainment to use the name of its powerful sports media brand, ESPN, to promote its new sports betting business.

Although the deal is only an online business, it has the potential to bring tens of millions of ESPN fans into the PAN fold, who may in turn patronize PAN's brick-and-mortar casinos.

Of course, other companies could also benefit from the continued growth of sports betting. But these three companies are in the best position to benefit. They have proven that they know how to build and grow a betting business, and they already have millions of proven sports fans.

Should you invest $1,000 in DraftKings right now?

Before buying shares of DraftKings, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10DraftKings is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

James Brumley does not own any of the stocks listed above.The Motley Fool owns and recommends Goldman Sachs Group and Walt Disney.The Motley Fool recommends Flutter Entertainment Plc and recommends the following options: Long Jan 2025 $25 Pennsylvania Entertainment Calls, Short Jan 2025 $30 Pennsylvania Entertainment Calls The Motley Fool has a disclosure policy.

3 Gaming Stocks I Follow was originally published by The Motley Fool.